The second edition of the Fintech acceleration bootcamp, Catapult: Kickstarter Fall 2021, concluded on Friday 26th of November with the cohort’s final pitches in front of a virtual audience and esteemed jury, with great support from the Luxembourg Finance Community.

The bootcamp was developed by the LHoFT Foundation in close collaboration with the Ministry of Economy in Luxembourg. Ten leading Fintech startups went through a two-weeks programme and pitched their solutions on the final day of the programme.

The five selected winners are eligible for up to €50.000 in subsidies to pursue their development in Luxembourg.

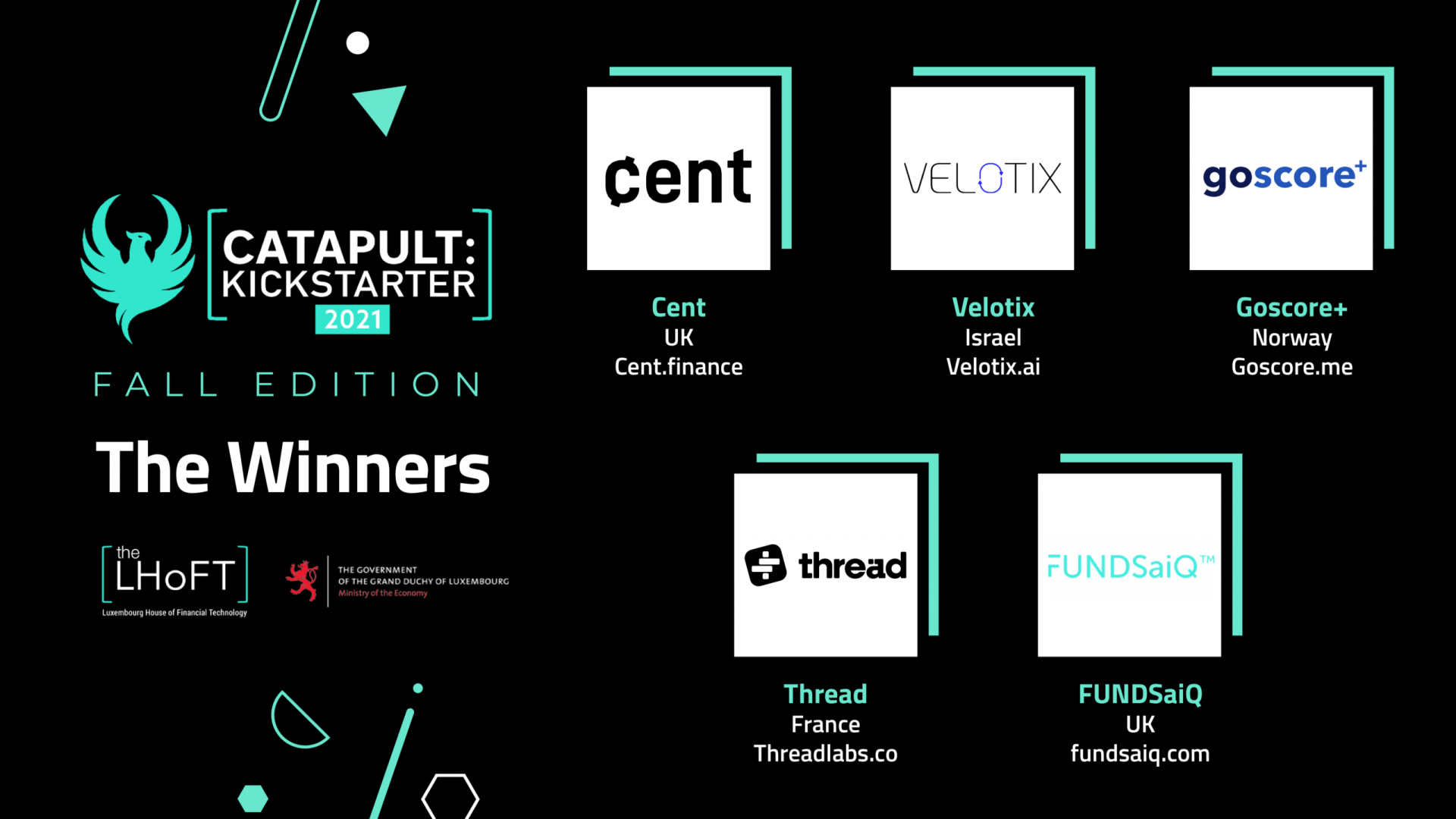

Cent Finance, FUNDSaiQ, goscore+, Thread and Velotix are the five lucky winners of this Catapult: Kickstarter 2021, Fall edition.

Cent Finance – UK

Cent acts as the gateway to the growing world of Decentralised Finance (DeFi), it allows users to understand, explore and invest in digital assets, responsibly.

FUNDSaiQ – UK

FUNDSaiQ provides a SaaS based, Machine Learning powered, B2B platform for financial advisors, empowering them to identify and monitor the best performing mutual fund managers in the market.

goscore – Norway

Goscore+ brings a human credit scoring to private customers using modern ML technology and data enriched with PSD2 customer transactions.

Thread – France

Thread Labs developed an AI-powered collaborative investment re- search platform, specialized in integrating ESG in traditional equity research.

Velotix – Israel

The Velotix Data Governance & Orchestration Platform is unlocking Data and making it usable while adhering to compliance policies and enhancing business performance and operational efficiency.

Mr Franz Fayot, Minister of the Economy stated: “Congratulations to the 5 winners of the 2021 fall edition of Catapult: Kickstarter. I am looking forward for the selected companies to launch operations in Luxembourg and contribute to the development and diversification of the local Fintech and start-up ecosystem with innovative solutions in the field of data, AI and sustainability.”

Targeting ten Fintech startups from around Europe, Catapult: Kickstarter 2021 Fall edition proved to be effective in providing support and critical guidance to the selected participant firms in their growth. In order to effectively leverage the strengths of Luxembourg’s community and capabilities, the selected firms focused on delivering services to financial institutions (B2B), with particular emphasis on Insurtech, DeFi, AI, Regtech, Fundtech, B2C payments, as well as ESG.

The two-weeks programme aims to help Fintech entrepreneurs to develop their business models with a focus on business scaling and risk management. Catapult: Kickstarter Fall edition was tailored to the particular stage of the participating Fintechs and structured around classroom tutorials, experts talks, customer discovery, one-to-one meetings, pitching sessions, industry discovery sessions and mentorship sessions. The ten participating Fintech companies have been supported across those two weeks by no less than 20 partners, including Compellio, Luxembourg For Finance (LFF), Expon Capital, and Middlegame Ventures (MGV), guiding them through business models, funding strategies and industry product testing.

This Fall Bootcamp culminated with an online pitch session on Friday 26th of November, gathering all the partners and supporters of the programme. The 10 companies delivered their final pitches, leveraging the input they had received from the programme partners, experts and mentors over the course of the two-weeks bootcamp.

The jury, composed of Mrs Ananda Kautz, Head of Innovation, Digital Banking and Payments at ABBL, Mr Frédéric Becker, Project Manager at Luxembourg Ministry of Economy, Mr Owen Reynolds, Associate at Expon Capital, Mr Philipp von Restorff, Deputy CEO at Luxembourg for Finance, Mr Kanishk Walia, VC & Growth FinTech Investor at MiddleGame Ventures and Mr Nasir Zubairi, CEO of the LHoFT, listened to 10 outstanding pitches and declared, after a very difficult deliberation, that Cent Finance, FUNDSaiQ, goscore+, Thread and Velotix were the five winners of Catapult: Kickstarter 2021, Fall edition. In addition to eligibility for up to €50.000 in subsidies from the Ministry of Economy to continue their development and expansion in Luxembourg, each company participating in the bootcamp received a one-year free membership at the LHoFT.

Mr Nasir Zubairi, CEO of LHoFT Foundation, concluded: “The ten participating firms were outstanding businesses with significant relevance to the Luxembourg financial centre, addressing some key challenges of and opportunities for local actors. The feedback from both the Luxembourg industry and the participants themselves has been humbling in its praise of the programme and the participating firms. Critically, it is great that all ten firms have already advanced in discussions with potential Luxembourg clients and partners.”

======

The 10 Selected Fintech Startups of the Catapult: Kickstarter 2021 Fall Edition are:

- Cent Finance – United Kingdom

Cent acts as the gateway to the growing world of Decentralised Finance (DeFi), it allows users to understand, explore and invest in digital assets, responsibly. It also provides an alternative to financial services offered by traditional banks like lending, borrowing, saving and sending/receiving. Although DeFi applications are growing at an accelerating rate, user acquisition has been from existing cryptocurrency investors, a small portion of the total addressable market (only 1 in 4 crypto users invest in DeFi).

- digitalUs – Luxembourg

The digitalUs technology developed at the SnT Research Center of the University of Luxembourg provides a solution to automate, and significantly speed-up the background screening process of individuals. It relies on a novel methodology to match the same entity across multiple publicly available data sources.

- Finanzmining – Germany

Finanzmining creates real-time business insights into consumers and enterprises derived from their bank accounts. Finanzmining real-time insights include a rich set of financial fitness and stability analytics of businesses and consumers, behavior analysis of businesses and consumers, financial forecast (e.g. of cash flow, P&L, “BWA”, etc.), business process analysis, signals based on interest and demand of businesses and consumers, consumer targeting, consumer reward processing, financial performance against peer groups, and much more. Finanzmining services are available via real-time API, offering analytics-as-a-service and white-labeled applications for a quick start without any IT effort.

- FLEXVELOP – BNPL+ Fintech – Germany

Flexvelop combines financial technology with a circular economy. Therefore, Flexvelop offers more than financial transactions, but a new way of funding equipment and flexible business growth. As the next generation payment solution for business equipment vendors, b2b customers are now able to flex new business critical equipment right at the point of sale (local + online).

- FUNDSaiQ – United Kingdom

FUNDSaiQ provides a SaaS based, AI / Machine Learning powered, B2B platform for financial advisors, empowering them to identify, select and monitor the best performing mutual fund managers in the market.

- goscore+ – Norway

goscore+ brings a human credit scoring to private customers using modern ML technology and data enriched with PSD2 customer transactions. goscore+ delivers solutions and services to banks, insurance, retail companies to help them make the right credit decisions, personalize existing and develop new products, get more customers without marketing budget changes, as well as reduce loan default rate.

- Schwarzthal Tech – United Kingdom

Schwarzthal Tech is building solutions to tackle financial crime using AI and advanced algorithms. The platform, Wunderschild, revolutionises compliance and investigation techniques. It provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning.

- Thread labs – France

Thread Labs developed an AI-powered collaborative investment research platform, specialized in integrating ESG in traditional equity research.

- Trensition – Belgium

Trensition is a trend analytics and forecasting company that builds upon a revolutionary and 100% data-driven methodology. The Trensition platform automates trend research and provides detailed trend & market insights tailored to the specific business context of companies.

- Velotix – Israël

The Velotix Data Governance & Orchestration Platform is unlocking Data and making it usable while adhering to compliance policies and enhancing business performance and operational efficiency.