A tale of two 2020s

The year 2020 will not be remembered fondly by many due to the significant sacrifices which we had to make globally, yet we may consider it a transformational year if measured by a number of technological and scientific breakthroughs. The fact that we are nearing the approval and distribution of what appear to be highly effective and reasonably safe vaccines for COVID-19 less than a year after the start of the pandemic is a powerful reminder of the fruits that continuous investments in R&D can bear for generations to come.

As far as Fintech is concerned, we at LHoFT have written repeatedly about the catalytic impact of this pandemic on consumer behaviours, investment preferences, corporate business development and financial markets infrastructure.

Change is afoot in payments

A few recent examples. Institutional investors and big corporates are not only talking the talk, but also walking the walk when it comes to driving the acceptance of bitcoin and other crypto-assets as part of mainstream diversification strategies, with Guggenheim and others amending their investment policies in order to allow for substantial asset allocation to crypto. Mizuho Securities reports that nearly 1/5 of all Paypal users have already used the service to trade cryptocurrencies just over a month following Paypal’s support of this functionality. Mizuho also report that the ability to trade crypto has positive read-through to overall user engagement on the payments platform.

Global payment solutions provider Visa has amped up its commitment to DLT-based technology and tokenisation of late, most recently by pledging to make U.S. Dollar Coin available to its 60m merchants. As described in Forbes, “the partnership, in conjunction with an earlier $40 million investment Visa led in a cryptocurrency startup for holding similar assets issued on a blockchain, a recent blockchain patent application for minting traditional currency on a blockchain, and an increasing amount of work directly with central banks, is the latest evidence that the credit card giant sees the technology first popularized by bitcoin as a crucial part of the future of money.” Speaking to the value proposition of USDC integration in its network, “Visa estimates that $120 trillion in payments annually are made using checks and instant wire transfers, costing as much as $50 each, regardless of the size of the transaction. Since USDC settles on the ethereum blockchain, transactions can close in a little as 20 seconds and, importantly, can be done for nearly free, Visa believes its vast array of merchants could choose to use this nearly instant alternative form of payment.”

This latest commitment is a concrete continuation of Visa’s mid-2020 statement on digital currency payment flows: “We’ve been advancing and evolving our digital currency strategy for quite some time. Last year we made an investment in Anchorage, a company building security infrastructure for the digital currency ecosystem. Our research team has been exploring the science of blockchain technology for several years. Their work has yielded several promising innovations, including Zether and FlyClient. Today their research is focused on new mechanisms to improve scalability and enable offline digital currency transactions.”

Visa also acknowledged that “policy leaders and regulators continue to have questions and concerns about digital currencies on a range of issues, from consumer protection to payments resilience. We believe the best way to address these concerns is by working closely with leading companies and the public sector.”

Private-public collaboration remains key

This sentiment was shared in a LHoFT editorial aptly titled “collaborating to succeed in the evolving payments space”. In it, I wrote that “Leveraging comparative advantages – intellectual property in relation to technological breakthroughs, established market infrastructure, regulatory affairs experience – will remain a key consideration for the future viability of any and all market participants in the payments space, be they small or large. LHoFT exists to enable such collaboration, which is facilitated by the all-hands-on-deck approach of our private and public partners in Luxembourg.”

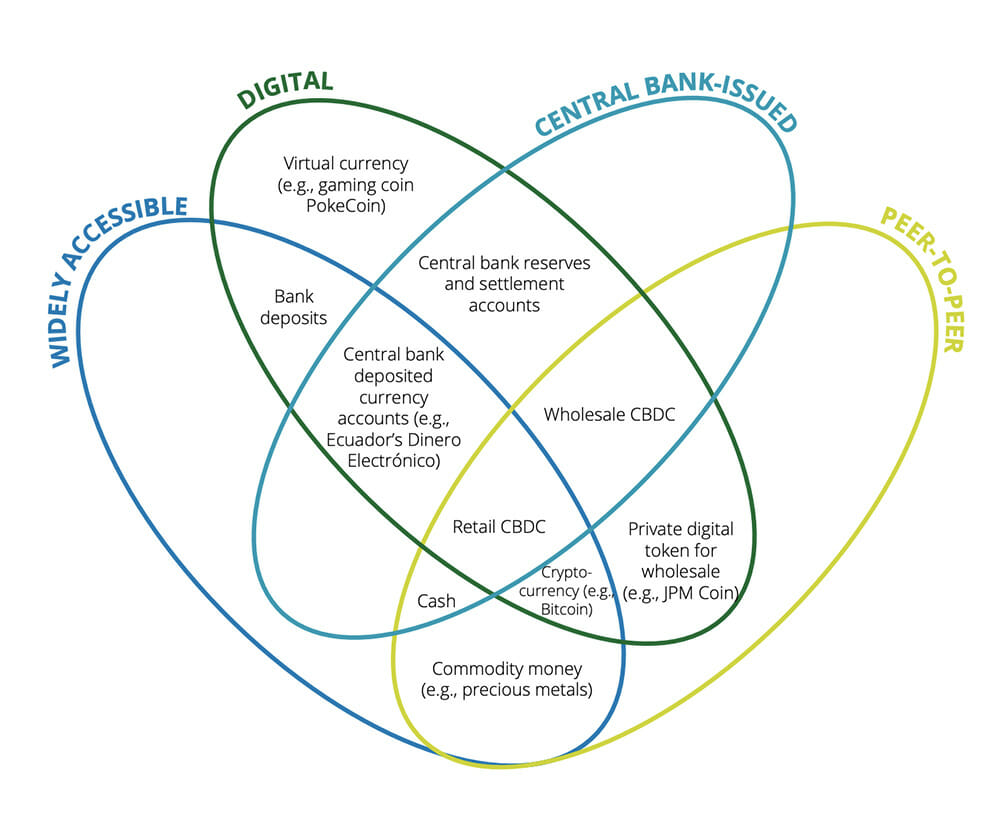

Regulators, meanwhile, continue to explore both private digital currency schemes and Central Bank Digital Currencies (CBDCs) with great interest. Recently, the BIS provided an extensive discussion of the “risks, potential and regulation” of stablecoins, which we may only gloss over for the purposes of today’s editorial – readers are encouraged to absorb the paper in its entirety for fulsome consideration. It is worth noting that the BIS researchers acknowledge the overt benefits of DLT-based financial assets and infrastructure, for instance by stating that “DLT has allowed for the creation of new digital forms of money and payment systems that could serve novel purposes and extend some of the well-known economic and regulatory issues with past innovations into the digital realm. Existing stablecoins […] also offer the possibility of so-called ‘smart’ contracts, i.e. self-executing code, and possibilities for ‘programmable money’.”

On CBDC specifically, the BIS authors note that “the question is how a CBDC could be designed to offer robust interoperability with novel decentralised financial solutions.”

While concerns still abound with regard to systemic risks to the global financial system as well as the increasing relevance of cybersecurity in a world which seems poised to transition towards a complex ecosystem of digital currencies, it is also clear that regulators are increasingly ready to engage productively with the opportunities and challenges presented by technological breakthroughs in finance.

Such opportunities, as well as important practicalities relating to different flavours of CBDC, are discussed in a recent report by LHoFT partner Deloitte. Our CEO Nasir Zubairi is quoted summarising the value proposition:

“CBDCs promise faster, cheaper and more efficient payments, both domestically and cross-border. Arguably, CBDCs also offer greater security and lower risk of fraud using blockchain technology.”

As with the BIS paper, the full report is worth a thorough look for anyone eager to better understand the nuances and dynamics associated with CBDCs, which Deloitte believe are “here to stay”.

Luxembourg as an innovation hub

Last but not least, we are delighted to highlight that LHoFT member Satispay raised EUR93m in a recent round with participation by Square and Tencent. CEO Dalmasso highlights the importance of the Italian mobile payments provider’s presence in Luxembourg: “We believe this new funding round will give us the extra boost we need in Luxembourg. In just a few months Satispay has already succeeded to convince thousands of consumers and two hundred merchants to use Satispay. This is just the beginning. The team in Luxembourg is growing and will grow even more in the next months. We are developing new services and features with the aim to significantly increase our consumer and merchant base during 2021.”

This raise caps a fulminant year for Satispay, “reaching more than 450,000 new users and 35,000 new affiliated merchants this year, including tier-1 retailers like Carrefour, Auchan, Autogrill and KFC.”

The strides made by Satispay and the macro dynamics discussed above are illustrative of the significant progress that has been made, or for which the groundwork has been laid, in 2020 in financial technology, and we at LHoFT are looking forward to accompanying our entrepreneurs and partners as we carry over this strength into a hopefully more merry, but equally productive, year 2021.

Author: Jérôme Verony – LHoFT Research and Strategy Associate