The LHoFT Foundation announces the 10 Fintech startups selected to take part in the Summer 2022 edition of CATAPULT: Kickstarter

A Fintech acceleration program for early-stage startups with up to €50.000 in subsidies for each of five winning Fintechs

Building on the success of both the 2021 Editions of Catapult: Kickstarter, the LHoFT Foundation is opening on Monday 20th of June, the third edition of this unique program of Fintech startup development. After receiving 180 applications, the LHoFT Team and jury partners selected 10 impressive Fintech ventures to enter the program. The program will close on the 1st of July with a final pitching event, in front of a highly credible jury, investors, and audience members at the ICT Spring .

Developed by the LHoFT Foundation and supported by the Luxembourg Ministry of the Economy, “Catapult: Kickstarter 2022 – Summer Edition” will support 10 amazing Fintech startups over the course of two weeks, with the aim to develop their business models, focusing on business scaling and risk management, and bring them connectivity with the Luxembourg Financial Services ecosystem. As the name suggests, the programme aims to kickstart business growth through expansion to Luxembourg leveraging outstanding mentors, tutors and by establishing highly promising connections to the local ecosystem.

Over recent years, Luxembourg has built up a supportive and robust Fintech startup ecosystem through collaboration between key public and private decision-makers. Aligned with Luxembourg’s ambition to create a leading startup and entrepreneurial nation, Catapult: Kickstarter programe is dedicated to further catalysing Fintech innovation in Luxembourg and beyond.

In order to effectively leverage the strengths of Luxembourg’s community and capabilities, the selected firms focus on delivering services to financial institutions (B2B), with particular emphasis on Insurtech, Regtech, Fundtech, Cryptocurrencies and Digital Assets, B2C payments, and Cybersecurity. For this, the first of two 2022 bootcamps, ESG-related Fintech is also a key area of focus.

The two-week program is tailored to the particular stage of the participating Fintechs and is structured around classroom tutorials, customer discovery, challenges, one-to-one meetings, pitching sessions, entrepreneurs’ feedback sessions, and mentorship sessions. Coming out of a period of Covid lockdowns, this edition of the programme will be the first where the participants will also be on-site in Luxembourg.

The 10 participating Fintech companies will meet multiple partners across those two weeks, including Luxembourg For Finance (LFF), Société Générale, and Middlegame Ventures (MGV), guiding them through business models, funding strategies, and industry product testing.

The program will begin on Monday 20th of June and it will close with a final pitching event on Friday, 1st July open to the public. Five of the ten participating firms will be able to access up to 50,000 EUR in subsidies from the Luxembourg Ministry of the Economy, based on the fulfilment of eligibility criteria.

Mr. Nasir Zubairi, CEO of the LHoFT, commented: “The 10 selected Fintech firms are all exciting businesses with high relevance to the Luxembourg financial centre, addressing some key challenges and opportunities for local actors. It is great to have such an application boom following two years of uncertainty and lockdowns as a result of COVID19. It is exciting to be able to have these firms be present physically in Luxembourg, to enable us to create strong synergies with the Luxembourg finance community.”

Join us, at the ICT Spring, on Friday 1st of July for the final pitching event to discover the best Fintech solutions developed during the program.

======

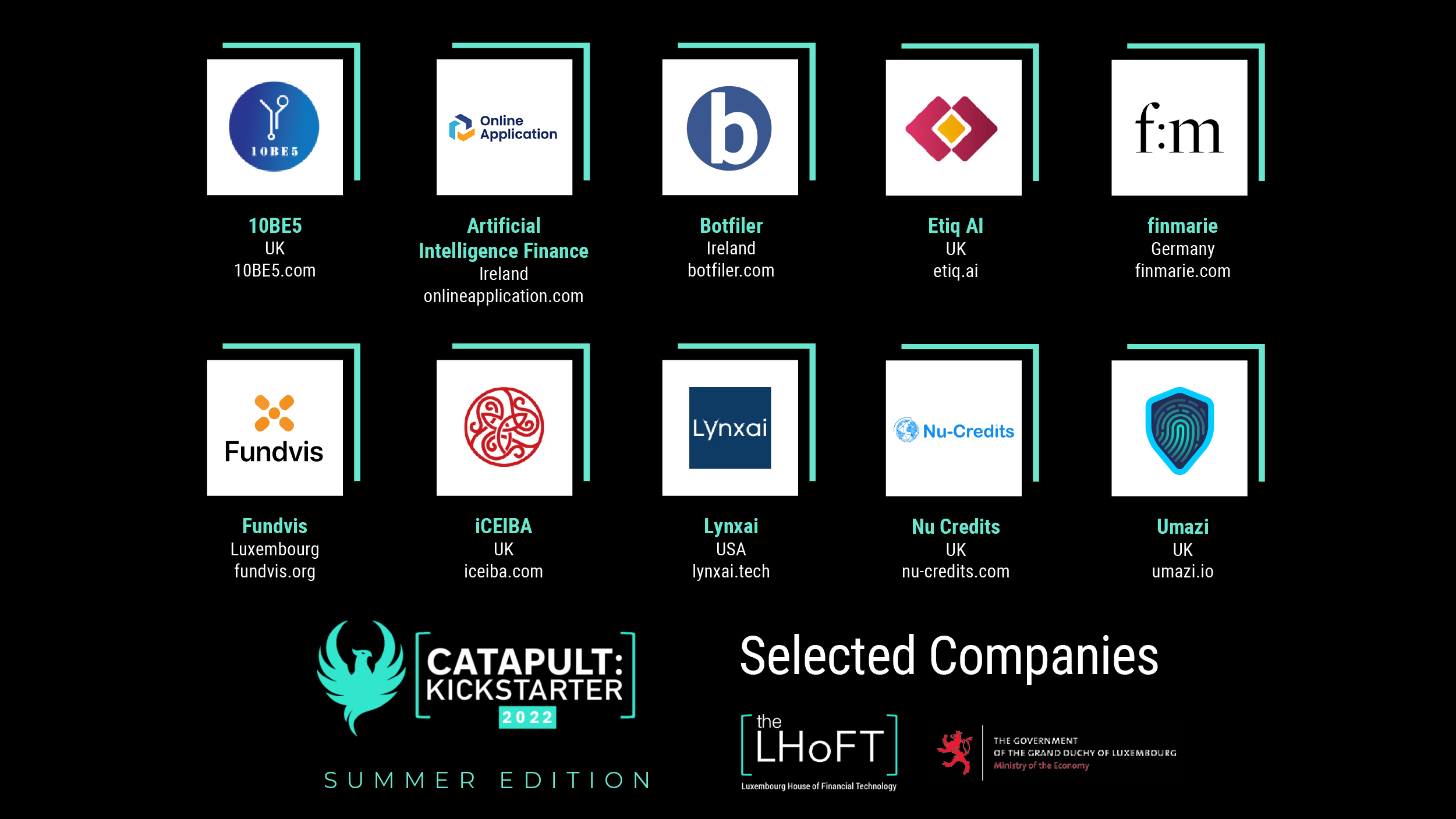

The 10 Selected Fintech Startups of the Catapult: Kickstarter 2022 – Summer Edition are:

- 10BE5 – United Kingdom

10BE5 is building a natural language processing-powered platform that automates the drafting of capital markets disclosures and related processes. Their solutions automate substantive legal work. They are domain experts and design their products with input from top law firms. Their products help reduce staff burnout, free up capacity to undertake other complex work, and reduce risks through the elimination of mechanical errors. They also reduce the overall cost of access to capital markets for companies.

- Artificial Intelligence Finance Ltd – Ireland

Artificial Intelligence Finance Ltd provides a digital Saas platform for customers to apply for mortgages and life assurance through brokers & banks : application, document upload, AML, KYC, Open banking, Underwriting, CRM. This B2B Saas platform makes mortgages easier, faster, and better for everybody through a ‘one touch’ digital application.

- Botfiler – Ireland

Botfiler enables more cross-border eCommerce sales. Their technology platform enables this by integrating with leading cloud accounting platforms and online marketplaces, so that local and cross-border VAT reporting can be automated. Botfiler also features review capabilities so reporting errors are spotted and fixed quickly.

- Etiq AI – UNited Kingdom

ETIQ helps companies to test and monitor their predictive models. For data teams, ETIQ can help to maximise the value they get from their data and AI without having to invest a lot of time and money. It tests data & ML algorithms, identifying issues, bias and preventing accuracy loss in both building & production stages. It consists of 4 pillars of offering and mainly used by data teams, it’s flexible and customisable and allows to quickly and easily run tests on data & ML algorithms. Users can identify and correct issues, ensure compliance and mitigate unintended bias – so they can cut costs and reduce risk across their organisations.

- finmarie – Germany

With a mission to help women become financially independent, finmarie builds mobile and desktop consumer financial technology with smart tooling and a hybrid human-digital model of financial and insurance advisory.

- Fundvis S.A – Luxembourg

Fundvis offers a workflow management Software for the Fund Industry. They bring the entire industry onto one platform, digitalise their processes and thereby allowing the setup and management of AIF Funds globally.

- iCEIBA – United Kingdom

iCEIBA launched the Dispute Recovery Platform to help small and medium businesses which lose money due to distressed contracts, unresolved commercial claims, and litigations.They provide a low-cost, hands-off, and risk-free solution that uses tech to analyse, manage recovery and monetize distressed contracts and commercial claims.

- Lynxai – United States

Lynxai offers a data-driven platform that makes ESG investment more efficient.

Lynxai provides quantitative and qualitative data to facilitate the investment analysis. The provided data is adapted to the client ESG standards. The company helps the client navigate through any government regulations – like EU Taxonomy – and control any red flags from their investments. Lynxai also collects data from non-financial reports, big data and score providers, institutional news, Twitter, Reddit, Glassdoor, blogs, social media and offline sources, so that every information is covered.

- Nu Credits – United Kingdom

Nu Credits is a trade finance marketplace that connects SMEs with global lenders (Challenger Banks, Fintech Lenders, Crypto Exchanges, Family Offices and Alternative Asset Investment Managers) in Europe and Asia. They are solving the SMEs trade finance liquidity gap issue by providing multi capital sources lending products such as Purchase Order Finance (B2B BNPL), Receivable Finance, Leasing and Revolving Credit Lines to meet their working capital needs for both cross-border and domestic trades and offering verified multi-dimensional credit data SaaS solution to lenders to make faster and more accurate credits underwriting decision to SMEs.

- Umazi – United Kingdom

Umazi is an enterprise identity platform, enabling all businesses to share verified client identity data leveraging Web3/DLT. Umazi facilitates the creation of business identity wallets to allow for streamlined business verification and by design enables continuous real time compliance.

Umazi is disrupting the existing due diligence manual, cumbersome and time-consuming due diligence processes by providing those who need access to validated corporate identification with data that they do not have access to today. On the enterprises looking to prove their identity, Umazi facilitates faster verification while allowing them to control their own data (self-sovereign identity management). The enterprise credentials are cryptographically verified to provide a full audit trail on the company, further removing the need to dig up 5years of data evidence.

======