How do cryptocurrencies fit into the larger conversation about sustainability? The crypto landscape continues to shift under the influence of external events, with the market evolving in line with investors’ expectations. Critically, there are ongoing and pertinent questions about the future of cryptocurrencies in the context of climate change and increasing energy prices.

How do cryptocurrencies fit into the larger conversation about sustainability? By addressing the matter of consensus mechanisms.

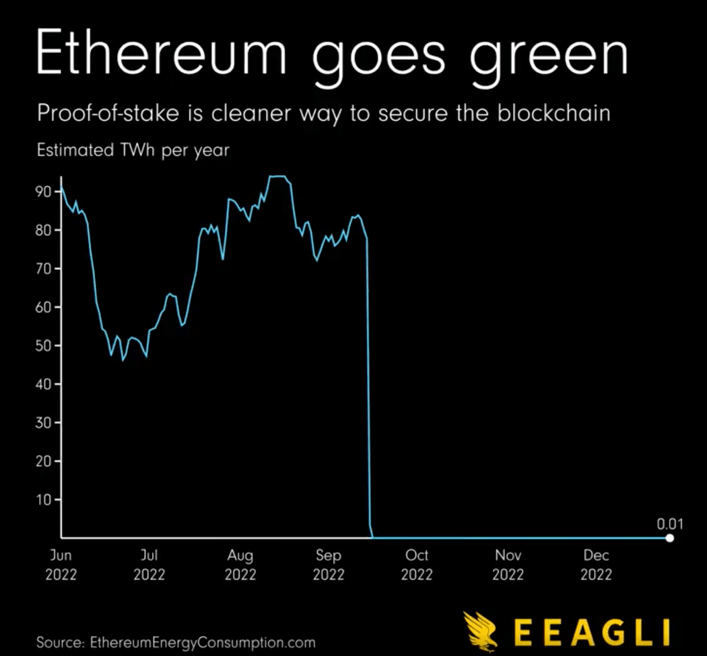

Let us look at this topic from an evolutionary perspective. In September 2022, a significant event altered the landscape of the crypto market – yes, even before the notorious bankruptcy of FTX. Ethereum, one of the largest cryptocurrencies networks, transitioned from proof-of-work (PoW) consensus mechanisms to proof-of-stake (PoS). This historical move was dubbed “The Merge” and, according to Ethereum.org, it reduced Ethereum’s energy consumption by ~99.95%.

Understanding consensus mechanisms

Proof-of-work (PoW) and proof-of-stake (PoS) are two of the most widely used consensus mechanisms in the blockchain industry.

PoW is the original consensus method used by the first cryptocurrency, Bitcoin, and requires miners to solve complex mathematical equations to validate and add new blocks to the blockchain. PoS is a newer consensus method that requires users to stake their coins to validate transactions and add blocks to the blockchain.

The main difference between PoW and PoS is that PoS does not require miners to use their computing power to solve complex mathematical problems, which helps to reduce energy consumption. Both PoW and PoS have their advantages and disadvantages, but both are important components of a secure and reliable blockchain.

A real-world analogy for the difference between PoW and PoS is the difference between a gold rush and a shareholder vote. Just as gold miners use their resources (mining equipment, electricity) to search for and extract gold, nodes in a PoW system use their computational power to solve complex mathematical problems and validate transactions. The first miner to find a solution is rewarded with the right to add the next block to the blockchain, much like finding a gold nugget.

In contrast, in a PoS system, validating transactions and adding new blocks to the blockchain is akin to a shareholder vote. Just as shareholders vote for the leadership and direction of a company, validator nodes in a PoS system “vote” on the validity of transactions and the addition of new blocks by staking their cryptocurrency holdings. The more stake a validator holds, the more “votes” they have and the more likely they are to be selected to add the next block to the blockchain, like having more shares in a company.

The Merge of Ethereum

Ethereum utilised two engines of block addition. The original one, the “Mainnet”, was secured by PoW; the second one, the “Beacon Chain”, ran on PoS. Both algorithms exist as consensus mechanisms, to keep the blockchain secure for users: by verifying transactions on computers, they provide means for participants to “prove they have supplied a resource […] such as energy, computing power, and money” to it.

On September 15, 2022, the two blockchain algorithms of Ethereum were merged, replacing one system, the Mainnet with the other, Beacon Chain, permanently.

The Merge marked the end of proof-of-work for Ethereum and started the era of a more sustainable, eco-friendly Ethereum. Ethereum’s energy consumption dropped by an estimated 99.95%, making Ethereum a green blockchain. – Ethereum.org

Cryptocurrencies and Sustainability

Quoted by James Eagle, Founder of EEAGLI on LinkedIn

In my previous article about the Crypto Winter, I mentioned the report on the Global Impact of Crypto Trading by Forex Suggest. In a global context of climate change and energy high prices, policies and priorities are being re-evaluated. The International Energy Agency pictures the global energy crisis concluding last year as follows:

High fossil fuel prices are stoking inflationary pressures; the combination of falling real incomes and rising prices is creating a looming risk of global recession.

Unsurprisingly, the cryptocurrency industry, with its reported consumption of energy, has drawn considerable attention to itself, in relation to “sustainability”. With an overall energy consumption of 62.56 kWh per transaction and a staggering 22 million tons of CO2 emissions in 2021, Ethereum ranked 2nd in the report in terms of energy intensiveness and environmental impact. Removing a year’s worth of Ethereum transactions from the atmosphere would require planting 109.8 million additional trees.

Additionally, crypto enthusiasts are more driven by energy efficiency than sustainability concerns; they focus on getting the most out of their hardware for the least cost. This is reflected in the increasing development of more energy-efficient technologies; many of these technologies are still in the early stages of development, but the overall trend is toward more efficient and cost-effective solutions.

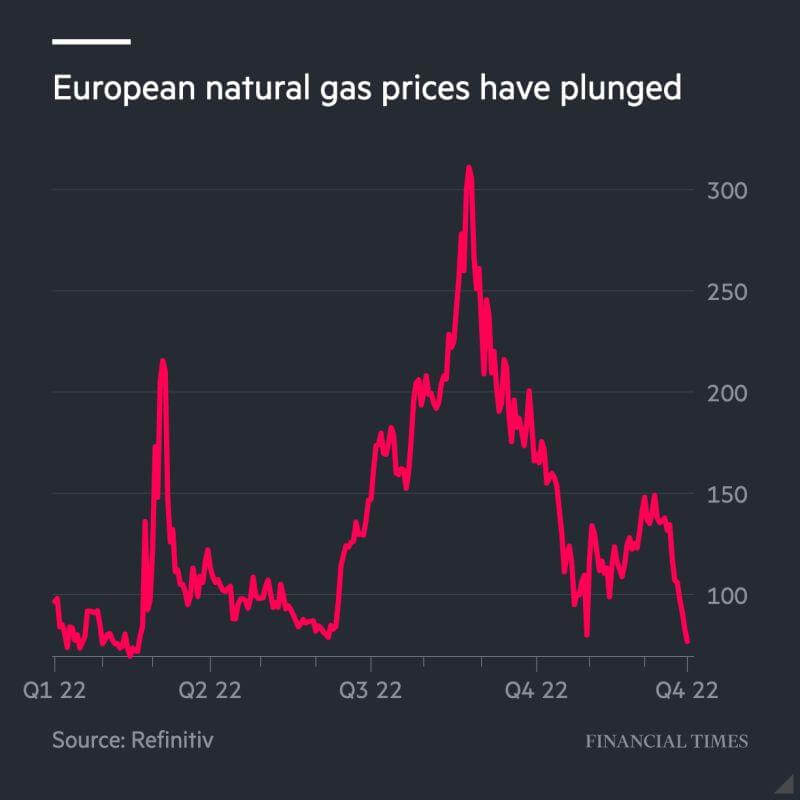

Interestingly, energy prices have recently dropped significantly: Q4 2022 saw a plunge in natural gas prices, triggered by warmer-than-expected weather – a record-breaking one for many countries in Europe, according to meteorologist Scott Duncan. However, it will not provide relief for the long term “when the volume of gas supplied from Russian pipelines will be considerably lower and the liquefied natural gas market, which the region has depended on this year, remains tight”.

Quoted by the Financial Times on LinkedIn

Considering this evolution, will moving to a PoS model be enough? Or will the crypto market need to try harder, while being able to safeguard the decentralized feature of the crypto market? Ethereum is open source, but crucial changes such as The Merge span from the Ethereum Foundation and its co-founder Vitalik Buterin. Can this formula be applied to a truly decentralized and individualized system such as Bitcoin? According to William Farrington for Currency.com,

Bitcoin lacks any substantial leadership structure or central party and the Bitcoin Foundation went insolvent in 2015. [….] Theoretically, the community could vote on-chain in favor of a code change, but given the influence of miners in the community, this is extremely doubtful.

Generated with Midjourney

There is indeed a strong interest in PoW among the Bitcoin community, despite the environmental controversy. Bitcoin miners under PoW get rewarded for their efforts through the mining process, which involves solving complex mathematical puzzles. Old timers have gained a competitive advantage through their investment in energy-consuming technology ‘farms”, that have the resources to buy more and better hardware and pay for the electricity needed to keep the mining operation running. Such complex settings would become useless in a PoS environment.

For those reasons, Bitcoin mining accounts for the largest crypto-mining industry. However, because of the famous 21 million Bitcoin ceiling embedded in the source code, the mining and reward process is designed for growing complexity – and rising energy costs.

Miners are also competing against each other to be the first to solve the cryptographic puzzle. This has led to a situation where public entities, such as Fort Worth, Texas in the United States, or even governments such as El Salvador, also entered the game to secure the largest share of the network. This competition has been beneficial for the industry as it drives innovation and efficiency: to mine its first fraction of a bitcoin, El Salvador used the power harnessed… From a volcano.

Tweet from President Nayib Bukele (last accessed: 29 December 2022)

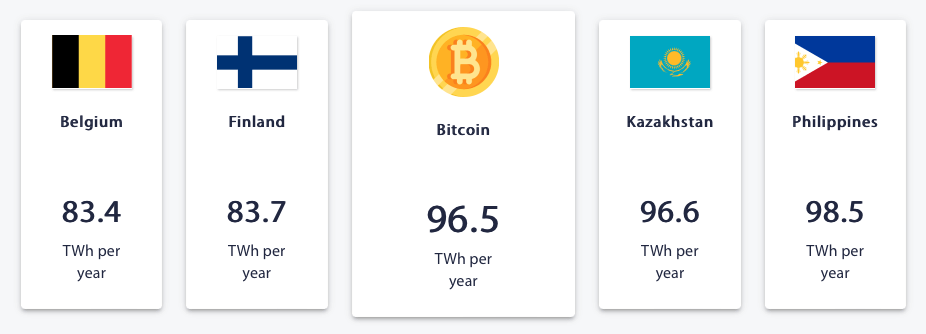

To better grasp the incentive around clean crypto mining, we need to understand the estimated impact of Bitcoin. Thanks to the Cambridge Bitcoin Electricity Consumption Index (CBECI), an online tool launched by the University of Cambridge, researchers were able to estimate that the global Bitcoin network is consuming 96.5 terawatt hours (TWh) of energy per year – more than entire countries such as Belgium or Finland.

Source: CBECI (last accessed: 04 January 2023)

The report of Forex Suggest also ranks Bitcoin as 1st offender in term of environmental impact, as “the most polluting cryptocurrency of 2022, with a projected 56.8 million tons of CO2 emissions that would require 284.1 million trees to offset”.

In contrast to this bleak picture, a report from the Bitcoin Mining Council (BMC), a “voluntary global forum of Bitcoin mining companies and other companies in the Bitcoin industry”, announced that for Q2 2022, the *global bitcoin mining industry’s sustainable electricity mix is now 58.4%” and has increased “approximately 59%” from 2021 to 2022, “making it one of the most sustainable industries globally”.

Challenges and limitations of using cryptocurrencies to promote sustainability

The fact that cryptocurrency is not regulated makes it easier for companies to make false or misleading claims about environmental or social benefits. This can lead investors to invest in cryptocurrencies that are not as “green” or “socially responsible” as they seem. Additionally, this can result in a general mistrust of cryptocurrencies, and make it harder for responsible companies to differentiate themselves from those making false claims.

In April 2022, Canaan senior vice president Edward Lu announced his company’s plans to implement green energy standards for Bitcoin mining. His Mining Disrupt 2022 speech, “Clean Energy: The New Revolution for Bitcoin Mining”, emphasised the active role Bitcoin mining has to play in the global energy market, for the industry to “be accepted as mainstream”:

The future growth of the Bitcoin mining industry is […] dependent on whether it can benefit human society; sustainable Bitcoin mining is thus one way for the industry to gain wide recognition.

Regarding the progress recently made by the industry, M. Lu mentioned “blockchain upgrading”, the adoption of greener solutions such as hydro power, effective utilization of power grids excess capacity and… Leveraging the power of SQL to mine crypto currencies in the cloud, an idea dating back from 2018 and probably outdated, since Bitcoin mining complexity is higher now.

As we know, for anything labelled “green” checks should be put in place to improve the industry’s transparency regarding energy efficiency claims. Bitcoin alone accounts for 0.25 percent of global electricity consumption; non-governmental organizations are therefore calling for action and the implementation of new regulations limiting the impact of crypto mining on ecosystems. The Tony Blair Institute for Global Change published guidelines for policymakers, inviting them to support efficiency innovation by “incentivising miners to switch to less energy-intensive designs” and “better e-waste management”. Regulations should also help “raise the bar on clean-energy use” by solving the equation of available renewables/fossil fuel sources, the side effect of grid strain, and the auditing requirements.

Other initiatives in the U.S. call for more transparency regarding the crypto mining industry, urging public authorities to:

Subject permits related to cryptocurrency mining to stringent environmental reviews, to create a registry of mining operations, to set energy efficiency standards for digital currencies, to establish power density limits, and to limit financial transactions which increase climate pollution, interrupt critical supply chains, or limit the availability and affordability of electricity for essential industries.

The same letter also addresses the potential social impact of unregulated Bitcoin mining on local communities, calling to preserve the public electric grid from being “siphoned to proof-of-work mining operations at the expense of local ratepayers”.

In the European Union, crypto-asset issuers and service providers under the scope of the new Markets in Crypto-Assets (MiCA) regulation will have to comply with strict disclosure requirements regarding the consensus mechanism chosen. Although not banned by the text due to their ubiquitous nature, PoW protocols will have to be transparent about their energy-intensive nature.

Maybe the future of cryptos also lies with ReFi, or regenerative finance, an umbrella term for the Web3 roadmaps to a low-carbon economy. For example, the Cosmos-based Regen marketplace encourages corporate sustainability departments to “purchase, transfer, retire, and bundle tokenized carbon on the blockchain for carbon offsetting purposes”. The Reneum marketplace is vouching to “use blockchain to fund renewable energy, leveraging the technology to verify every clean megawatt-hour produced and trace the journey of every single dollar spent.” In other words, implement greater transparency around renewable energy credits (RECs).

Evolutionary perspective for the future of cryptocurrencies and sustainability

To end this analysis on an optimistic note, let us talk about the potential benefits of cryptocurrencies for sustainability from a societal point of view, such as reducing reliance on traditional financial systems and enabling new forms of decentralized decision-making.

In a decentralized system, there is no single point of control or decision-making authority. This power is instead spread out among many entities, and no single entity holds significant control over the entire system, thus making the system more resilient to failures and less vulnerable to attacks – since there is no single point of failure. All entities have an equal say on how to run the system, and users validate all transactions in exchange for a reward.

In addition, crypto-currency transactions can be peer-to-peer and help reduce the need for intermediaries such as depository banks. This results in lower overall trading costs and, potentially, greater financial inclusiveness.

Overall, decentralized financial systems can help to reduce the market share of large financial institutions and make the financial system more resilient to shocks, especially in relation to systemic risk.

Looking at the big picture, the blockchain technology enabling crypto transactions is often praised for its transparency and immutability. This could lead to reduced fraud, illegal activities and corruption, which could in turn encourage public trust.

As with most things, the crypto world is the product of its context, with both external influences and internal events shaping and transforming its market rules and practices. There is no “business as usual” yet for this unique market, despite its 14-years history – starting with the 2009 launch of the Bitcoin Network. However, neither do we have historical benchmarks for the energy and economic challenge of climate change. For this reason, the questions around the sustainability of crypto trading must be addressed thoughtfully, exploring all possibilities, and taking into account the complexities related to Bitcoin mining.

For many observers, cryptocurrencies using public blockchains, such as Bitcoin and Ethereum, are the way forward. This will only prove true if their global adoption takes place in the context of a low-carbon economy. Quoting Marc Blinder for Harvard Business Review:

Blockchain [cryptocurrencies] have the power to change our world for the better in so many ways. It can provide unbanked people with digital wallets, prevent fraud, and replace outdated systems with more efficient ones. But we still need this new and improved world to be one that we want to live in.

Written by Oriane Kaesmann

Header image by Zoltan Tasi on Unsplash