On the 30th of June we were fortunate enough to host a showcase on Luxembourg’s Banking industry, as a part of our International Showcase series of webinars with Luxembourg For Finance and representatives from across the ecosystem. The slides may be downloaded here and we’ve also transcribed the full talk and Q&A section here.

Antony Martini, Engagement Manager, LHoFT Foundation

Welcome to our third episode of our international showcase over a series of four focusing today on the banking industry in Luxembourg. First a little bit about our fantastic speakers background. We have:

- Chris Hollifield, Fintech development and Fintech advisor at Luxembourg for Finance.

- Jean Diederich is the vice chairman of the Digital Banking and Fintech Innovation cluster at ABBL.

- Andrey Martovoy is a Fintech Adviser at the ABBL.

- Fred Giuliani is co-director of Informatics Development Departments at Spuerkeess.

On the moderator side, we have our co-host and my colleague Alex Panican, Head of Partnerships and Ecosystem at the LHoFT.

Alex Panican, LHoFT

Thank you Anthony.

Thanks for joining us. This is our third international showcase and today we’re gonna focus on Luxembourg’s Banking industry. We started this series of webinars in partnership with Luxembourg For Finance, and it’s mainly to help Fintechs from all around the world to discover the Luxembourg Financial Industry, but also to learn how to work with this industry. So, today we’ll have a quick introduction of the banking industry by Chris from Luxembourg for Finance. We’ll learn more about ABBL, the Luxembourg Banking Association with Jean and what they do in the field of Fintech mainly. We’ll also have a very interesting talk from Spuerkeess, one of our main banking partners, one of the largest banks in Luxembourg, how they work with Fintechs and what are the challenges they face. And finally, we’ll finish with a Q&A. So please don’t hesitate to drop your questions. So Chris, without further ado, please explain what’s the Banking Industry all about in Luxembourg.

Chris Hollifield, LFF

So, as Alex said, thank you for being here today. I’m just going to give you a very quick run through the banking sector here in Luxembourg, just to give you some background onwhat we’re talking about and what are the primary activities. But first, I think it’s important also to start with a bit of context about Luxembourg, particularly for the Banking sector. So Luxembourg, as you probably noticed, is a tiny country in the middle of Europe with a population of about 600,000 people. And geographically it’s about three times the area of Hong Kong. And while geographically speaking, it’s very small, in terms of finance, it’s a really major Center. This is another way of looking at Luxembourg. And here Luxembourg is one of the biggest countries on earth. And that’s because Luxembourg, as an international financial center, the financial activities that get transferred through Luxembourg are fairly major.

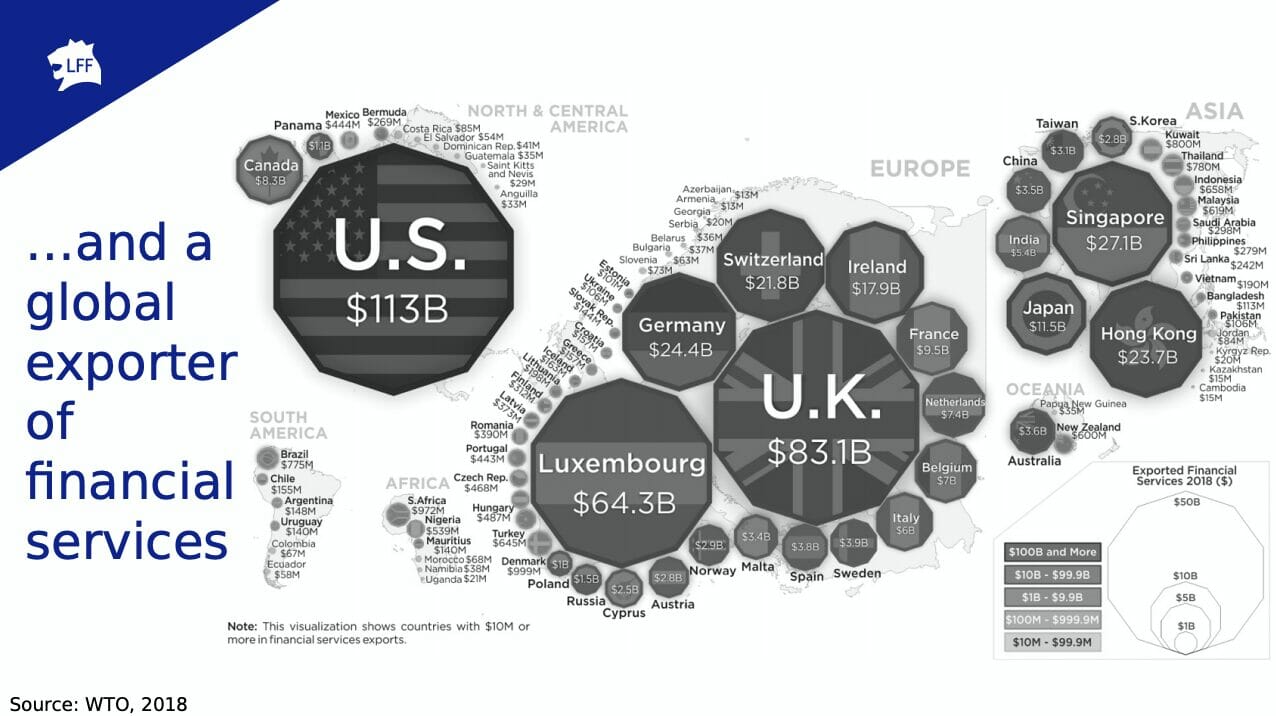

This is another way of looking at it. This is a global export to financial services exports from Luxembourg. Okay, basically acquainted Luxembourg being the third largest country in the world.

So the big question is: why? And for me there are two real key reasons.

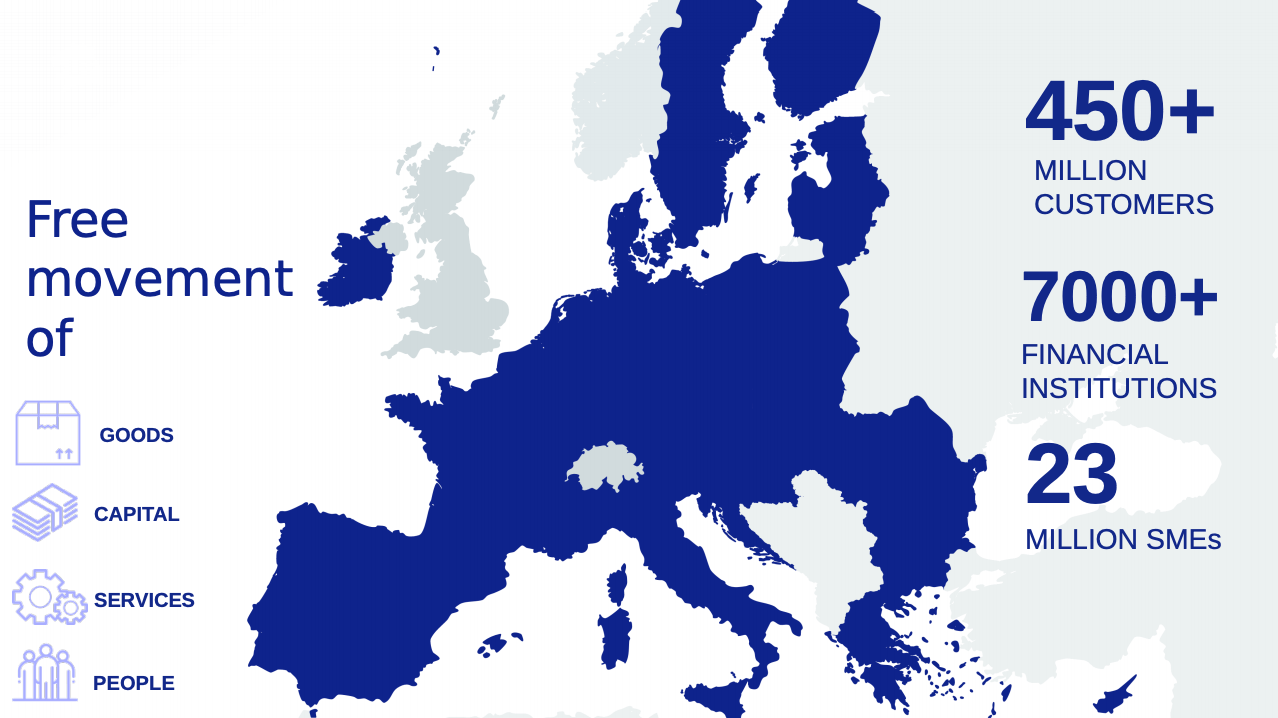

The first one is because Luxembourg is a founding member of the European Union. And so the market of financial services in Luxembourg is not the the 600,000 people in Luxembourg, it’s rather the 450 million consumers throughout the rest of the European Union, the 27 member states of the European Union, it’s the 7000 financial institutions across the rest of the European Union, and it’s the 23 million SMEs that exist throughout the rest of the European Union as well.

As a result of being a member of the European Union, Luxembourg sees its population go up by around another third every day with cross border commuters coming to work in the financial sector in Luxembourg, and then returning to the neighboring countries with France, Belgium, Germany, in the evenings.

The other main reason why Luxembourg exists as a financial center is stability. Luxembourg is one of the few countries left on the planet that maintains a triple AAA credit rating. Up until the beginning of Covid19, Luxembourg had a debt to GDP ratio around 21%, and now it will only climb marginally as a result of Covid19 measures. But it’s not just about financial stability. It’s also about political and regulatory stability. So, since the end of the Second World War, Luxembourg has had a grand total of eight finance ministers, which is actually a surprisingly low number in comparison to the rest of Europe. And it’s that kind of continuity of a thought process, that continuity of politics that ties over into the regulatory atmosphere. The companies that are based here, that are regulated here, are very aware that the environment in which they’re regulated, will be subject to broadly similar to how it was last year, to how it was three years ago. So all of these things tie into why there is such a strong banking sector in Luxembourg.

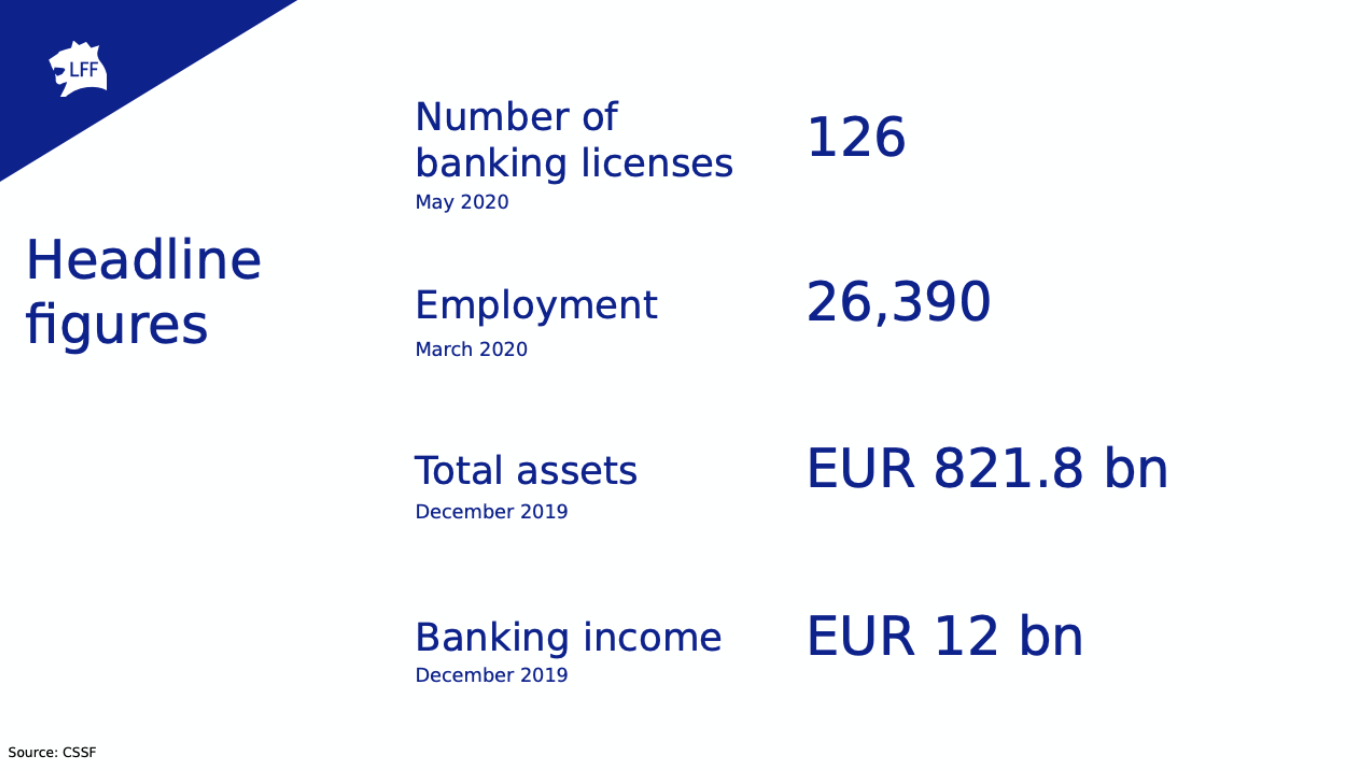

So now to move into a few more specifics about the banking sector in Luxembourg. Here are a couple of high level figures for Luxembourg: around 126 banking licenses and just a bit more of 26,000 employed people. We have total assets of around 821 billion euros on the balance sheet and a banking income of around 12 billion euros. This makes banking one of the main pillars of the Luxembourg financial ecosystem.

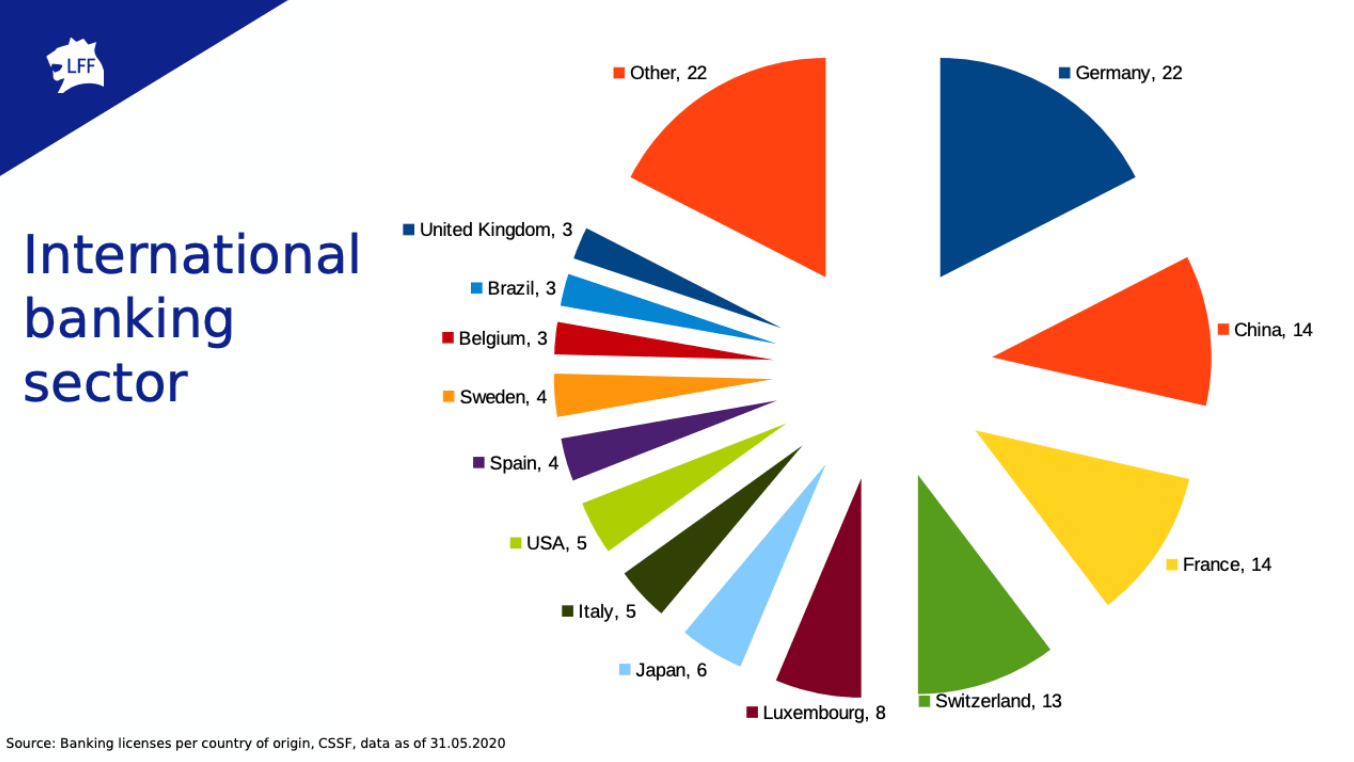

It’s a very international environment. The origins of the banks that are present here in Luxembourg, they come from all over the world, not just in Europe, but also outside, you’ll see also a sizable proportion of Swiss banks and as well as a number of UK, Brazilian banks and also countries from the rest of the European Union.

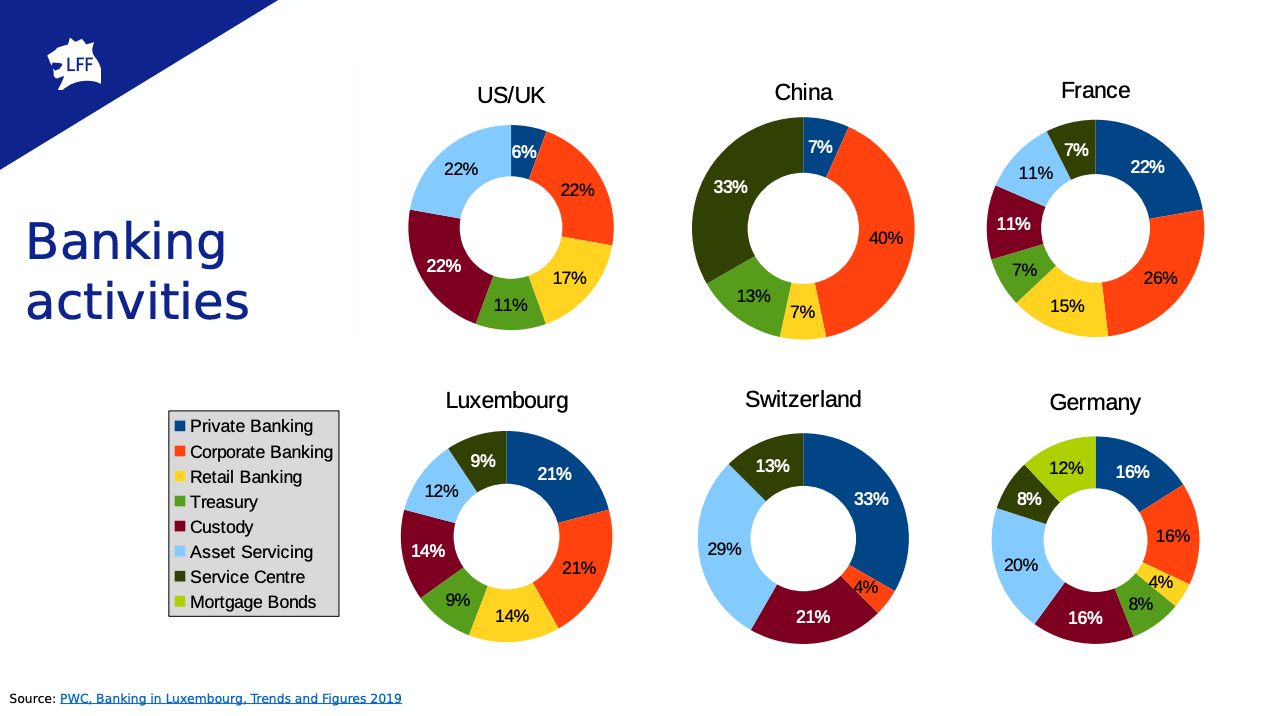

And now in terms of activities. Luxembourg is primarily a center for a variety of different banking services. The primary one being services supporting the fund industry: depository banking; asset servicing; custody services. Another major area of being private banking and a third area being corporate banking. As you can see from the chart the geographic origin of where the banks come from has a certain impact on what those banks do here in Luxembourg.

One thing that I think should also be clear across these slides is the retail banking sector, that is relatively small in comparison to the rest of the banking activities. Luxembourg is primarily a B2B corporate banking center, a private banking center. And it’s for those reasons that the banks come here often as it is kind of like massive retail banking activity obviously, there are some supporting the local market in comparison to the border membership of banking, active in Luxembourg, it’s comparatively small activity. So that’s kind of like a very quick overview of the banking sector. And I’m happy to obviously take questions. We’ll go into further detail if people have questions afterwards, but I’m going to hand over now to Alex to move on to the next presentation.

Alex Panican, LHoFT

Thank you so much, Chris. Very interesting. numbers. Jean, please. The Luxembourg Banking Association. This is your industry. Can you explain a bit about the association and what you guys are doing in the Fintech sphere mainly.

Jean Diederich, ABBL

It is my pleasure to present the oldest and the largest professional association of the financial sector in Luxembourg, which exists since 1939, and has more than 210 members. We call it the voice of the Luxembourg financial sector. And what is also very innovative is that the membership not only includes bankers, or people from a financial institutions. It’s larger than that, meaning I have seen that the biggest category of people listening today is 33% of consultants. So I’m also a consultant, which means that the Banking Association is quite open minded. Consultants, auditors, law firms, and other financial sector professionals can become a member of the association and contribute to it. Also, like payment institutions, e-money institutions, meaning people having the status not of a credit institution, but more like Fintech.

What we do is that we represent and we develop the professional interests of our members or categories of members. We are hubs of exchange between the different categories of people. And something very important, especially when you are a founding member of the European Union, is to have a representative office in Brussels, because most of our regulations and directives come from the European Union. What is also very important for Luxembourg, as big exporters of financial services, is that through the EU mechanism, you can do all over Europe, banking services and other services. So it’s very important for us to provide these categories of services and intelligence resources to our members.

We are of course part of the promotion and branding of the Luxembourg financial sector. We have a Management Board where we have a new CEO: Yves Maas, Chairman of the Board of Credit Suisse Luxembourg S.A. since 2017. He has next to him some technical advisors, and of course can support the Brussels office of the ABBL in order to make the link to the European Banking Federation where different association of banks representatives at EU level. So ABBL is much larger than what I represent here, as I said before, so we are the digital banking and Fintech innovation cluster.

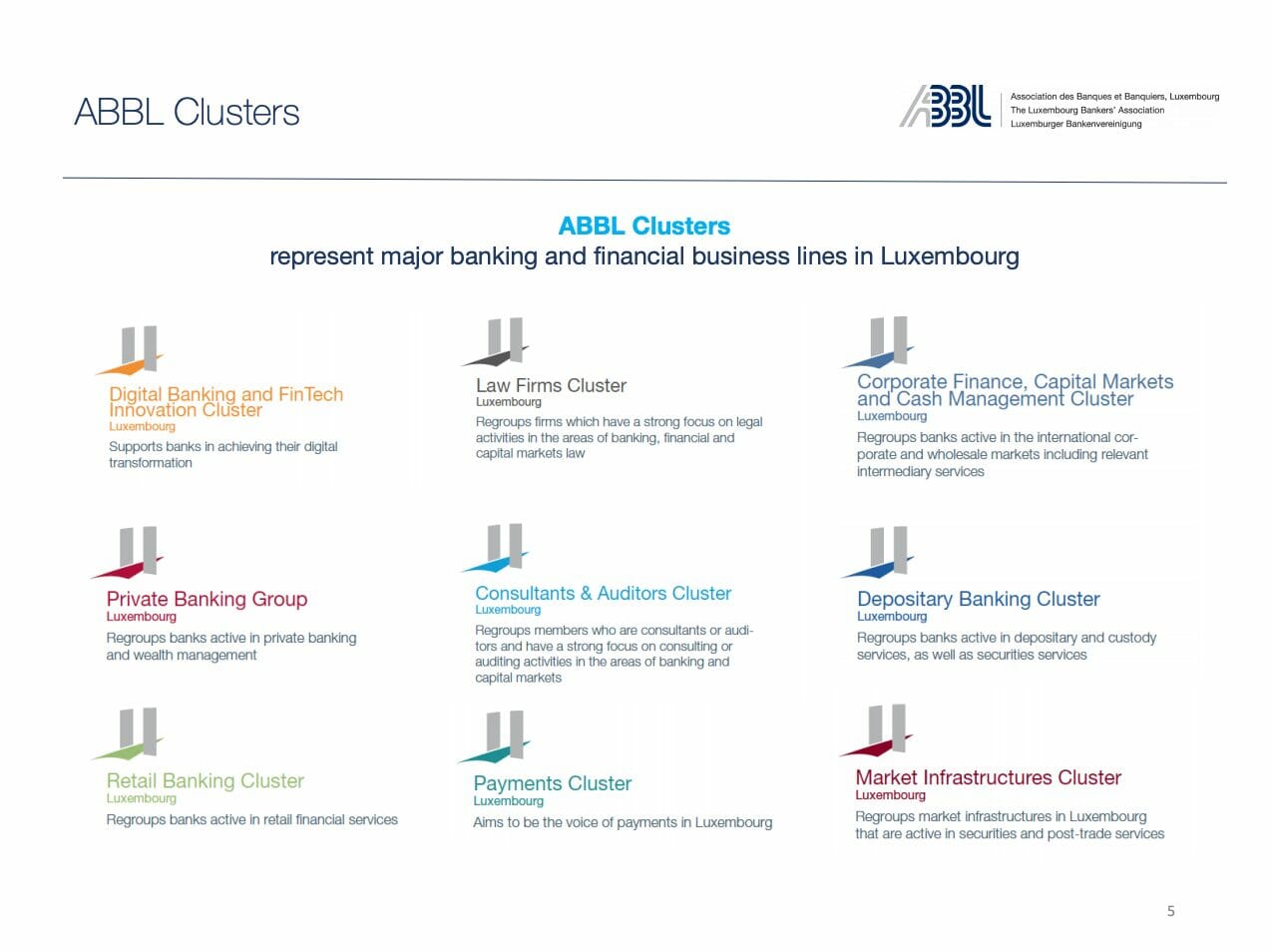

I’m one of the vice chairman. My chairman is from a bank in Luxembourg, Jean Hilger from BCEE. There are also other clusters called the Private Banking Group, the Retail Banking cluster. Then, there is also another cluster where all the different law firms collaborate. We have our special sessions between consultants and audit firms. And for a long time, I’m also a member of the payment cluster, where a lot of evolution came through the 2009 Payment Service Directive and recently in production of the payment service directive PSD II. We have another cluster corporate finance, one or depositary banking, and of course, one on market infrastructure. Our cluster was created in 2016. It’s a mix of different categories of firms. Many law firms, many Big4 firms, many Fintech firms, many digital financial services firms.

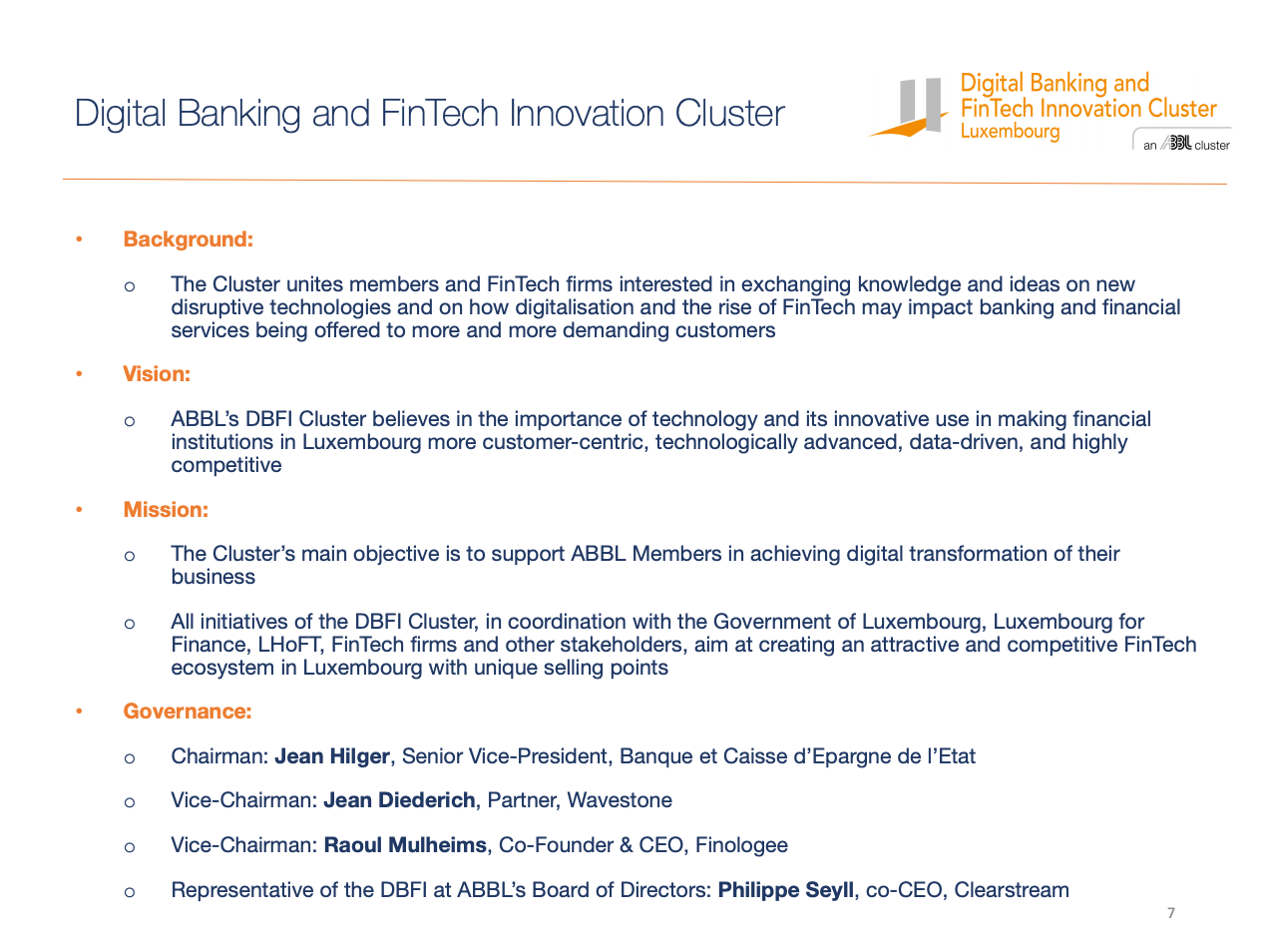

What is very important is that our cluster intends to exchange knowledge of what is going on in the digitalization of financial services. And especially two aspects, meaning on the one side you have the evolution of the financial services and its digitalization; on the other side, you have the disruption or the revolution coming on. And so, we are covering both affects on one side, we want to give all necessary information to the traditional banking members and on the other side, we want to connect with all different Fintechs in Luxembourg in order to make the financial institutions in Luxembourg more customer centric, that we have more focus on the technology and the digitalization of banking services. Everything around the data driven and of course staying very competitive in that area. So as I said before, my chairman is from the BCEE, he is a banker. I’m from a consulting firm Wavestone. And the second vice chairman is Raoul Mulheims. He’s a co-founder of Finologee, which is a Luxembourg Fintech company. And we have representative of the DBFI at ABBL’s Board of Directors: Philippe Seyll, who is the co-CEO of Clearstream, who is mainly in charge of infrastructure in Luxembourg, Europe and worldwide.

What is important to understand and why you could join us, or you should even join us, is all actions and activities we do. So we have all in all 3 goals:

- The first is to share knowledge. So we are making an organizing matchmaking event. We drive Fintech Greets meaning speed dating events for banks and Fintechs, where they can exchange information and get to know each other much better. We may organize workshops on Fintech and innovative topics. These traditional meetings on “ABBL Meets Members” on specific financial digital topics. Then, also what is important is that we support financial institutions to set up their innovation facilities and labs in Luxembourg. And we have also run last year open banking seminars on Payment Service Directive with APSI and the LHoFT.

- Second, we aim to cooperate with the stakeholders. We have different working groups: one is on cloud computing; one on DLT blockchain, one on Stablecoin /Libra; on big data and analytics. What is important for us is to contribute on different topics to the Luxembourg High Committee for the Financial Center. And we have many bilateral exchanges with other Association from the fund industry, insurance and digital, data protection regulator, and so one. And we are linked, as I said already before, to the European Banking Federation, where we support the digital strategic group as well.

- Third, we aim at contributing to the Fintech ecosystem. Different studies have been organized: one now on COVID-19 jointly with KPMG Luxembourg; another on between the cooperation of banks and Fintechs with our business advisory; one on the cloud adoption with KPMG; another one on the DLT adoption with Wavestone; and then also, some research projects on the application of DLT to KYC processes, funded by ABBL Foundation for Financial Education and the SnT. There’s also other research projects trustworthy AI for instant AML due diligence, because, as you know, if you do instant payments you need also to have an intelligent anti-money laundering process, which is also instant. So, you can find a map that we maintain at fintechmap.lu. So this is a Fintech Service Pack for Fintech firms where you could subscribe, and you can be part of the list of the ABBL and so all the community is aware of what you do in Luxembourg. And this will help you also to connect to the Financial Center.

If you want to contact us, you have the email of Andrey Martovoy, ABBL Fintech advisor and coordinator. If you have any questions, feel free to ask them and we will try to give you the best possible wisdom. Thank you very much.

Alex Panican, LHoFT

So for the LHoFT, I’m going to be brief because the goal is to have an interesting Q&A. So we are mainly a foundation, and not a for-profit foundation. It’s a public-private partnership between the Ministry of Finance, Ministry of Economy, Chamber of Commerce, Luxembourg For Finance and 20+ private partners and as you can see, some of them are bankers.

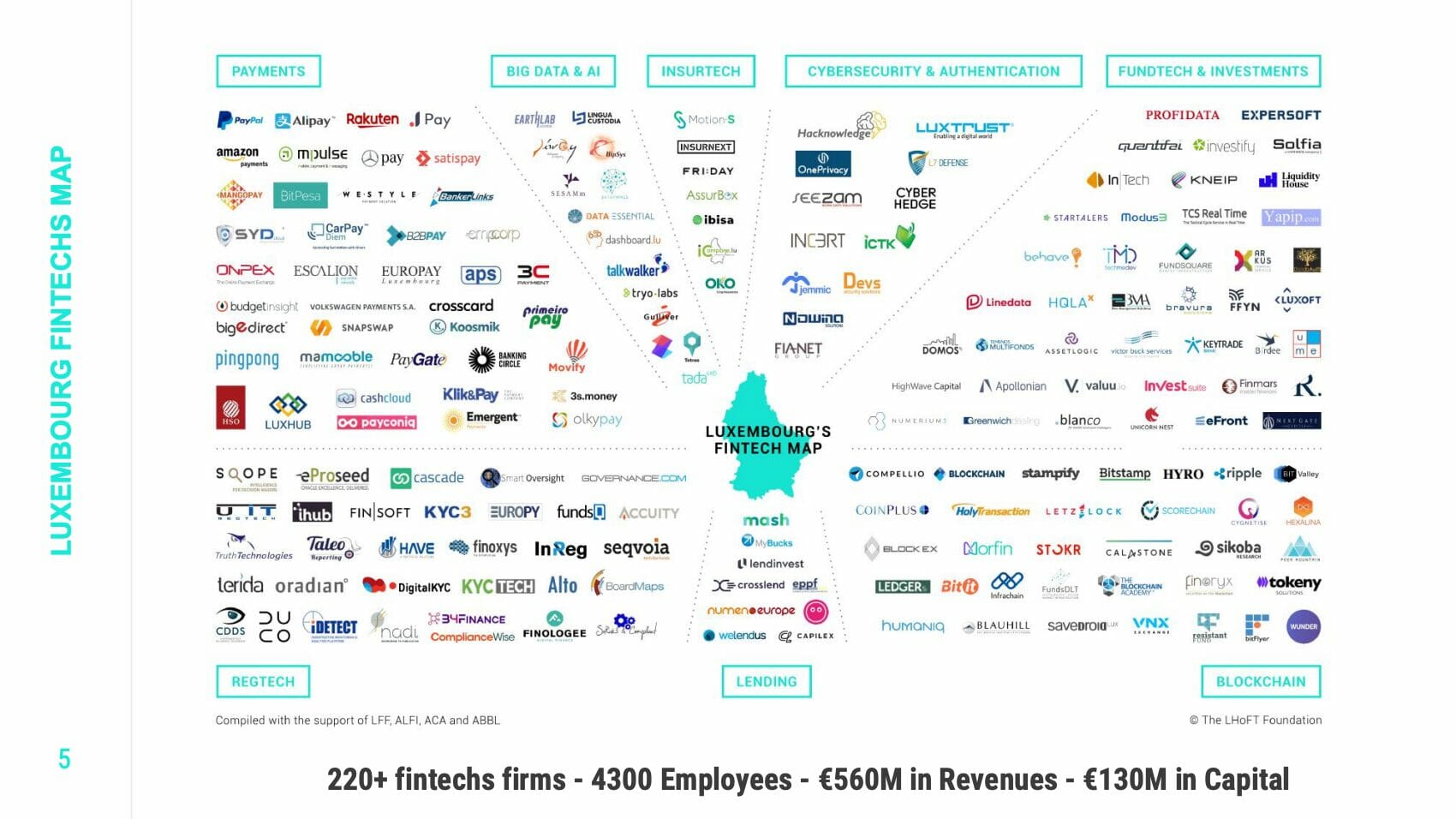

The idea of the LHoFT is to foster innovation and financial industry by connecting the Fintechs and the innovators from all over the world with the local local industry. We host here at the LHoFT around 74 firms. As you can see, we have co-working space, open desks, closed offices, we work closely with the regulator to make sure that on the security side, everything is okay. And it’s a fun space. We also have a Fintech map. So coming back to what Jean was saying. With ABBL, ALFI, the fund industry association in Luxembourg, and with ACA, the insurance industry association, we have put together this map and as you can see, we have a huge portion of Fintechs who are on the payment side.

We also have a lot of companies in the Fundtech, Regtech, Blockchain and Lending sectors, many of whom have moved their headquarters for Europe to Luxembourg. As you can see it’s an ecosystem that’s growing and could be quite interesting for you.

Why are those people coming to Luxembourg? As Chris already explained, we are a huge financial center. Most of the banks are here. But something that’s maybe worth mentioning is language. Most people in Luxembourg speak on average 3.6 languages. Everything can be done in English, compliance can be done in English. You can also do it in French and in German. So it’s quite convenient.

I’ll finish with the ecosystem, which is the most interesting part of Luxembourg. We have a full value chain here for the Fintech industry. We have support from public initiatives such as the LHoFT but also from private initiatives, be it incubators, be it clusters, as we mentioned, ABBL, ALFI, or Digital Luxembourg. On the financing side, we do have a few VCs. But we also have special schemes from the Ministry of Economy that can be helpful. And finally, we have the European Investment Fund based in Luxembourg, and they have a special scheme called the Luxembourg Future Fund which is quite interesting if you’re looking for funding.

It’s also worth mentioning we have a great university, including the SnT that is the technical department of the University of Luxembourg. They’re working a lot with Fintechs. SnT is also working with ABBL on some KYC projects, so they understand Fintech, they understand payment, they understand AI and they understand blockchain. So that’s very interesting if you’re looking to do such a government project with academia.

Luxembourg, as Chris mentioned it, is very international. At the LHoFT, we have 20+ hub partners all over the world. But we are part of what we call the Talent Route in Europe. So we work with 15 Fintech hubs based in Europe. So if you’re coming to Luxembourg, you’re going to serve the local market, but we’re going to help you connect with other regions from Europe, be it Spain, Italy, Denmark, Eastern Europe now. So we are a gate for Fintechs to Europe. So the LHoFT is mainly, as I said, a community where Fintechs, research centers, banks, funds, they’re all coming together trying to work and define what the financial industry will look like tomorrow. So that’s it for me. I will share some information in the end. So now Fred Giuliani is with us. So Fred, you are one of the largest banks in Luxembourg, right?

Fred Giuliani, Spuerkeess

Yes, we are. We are mainly a retail bank, but also very interested in digitalization.

We are going to speak about the collaboration between Fintechs and banks, why some problems arise, and how we’ll go around them. Let me first make a disclaimer: some statements I will make are a little exaggerated or overstated. This is done on purpose. I will draw a black and white painting and we all know that reality is not black and white, but it’s a lot of grey shades in between.

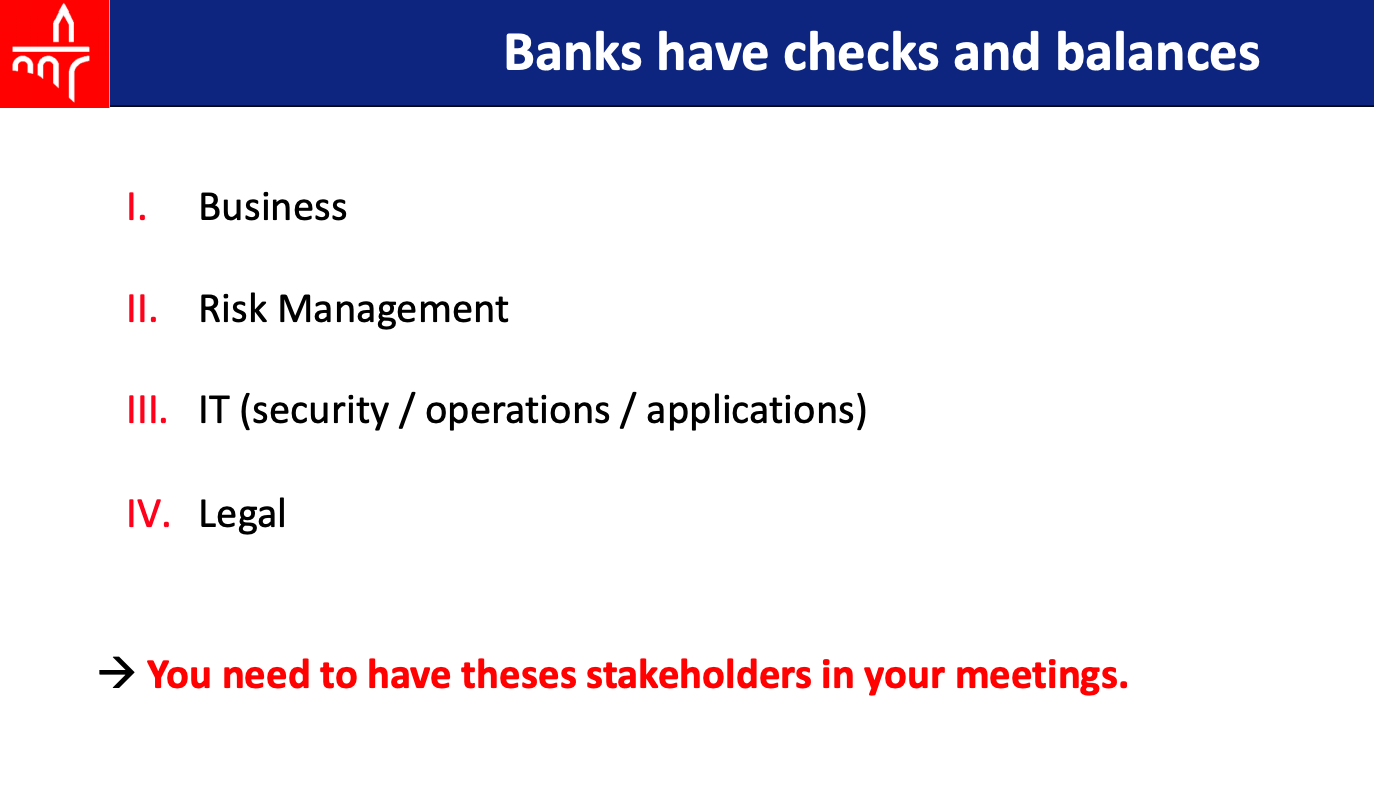

Two years ago, I joined the European Fintech exposition in Vienna. And after the exposition, I was attending a privately organised panel between Fintech owners and banks. And we spoke about the problems that came around collaboration between those two units. The Fintechs reported several problems, but one problem that always came up was the question: “Why does it take so long to have a partnership with a bank and to go to production?” And this is all about the sales cycle and how much money a Fintech has to put into it, before the collaboration works. One of the participants made the summary like this. First of all, it’s very difficult to find the right person in the bank to talk to. When you find the right person in the bank, and he likes your idea, then it takes time because he has to go to his boss, and to present the idea. If the boss likes the idea, he will come back to you. And the second meeting was all the same content you already had in the first meeting. If after that meeting, the boss is still interested in working with you, he says, “Hey guys, now you have to go to see IT.”. Then you go to the IT department and there are not one person but three persons with different interests: one in security, one in operations and one in application development. And then for the third time, you have to do all your presentations all saying the same things, again, answering the questions and it takes time. When all these people are still convinced that it’s a good way to go, they do a business case and they go up to the bank’s board. The banks board will then say: “Hey, risk management, have a look at it and tell me if this is okay with the bank’s regulation.” And the risk management department will call you again and you will have to see all the guys from risk management, they are asking the same questions and you have to go over it again. Suppose now that they are still very in favor of your project, of your solution, then they handed it over to legal.

Legal, of course, will all have to say about the contract that will be done between you and the bank and it takes again some time. Suppose that you avoid all the pitfalls, then you get signage on the contract and saying “Yes, I did it”. But again, you’ll go back to IT and they tell you that they have really cycles and that for the next recycle, it’s not okay to have it, that it will take three additional months to do this. And then when you go live, it’s about 12 to 18 months, where you, as the Fintech, probably thought it would take three months and that’s one of the big problems that I call highly agile versus highly regulated.

Highly agile VS highly regulated

In fact, you as a Fintech, you are agile and you want to move fast and that’s great. Banks on the other side, are regulated entities. People put the money in that bank and so they are highly regulated in order not to lose that money. They are submitted to supervisory authority, they have three lines of defense being operational, the risk management, the audit etc… Banks are used not to take unconcentrated risks, they take risks, but they are very cautious. So they have put into place checks and balances. And there are a lot of control points to go through. So, on the collaboration side, you as a Fintech, you have to convince, of course, the business side, the risk management, the IT, and the legal. One advice I can give you after the first meeting, ask the business side to bring along all these persons, because only when you have them all in the meeting and they are all participating and convinced about your project, then it will go further very quickly. I have to say that in the last two years, a lot of banks have made a lot of progress in this area, and they have taken appropriate measures. They have normally now a special team in place that will act as your single point of contact, and things will probably get much faster. But not all banks have done this.

Fintech are an “operational risk” for the Banks

The second point is that when they look at your Fintech, they see of course, a great company and maybe a great product, a great service, but they also see Fintech as an operational risk for the bank. And let’s begin with the business side. Of course, they have some interests in your product, they want to increase customer satisfaction through your product, through your service; they want to increase customer satisfaction, to drive up profitability, to make more revenue, and they are probably your biggest sponsor in the bank. But even this person has some fears. And one of their fears is: “What if the new product or service I’m offering from the Fintech to my customer is not successful?” Will the blame fall back on them? Are they made responsible for the failure?

Suppose that it’s not even a question of blame if the product is not successful, but now comes the question: “We have sold so many units to customers, how are we going to stop it?” How can we tell the customer “Okay, this was something that went wrong,” how can we go back from it? And then that’s, of course, also a personal question in it. If Fintech has a great product, maybe it makes the bank or the advisors much less needed. And there is also the fear to get disintermediated in the whole process. So in order to get the business on your side, one thing which is good is to provide a market analysis for your product or service.

Nobody knows the product better than you because you have been building it, you have been putting research in it. And you probably know better than the bank how to market it to their customers. Help them, advise them on how to build a value proposition for the bank so that they can convince the board about it.

The next part is risk management. What keeps those guys busy at night? Well, they are there to keep the risk for the bank as low as possible, or at least at a manageable level. So what are their fears? Well, they fear that maybe your company will not be there in 2, 3, 4 or 5 years. They will fear that maybe you sell your company to somebody that will not continue the partnership. They fear that if your company goes out of business, that they have an operational problem that they can’t continue the service provided to the customer, because they rely on you. They will always look for exit strategy paths. So if you should go out of business or you should stop simply the product, how can the bank have an exit from it? And of course, they are also afraid that you are making mistakes that will harm the bank’s customer. So it’s also a question of liability. So what can you do to persuade these guys that you are a good partner? First of all, provide a business plan. And if this business plan looks sound to them, then they know that you will be going to survive and that your product will be a success. Offer Plan B if for one reason you should go out of market. This is often said, hey should we ever go out of the market, you can use our technological solution, etc from 12 additional months if you pay for it and you host it. So, give them some options if you should go out so that they have a period to recover from it and explain to them how you will mitigate the risk your Fintech is facing. These are people of numbers, these are very rational and logical people you can really discuss well with them.

The third part is IT and it is probably more than one. I will begin with IT security. So their interest is to maintain secure and trusted systems. So if you speak about collaboration with them and interfacing your systems to them, they are thinking about all security: “is there a risk of getting hacked?”; “is there a data leakage problem?”; “is the service GDPR compliant?”, etc. So they are all taking into consideration the overall security architectures. And if you want to help those guys, provide them with your security, architecture, documentation of the system, explain them in detail how you handle different security scenarios, if you have them. Show an external security audit and PEN test so that they are reassured that you are knowing your job and that you are doing a good job. If you have any ISO, or any security certifications that are supervised by banking authority, that’s of course the golden standard.

Alex Panican, LHoFT

When you say Fred “being supervised by a banking authority, do you mean that they have a PSF license? Is this what you have in mind?

Fred Giuliani, Spuerkeess

Exactly. For example, if it’s a PSF license or even if you are speaking about open banking and you are TPP, so it gives already some more credit to be registered.

So then, as I was saying, you have IT operations. Well, these are the guys who keep the systems up and running for 24 hours, seven days a week, and 365 days a year. These guys are concerned with whether the Fintech system impacts the banking system. What if Fintech is offline? Will the banking system go offline too? How can we close the gap between the reliability between the two systems. They will be interested in disaster recovery and business continuity. And they are of course very interested to have skilled technicians on your site that they can help or that they can address the questions to and they get help from. So basically, what can you do for them, provide them an SLA (service-level agreement) with your product or service, provide the disaster recovery plans, and show them also that you have already tested them. Describe your suppliers, your cloud partners, etc, so that they know that you’re working on a reliable system and have a helpline for that technicians so that the technicians don’t feel to be alone so that they always know hey, I have a phone number, I can call somebody from the Fintech, if there’s a problem.

Then you get IT applications. And these guys are probably also some of your support. That’s because they can integrate new cool features into their banking software. But of course, they also have some fears. How do they integrate the Fintech technology? They come from a legacy background so they will know Java, .Net, Cobol…more legacy programming languages and they know much less about JavaScript and new development languages. They will also ask if the Fintech has skilled technicians that might help them with interfacing. And of course, how often does the system of the Fintech change? Are there modifications that are to be done on the banking system? So these are all the questions that will bother these guys. What will always help is if you provide adequate documentation and code snippets and .Net and Java, so that will really help the guys to get operational very quickly. Fix an upgrade policy and underlying that you will be backwards compatible with your product or service for at least 6 months or 12 months. So give them some guarantees. Propose to have common workshops so that they learn how your technology works and how they can integrate it best. And then have some common playground or environment where they can test everything when you keep playing around with it and make their code work.

Last but not least, we have the legal. What is their interest? their interest is to have a sound relationship covered by legal agreement between the parties. And what do they look at the contracts? They want to make sure that all important items are covered in your common agreement. This comes from SLA, to liabilities, to intellectual property, to termination, etc. And they want it to be an understandable and fair agreement. But they also want to make sure if they put some clauses into it that you understand the agreement and they’re still convinced that it’s a good agreement. And then of course, if some things should go wrong, it’s also about is the agreement enforceable? Can I really use it if I need to. So basically, what will always help in such a situation is to provide already a fair agreement model for discussion. You know your product and service better than anybody else. So you can really work on that agreement and it will help you with every bank. Explain also what elements are important for you to be in the agreement, so that they can really be in the agreement. Explain also what elements you have explicitly taken care of. So that they understand why they are in the agreement and why this is important to you. If you have an agreement with Luxembourgish Bank, the lawyers of the bank will feel much more comfortable with Luxembourgish law than with US law. So basically, if you have to put it up, put national laws. If you don’t make that then only go to non EU laws, because that willI probably be some point of discussion with the lawyers of the bank. And then this is the jurisdiction, that means if you go to court, where are the courts that will take in the case. Basically, these are the main points which will really help you to speed up the sales process, the go to production process if you follow it.

Open Banking collaboration : some lessons learned

Then the third question is about open banking because it was explicitly asked that I also speak about open banking and we have already collaborated with some Fintechs in that domain. And there are some lessons to be learned. First of all, there are banks who are quite familiar with API’s, if you go to BBVA, if you go to Deutsche Bank, they are all the golden standard in API’s, they have teams that do nothing else, buy sell and market their API’s, they will help you to use them, they will help you to put everything into place. But most banks are not that advanced, if they are smaller banks, they probably don’t have all that into place. So first of all, most banks will be happy to work with you. They have put into place their PSD II API’s. And they have a positive attitude to these API’s in so far that they want the API being used, they want to stay relevant in the banking context. And that is to be offering the API’s and your software using those API’s. Basically, not all banks have API managers. So the API may be published somewhere, the specifications are there.

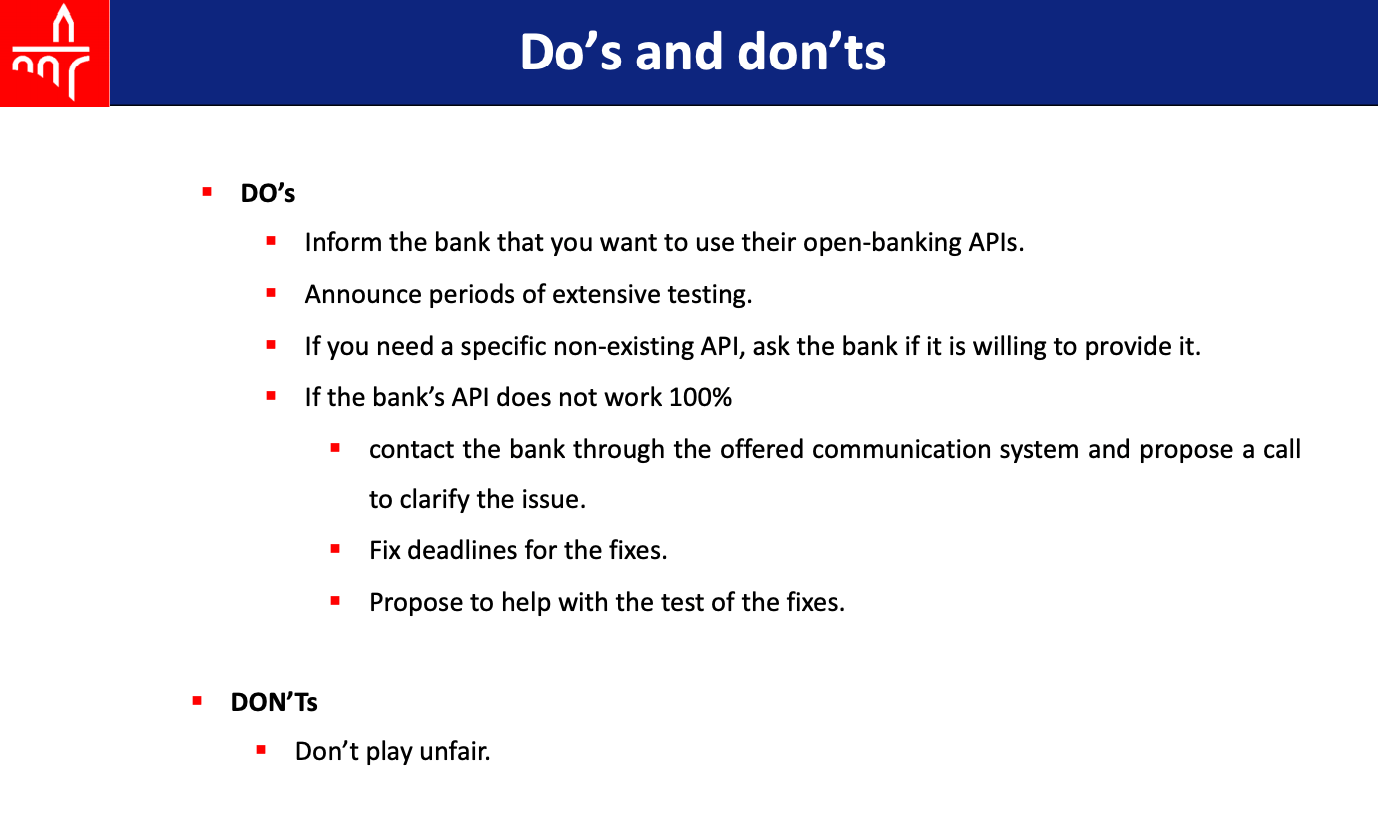

But it’s difficult to join somebody in the bank. Have a look at the API, have a look at their website, have a look at the developer portal and you will see on what level the bank really is. If you want to use the API’s, follow some rules and they are very simple and they are just common sense. First of all, inform the bank that you would want to use their APIs, they will probably be happy to help you in the setup. Announce periods of extensive testing. If you want to test it, tell them before so that they can have people dedicated to the test, that will help you with the test, and that will assist you should something go wrong. If you need a specific non existing API, feel free to ask the bank if they are willing to provide it. Maybe they just didn’t think of it. And they find it a good idea to provide such an API I’m sure that they will have a look at it and come up with an answer.

Then there’s always the problem with the API’s. An API depends on the standard that you use and how it is called. Maybe it does not work 100% like it’s specified. So if it does not work 100% as specified, contact the bank and tell them that there’s a problem. But be very strict on it. Tell them that you are working on it, and that you need that fixed. So set deadlines for the fix that they know, okay, this is an important matter, somebody is using it, he can’t use it, the API is not working like it should work. So we have to fix it. And you can also propose to help to test the fixes because they can do the fixes, but it always helps if somebody else helps them with the test and says “No” or “It’s okay”. The only thing you should not do is play unfair. If the banks API is not working, don’t go directly for the regulator, inform the bank that there is a problem, inform them that you will need it, inform them that they have one week or two days or three days to fix it, and that afterwards, you can go to the regulator, but just don’t play unfair. And I think most banks will then be more than happy to collaborate with you.

Alex Panican, LHoFT

Thank you Fred, it was fascinating. So we have one question from one of our Fintech actually, not based in Luxembourg. What’s your suggestion for a Fintech, that’s not based in Luxembourg, to work with a bank like yours?

Fred Giuliani, Spuerkeess

We all speak up about the European market. So Europe is now clearly one of the main markets. The question is always about what is the product or service does the Fintech offer? We, as a luxembourgish Bank, we are looking at luxembourgish retail customers. So basically the question is always “is it something that is interesting for our customers?” And if it is, I think that the country does not play a major role. It’s more the fit of the product, of the solution, and how you can use it in your banking context. So, that’s the main part of it. The country doesn’t play a role as long as it’s somewhere EU supervised and aligned with the standards of Europe.

Jean Diederich, ABBL

So, what we can say is that it is meeting the purpose of PSDII and open banking is that is European wide meaning all EU countries, and the extensive zone of Iceland, Norway and Liechtenstein, so of course you can transport and it’s very important that every bank in Luxembourg can work together with every Fintech and vice versa. And, of course, as Fred was saying, some functionalities are very specific, like for example, if tomorrow you have a Fintech in mortgages, the Luxembourg ecosystem is very different from other ecosystems. So it will be very difficult. But if you have a Fintech in small credits or other things, a global approach can be of importance. So I think it depends on the functionality you want to propose as a feedback effect. Andrey, you want to add something?

Andrey Martovoy, ABBL

When it comes to the ABBL, we are open to cooperation with any Fintech firms which are not yet let’s say installed in Luxembourg, of course, I would like to say we’re open to any kind of interactions, just feel free to drop me a line here by email. And then of course, we can understand how we could be of help to those Fintechs either to get in touch with the banks or getting connected with other stakeholders.

Najia Belbal, Nomura

How can a Fintech secure the first sponsor or ambassador within your bank, Fred, and how to make sure that the POC and deployment is well perceived by the employees?

Fred Giuliani, Spuerkeess

We have a new department which is called “Business Innovation Office”. And they are the single point of contact for Fintechs. The guys who are in charge are Roger Krämer and Alain Scholtes. They will look at it, and they will make sure that everybody in the bank, who is related to it, will get informed, will have the necessary information and can then express his interest in it and make the first tour of discussion.

Peter

I had an experience with Spuerkeess and they claimed that they accept only their own KYC processes. They don’t rely on the KYC processes by the firm’s accounting program but they told us that they don’t have enough people, they don’t have enough resources now, in order to extend the business beyond their own procedures at the moment. When you are coming to a bank with ideas for a business, for a project, they are requesting a business plan, they are requesting all those things that were mentioned. But, you know, an uncertain moment, we are coming to the conclusion, that it is a kind of showstopper, and in this case, it was KYC check, you know, if you are bringing, let’s say 10 or 20 additional clients, you know, the bank could have limited resources to accept on banking process.

Fred Giuliani, Spuerkeess

I’m not sure I understood the question but I will try to answer it, like I understood it. So basically, what I understand is that your value proposition is also bringing customers that will also be potential Spuerkeess customers. And as such, they will of course have to go through the due diligence custom approval process. And of course, that’s something that takes a lot of time, and that has to be done thoroughly. I do not know exactly all the procedures these guys do. But the compliance officer has a whole desk where every customer that comes has to be approved, they have to be a risk matrix to be made, etc, etc. And what I understand is that the customers your Fintech has, they will also become Spuerkeess customers and Spuerkeess would also be liable for these customers.

Sergei

How can we get a license from the CSSF, and under which regulation Fintech, can work with the financial industry, and especially regarding the PSF license?

Fred Giuliani, Spuerkeess

There are several licenses that make sure that you will be supervised by the CSSF. But there are also other supervisory authorities for other companies. But if we stick to the financial sector, there is a whole legislation on it, for credit institutions that have a special status and there is something specific called “Professional of the Financial Sector (PSF)”. It means that you are doing some activities which are related to Tech to Finance. And then in order to have the status, you’re also supervised by the regulatory authority. And if you do that, a lot of the checks that the bank has to do with you, as a company, are already done because you have that license and everybody knows that you are conforming to those standards. And of course, that takes a lot of burden out of the bank, because the due diligence is much easier.

Alex Panican, LHoFT

But let’s make it clear. This license is not mandatory to work with financial institutions?

Fred Giuliani, Spuerkeess

It is not mandatory. I just say: if you have it, then a lot of questions already answered. You don’t even have to provide the documents because they are self on top. But of course it is not mandatory. It’s not even something that it’s really recommended. But if you have it, it makes things easier.

Jean Diederich, ABBL

You have 2 categories of regulation:

The first is national regulation about the professional of the financial sector (PSF), this is only valid in Luxembourg. It is special to Luxembourg and it comes from the times where we had a banking secrecy and in order to have non banks being able working on technology around the banking sector.

And then we have all EU regulation. Of course, the bank is a protected institution regulated by the Central Bank and by the CSSF. Then you have something called an e-money institution, which is coming from the e-money directive, and which has limited capacity of safeguarding money on an e-money account (around 2400 euros a year).

And then you have something called a payment institution which was introduced by the PSD in 2009. And that is also where the Luxembourg Fintech started really, because most of the Fintech in Luxembourg are a payment institution license because you can passport all over Europe, meaning you get the Luxembourg license and you can make business in the EU with 550 million consumers. Now we see there have been two more stages added. One is an account information service provider, which goes to the API’s, as Fred was explaining, to access current accounts and get the information out of it in order to make a consolidation of information of different accounts you can have with different banks. And the other one is a payment initiation service provider. This is someone who is initiating directly an equity transfer over your current account to make a payment and get the confirmation directly. So this is as a bank payment, replacing costs payment, meaning a cost payment in Amazon / PayPal, you get immediately the confirmation that the cost payment was accepted is the same, but the payment is coming from a current account. And that’s the status of the payment initiation service provider.

Andrey Martovoy, ABBL

In addition to the older types of the different licenses, I would also like to reiterate the fact that of course if those Fintech firms are ready licensed in their home country, so of course, the banks here in Luxembourg should be informed about those licenses. And even in the case that let’s say you’re not entitled to any kind of supervision either in your home country or in Luxembourg, of course, such kind of communication would also be important for the banks to understand that actually you are legally OK, taking into account all the measures which have been explained. So I will say that, technically speaking, it is not compulsory, but nevertheless, of course, it gives some kind of portion of trust to the Fintech firms, which are interested to get in touch with the banks.

Alex Panican, LHoFT

Thank you so much, Andrey. One last question. We are running out of time. But this one is quite dear to the LHoFT, it’s about talent. Because you know, maybe 20 years ago, when you were a young graduate, you wanted to work for a bank. Now you want to work for a startup. So can we give the mic to Baptiste please? He has a very interesting question for Fred.

Baptiste

Thanks a lot. So, what we see here is that you know, as a younger generation, more and more young graduates propose to use programming languages such as Python, for example, or R that have not been used before, within the bank, just to use as well more or less innovative technologies, when you think about data visualization, you know, use Tableau or Klich. My question really is: how do you on your side approach these younger generations who have been navigating within banking, in the bank to be able to use these technologies or programming languages. And the second question is to someone who is in this generation and, and we’d like to promote these new technologies of programming languages, what advice would you give them? To be able to do it?

Fred Giuliani, Spuerkeess

Thank you for the question. First of all, we also use Python, for example, we have a big data department and they use the Python language, we do not use R but we use the SPARC framework, etc. So I think banks are adapting themselves.The bank is also learning from the young talents, and they will use the tools that the talent brings with and is familiar with, and they will of course build on it. So basically, it’s a give and take, of course if you go to legacy applications, that might be a different part. We have something what we call a “parrain” like a “god father” And when you come, this is the person that that will help you go to all those problems and find out what are you really interested in it, and maybe give you, if you work on the legacy team, to give you a one day per week with the data team so that they can learn from each other. That’s how we approach it.

Alex Panican, LHoFT

So, gentlemen, thank you. Thank you so much. Thank you to everybody who’s listening. I hope it was interesting for you.