Following the publication of the FCA’s Guidance on Cryptoassets Feedback and Final Guidance to CP 19/3, we summarise below the main elements of the guidance and draw some comparisons to our recent publication: Guide to Digital Asset Generating Events co-authored with various legal firms in Luxembourg.

Summary

The guidance from the FCA provides the FCA’s final position on the classification and regulation around tokens, concluded with mass consultation with market participants. The paper also addresses the extent to which it would be useful to create a specific framework for digital assets. Broadly, the FCA paper, much like our own Guide to Digital Asset Generating Events, concludes that existing regulation is adequate to regulate the different types of tokens; “old wine in new bottles” as one may say. The Guidance from the FCA provides a clear and comprehensive framework for firms, traditional and those in the new economy of Fintech, to understand how tokens should be treated under regulation.

Classification

The FCA have repositioned their classification of tokens, as proposed in earlier notes, removing reference to “Utility Tokens” – a token that provides access to a current or future product/service akin to pre-payment vouchers, which they feel are generally out of the scope of regulation, and added a classification of E-Money Tokens, which would likely include stablecoins, such as the Libra.

Likewise the FCA have removed reference and requirement for regulation for “Exchange Tokens“, previously covering cryptocurrencies and the like, as the token itself would not be regulated but services that use the token as a means to facilitate regulated payments would be. So the taxonomy according to the FCA now looks like this:

- Security tokens: this category does not change materially from the Guidance that we consulted on and refers to those tokens that provide rights and obligations akin to specified investments as set out in the RAO (Regulated Activities Order), excluding e-money.

- E-money tokens: this category refers to any token that reaches the definition of e-money. These tokens are subject to the EMRs and firms must ensure they have the correct permissions and follow the relevant rules and regulations. This category formerly sat within the utility tokens category. These tokens fall within regulation.

- Unregulated tokens: this category refers to any token that does not meet the definition of e-money, or provide the same rights as other specified investments under the RAO. This includes tokens referred to as utility tokens, and exchange tokens.

These unregulated tokens can, for example, be issued centrally or be decentralised, give access to a current or prospective good or service in one or multiple networks and ecosystems, or be used as a means of exchange. They can be fully transferable or have restricted transferability. These tokens fall outside the regulatory perimeter.

In our analysis, we reached a similar categorization and similar conclusions with regards to the applicable regulations to the more broadly accepted taxonomy:

- Security-like digital assets, generally operate and have a purpose similar to that of traditional securities or financial instruments, and therefore would likely require regulation. This category would also cover stablecoins that are backed by traditional assets such as currency deposits, bonds or other such. A token that gives claim to underlying assets are securities.

- Utility digital assets, designed to give access to a service or product provided by an organization or ecosystem, akin to a pre-paid voucher, the majority of these types of assets would require no regulation

- Payment digital assets, alternative means of payment generally accepted by third parties. The token and associated platform themselves require no regulation, but service providers, such as crypto exchanges, that help distribute or allow the token to be used for payment of services/goods would fall under the remit of payments or e-money regulation.

Unregulated tokens

While some unregulated tokens might be used a mean of speculation rather than for exchange purposes, this does not in itself mean these tokens constitute specified investments if they do not have the characteristics of securities.

Exchange tokens have also been categorised as unregulated by the FCA. Even if the token itself does not fall under the umbrella of the regulator, facilitators of transactions based on the tokens have to fulfil the requirements linked to the 5th AML Directive which enters into force in the coming months and adhere to general Payments regulation.

Security tokens

The FCA guidance also provides some clarity as to how to determine whether a token issue falls under the scope of being a security token – this is possibly the most contentious issue in Luxembourg and in many other jurisdictions and it is welcome to see the FCA take a firm stance and describe a process for determination, very much aligned with the guidance provided in the Guide to Digital Asset Generating Events.

There are a few factors that the FCA state are indicative of a security. These factors may include, but are not limited to:

- the contractual rights and obligations the token-holder has by virtue of holding or owning that cryptoasset

- any contractual entitlement to profit-share (like dividends), revenues, or other payment or benefit of any kind • any contractual entitlement to ownership in, or control of, the token issuer or other relevant person (like voting rights) 34 PS19/22 Appendix 1 Financial Conduct Authority Guidance on Cryptoassets Feedback and Final Guidance to CP 19/3

- the language used in relevant documentation, like token ‘whitepapers’, that suggests the tokens are intended to function as an investment, although it should be noted that the substance of the token (and not the label used) will determine whether an instrument is a specified investment. For example, if a whitepaper declares a token to be a utility token, but the contractual rights that it confers would make it a share or a unit in a collective investment scheme, we would consider it to be a security token.

- whether the token is transferable and tradeable on cryptoasset exchanges or any other type of exchange or market

- a direct flow of payment from the issuer or other relevant party to token holders may be one of the indicators that the token is a security, although an indirect flow of payment (for instance through profits or payments derived exclusively from the secondary market) would not necessarily indicate the contrary. If the flow of payment were a contractual entitlement we would consider this to be a strong indication that the token is a security, irrespective of whether the flow of payment is direct or indirect (or whether other ownership rights are present).

The case of Stablecoin

Given the hype around the Libra Association and the Libra coin, it is valuable to look in detail at the FCA’s specific guidance on “Stablecoins”. The report provides an explanation of the stablecoins as a token which is designed to limit its risk of volatility by being backed by another cryptocurrency, fiat-currency or commodities. The FCA states that given the complexity and variety of stablecoins, each of this token will be classified on a case-by-case basis. The FCA cites that while many of tokens stated as being Stablecoins may have a common purpose, they vary greatly in their structure and arrangement, making them inappropriate for any single classification. Therefore, not every ‘stablecoin’ will meet the definition of e-money, or a security token. For instance, it may be a derivative, a unit in a collective investment scheme, a debt security, e-money, or another type of specified investment. Or, it might fall outside the remit of the regulator. Many tokens are “backed with” fiat currencies, most commonly the United States Dollar (USD). In some cases, the issuer of the stablecoin token “pegs” the value to that currency – i.e guaranteeing the value of the token, while holding a reserve of fiat currency(ies) to ensure it can meet any claims. In other cases, the token gives the token holder an interest or right to the custodied fiat currency(ies), with the value of the tokens being directly linked to the value of the fiat currency held. These distinctions are also relevant for the models described below.

Some firms have experimented with algorithms to control the supply of tokens, increasing supply when a token’s value rises above a pre-programmed ‘peg’ (such as 1:1 with USD). Alternatively, they could decrease the supply when the value of the token falls below the set parameters, making them scarcer.

The FCA concluded that working models in the market are not yet at sufficient size or scale to require specific guidance.

Consumer protection

Consumer protection is, as for Luxembourg, a concern for the FCA given the global reach of cryptoassets. The report states that even if unregulated or not falling under the realm of the FCA, the activities linked to cryptoassets should be subject to other regulations in force, such as GDPR and other data privacy rules.

The question of the prospectus

The proposed approach by the FCA is comparable to the one of Luxembourg analysed in the report published by the LHoFT. The need for a prospectus should assessed in collaboration with a legal adviser and if required based on an understanding of the application of securities regulation. Potential exemptions apply as well as specific disclosures but this should not prevent cryptoassets-linked projects from providing an offer document to ensure transparency vis a vis potential investor.

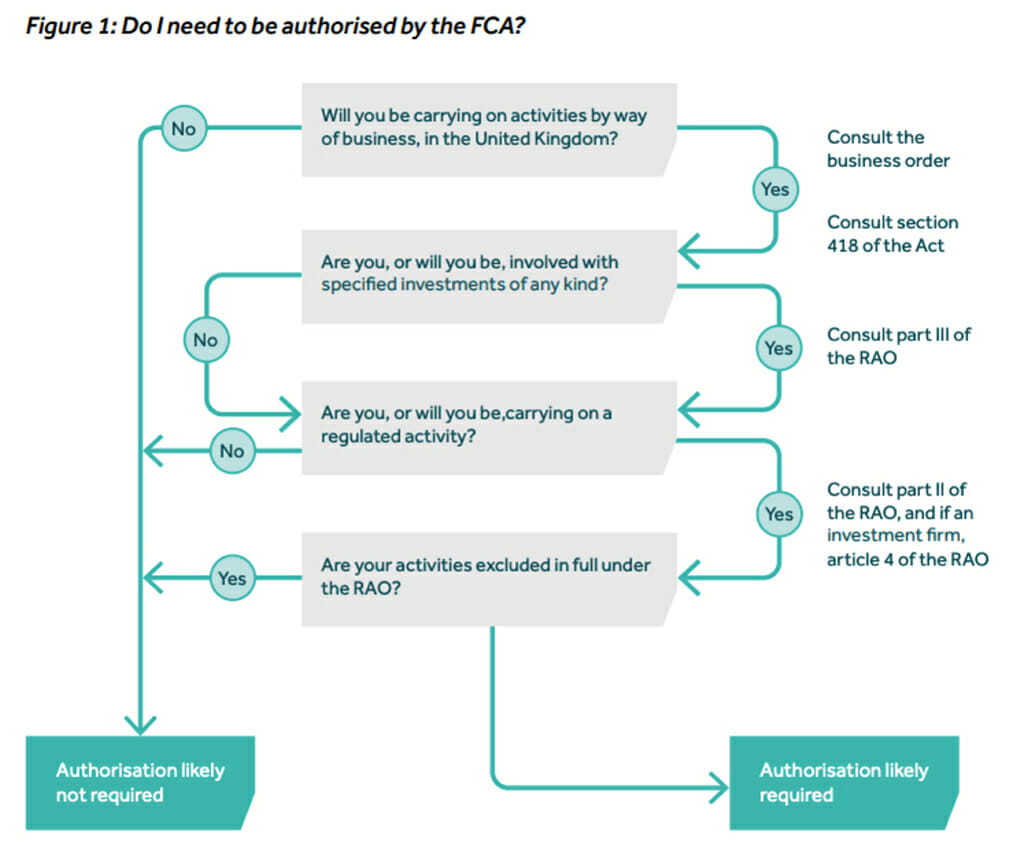

Do I need to be authorized?

The FCA provides a decision tree to help define whether a project is subject to regulation and which part of the regulation might be applicable.

Source: https://www.fca.org.uk/publication/policy/ps19-22.pdf

Conclusion

The approach proposed by the FCA is pragmatic and offers a much-needed level of clarity regarding the treatment of tokens, their classification and the need to regulate specifically certain type of activities.

We observe many similarities with the analysis conducted in the Guide to Digital Asset Generating Events of the regulatory framework in Luxembourg and would be in favour of a common approach in the European Union.

While the token market is still in its youth, it is maturing fast with more focus on robust use cases of tokens, particularly in the dematerialisation of securities and enhancement of settlement and transfers. Likewise, the Libra has brought considerable attention to the realm of stablecoins and the participation of large, reputable companies in the Libra Association, the proposed issuer of the Libra, clearly indicates that tokens are becoming more mainstream. It is important to have a clear starting point for regulatory application to the token economy and to learn through observation as to whether adjustments need to be made or whether specific regulations should be created for this new financial tool.