2018 was a year of great excitement for Fintech, with powerful technology developments generating a lot of hype. We asked 9 industry experts to contribute their thoughts on the year ahead, and a common theme was the need for these technologies to mature, with the genuinely useful implementations finally getting to market.

Expanding on last year, we have chosen seven areas of interest to focus on in 2019. Each represents a vital area of innovation in the financial industry, and has a particular relevance to Luxembourg’s thriving financial technology ecosystem.

Each week we will be choosing one of the topics to focus on, both in the content we share on social media, but also in a dedicated newsletter looking at the top five stories from that week. First, let’s introduce the topics with some of our favourite summaries for the uninitiated:

1. Regulatory Technology (Regtech) – CBInsights – Regtech 101

2. Blockchain – Deloitte – Blockchain explained… in under 100 words

3. Insurance Technology (Insurtech) – Investopedia – What is Insurtech?

4. Artificial Intelligence (AI) – PwC – Briefing: Artificial Intelligence

5. Financial Inclusion – ada Microfinance – Definition of Financial Inclusion

6. Cyber Security – Kaspersky – What is Cyber Security?

7. Payments (Paytech) – Medici – Overview of the Payments Industry

Fintech Foresight – Expert commentary on what to expect in 2019

Here are our favourite predictions around each of the areas mentioned above, drawing on the experience and expertise of some key industry figures:

Regtech in 2019

Jo Ann Barefoot: CEO, Barefoot Innovation Group and Cofounder, Hummingbird RegTech

Jo Ann Barefoot: CEO, Barefoot Innovation Group and Cofounder, Hummingbird RegTech

“Regtech growth will explode in 2019 because regulators worldwide will start truly driving it. Multiple countries will hold a joint hackathon at midyear, aiming to use technology to remove one of the biggest regtech blockers: how to share data widely to find risk patterns and fight financial crime, while fully protecting privacy and cybersecurity. Solutions will solve myriad regulatory problems. Even more importantly, the shared experience will move regulatory bodies into a new era of active innovation and collaboration with each other, industry, and academia.

Anti-money laundering will continue to be a leading use case, because the current system is so broken and costly and there’s so much low-hanging fruit to harvest through technology. We’ll also see AI and blockchain solving more problems, from digital identity and financial fairness and inclusion to API-based regulatory reporting, machine-readable regulations, and even machine-executable compliance.

These regulatory breakthroughs are not just nice-to-have. They are essential, if fintech innovation is to flourish. The regulations are the rules of the road we’re all traveling.”

Bert Boerman: Co-Founder and CEO of Governance.com

Bert Boerman: Co-Founder and CEO of Governance.com

“2019 will see the growing adoption rate of RegTech accelerate, as the term has matured and is demystified. Important drivers for adoption will be sanctions and fines that will continue to increase, but also increasing personal liability for senior executives and directors of financial institutions. More executives will recognise that RegTech is not a disruptive force, but rather an ecosystem of complementary solutions to protect and enhance their business models.

Adoption will however not happen everywhere, as procurement and legal hurdles have still not been addressed in many financial institutions, especially the larger ones. RegTech solution providers will focus their critical resources on those institutions that are ready to move, which will create an increasing competitive gap between technology enabled institutions and others. This gap will narrow in 2020 when those left behind find themselves unable to compete on costs, efficiency, client focus and oversight.

RegTech companies will form alliances with other RegTechs to be able to provide turnkey solutions that financial institutions expect, but with a modular, best-in class approach.”

Blockchain in 2019

Mike Kane: Co-Founder and CEO of Hydrogen, winners of the 2018 Luxembourg Fintech Awards

Mike Kane: Co-Founder and CEO of Hydrogen, winners of the 2018 Luxembourg Fintech Awards

“I believe 2019 will be the year of de-coupling and productization of the blockchain market. Over the past few years, sentiment has gone up and down for any company that put “blockchain” in their tag line, based on sentiment for Bitcoin. Beginning next year, I believe companies will be judged on their own merits, and can be highly successful if Bitcoin is worth $1 or $1 Million.

The market is maturing rapidly, and the companies in it are becoming more professional. This means we will see more usable products, outside of just trading apps, released in blockchain next year. For example, the community behind the open-source public blockchain platform I founded, Hydro, has a dApp store being released that will have dApps for things like P2P payments, remittances, document signing, and financial KYC.

My hope is also that enterprises in 2019 will start to see the beauty and scalability of public blockchains. It has been a few years since many started their expensive experiments with private chains, and I sense the tide is beginning to turn. The world is moving towards less centralization of power, more transparency, and more ownership of data. To survive, enterprises need to become part of the solution, not continue to add to the problem.”

Insurtech in 2019

Simon Schwall: Founder and CEO of OKO

Simon Schwall: Founder and CEO of OKO

“Telemetrics and smart contracts are going to help automatise insurance in the coming years. Already today insurance contracts can be linked to a real-time data, and payments can be made automatically when specific events are identified. An example? Last year Axa launched Fizzy, an insurance product that automatically pays you if your flight is late by two hours or more. Such applications are endless, and we will see a lot of new insurance products emerge. We at OKO develop insurance contracts for farmers in emerging countries. If the accumulated rainfall (measured through satellite data) falls below a given threshold, farmers get automatically compensated.

While this brings a lot of opportunities and hope for activities that were previously too small to receive “human attention”, it also comes with its challenges. One of the founding principles of insurance is that the payout corresponds to the loss incurred, and if no claim assessment is conducted this is not guaranteed anymore. It is also a paradigm shift for insurance companies, whose area of expertise needs to move from customer service and interpersonal trust to expertise in data science and accurate algorithms. And this is where large established companies and startups can collaborate to prepare the future of insurance.“

Artificial Intelligence in 2019

Christian Gillot: Founder and CEO of Tetrao

Christian Gillot: Founder and CEO of Tetrao

“AI is a new paradigm and its growth is unstoppable. It’s changing the world for better, just like previous industrial revolutions did before. Many initiatives were launched in AI and Machine Learning in 2018. Looking back, some were crazy, some just made sense, with a lot of innovation going on.

The year 2019 is going to be the year of maturity for AI and Machine Learning in Fintech. Many projects are going to be put in production and demonstrate their value, only to be continued on a more ambitious scale. At the same time, many of the initiatives that can’t prove value will be axed, because technology was too early or the team couldn’t execute. It is to be expected since the financial industry has built experience around and learnt how to manage AI in a responsible and profitable way.

All in all, the market is going to get more competitive and exciting technology is going to reach more and more people. The great miracle of AI though, it’s that most of end-users won’t even realize that the companies that they interact with have implemented this technology. They will only realize that everything just got a bit faster and simpler and that will be most welcomed!“

Financial Inclusion in 2019

Viola Llewellyn: Co-Founder and President of Ovamba

Viola Llewellyn: Co-Founder and President of Ovamba

“One of the challenges that Ovamba sees with Financial Inclusion is that it is a multi-faceted problem offering multiple opportunities to create impact. For us, the goal of financial inclusion is to create a self-sustaining business ecosystem that reduces the barriers to access (such as gender, property ownership, religion, culture, language, ethnicity and literacy) as more customers gain confidence in the ecosystem. It would almost be pointless to innovate FinTech solutions that require formal education or functional literacy when in many cases, some customers have communication or structural challenges that have created the exclusion. We would like to see a multi-level approach to resolving the challenges of financial inclusion. One of those approaches will focus on making customers in emerging markets a better risk by teaching and supporting their ability to run well performing businesses that are built for long term growth and not just for subsistence and survival.

The other approach would be to partner with banks and support them with our innovations to provide alternative finance and services to customers they would normally not be able to serve. We would also like to see better tax structures that don’t drive businesses into the “gray” market or away from inclusion in GDP count due to crippling taxation. At Ovamba, we prioritize wealth generation and financial freedom as the foundation of financial inclusion. Financial Inclusion is a ‘human and business aspiration’ that is imperative for all emerging market business owners who wish to transfer wealth to the next generation and throughout their communities.”

Livingstone Mukasa: Founder and CEO of Four One Financial Services, and winner of CATAPULT: Inclusion Africa

Livingstone Mukasa: Founder and CEO of Four One Financial Services, and winner of CATAPULT: Inclusion Africa

“Our aspirations in 2019 is popularize a new term we coined towards the end of the year “Micro Social Security” which encompasses retirement savings, affordable health insurance, micro mortgages and education financing” because we believe these are still the areas with the highest exclusion.

When it comes to investments and innovations in financial inclusion, Africa will continue to lead but we will increasingly see resources going beyond payments and common services like access to credit or bank accounts. There will be strong emphasis on helping those in need manage risk better using improved tools like crop insurance and health insurance.

Financial Inclusion is tough business. My wish for the year that available resources be directed to areas and sectors that still face the highest exclusion but offer us a chance to improve the livelihoods of millions of people. We should do this while finding better ways to support leaders that risk nearly everything to help others find ways to break the cycle of poverty.”

Cyber Security in 2019

Barbara Terra: Business Development at Hacknowledge Luxembourg

Barbara Terra: Business Development at Hacknowledge Luxembourg

“Cybersecurity is becoming too complex, too expensive and yet too crucial to be ignored. Taking advantage of this situation, in the last few years some unprincipled vendors have pushed customers to invest in new technologies they sometimes do not need, or aren’t able to implement to full potential. We believe that cybersecurity is a matter of trust and honesty and not all companies can afford to have a dedicated security team of several engineers. In 2019, security is a subject that is discussed at board levels, and it must be the year of rationalization. We believe that in 2019 cybersecurity has to become effective, affordable and understandable. We are ready for this, are you?”

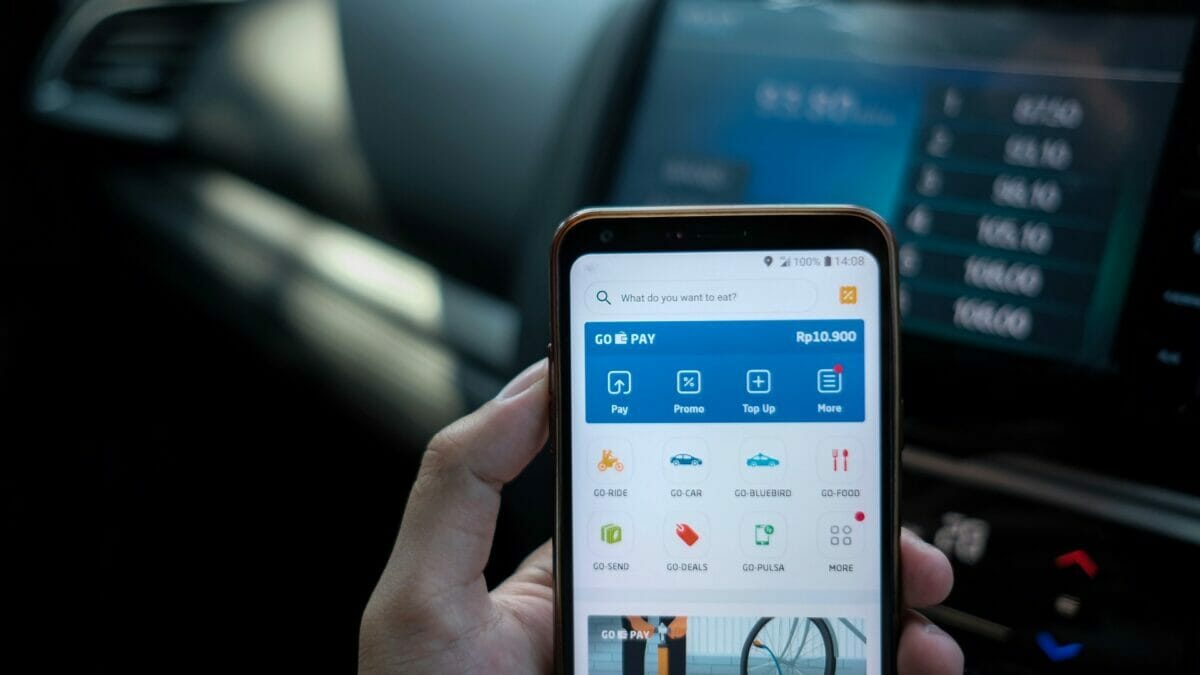

Paytech in 2019

Şebnem Elif Kocaoğlu Ulbrich: Team Lead Business Development at Lendico

Şebnem Elif Kocaoğlu Ulbrich: Team Lead Business Development at Lendico

“It’s only mid-January but all the Fintech oracles have made their Paytech predictions already: the market seems to expect a lot more of experimenting regarding blockchain, AI and IoT in 2019. Although it is hard to make a general statement that’d cover all geographies, judging from the development trend, overall, 2019 is not supposed to be a year of exploration but rather a year of settlement and maturity in Paytech. The proof of concept developments banks and Fintech companies have been running in the background will finally reap the fruits of victory in many different trends like APIs and Open Banking, contactless and NFC. We can also expect more banks to stop exploring blockchain and working on creating silos for payments with an underlying DLT technology this year, which might make real time payments cheaper and more accessible.”

Which is your favourite prediction? Which of the five areas do you think is likely to drive the most change for financial services in 2018?

Don’t forget to subscribe to our newsletter to receive our weekly updates — each week looking at one of the topics above. We also send out a monthly report that covers the LHoFT activities, the Luxembourg Fintech ecosystem, job opportunities, and some broader industry news.