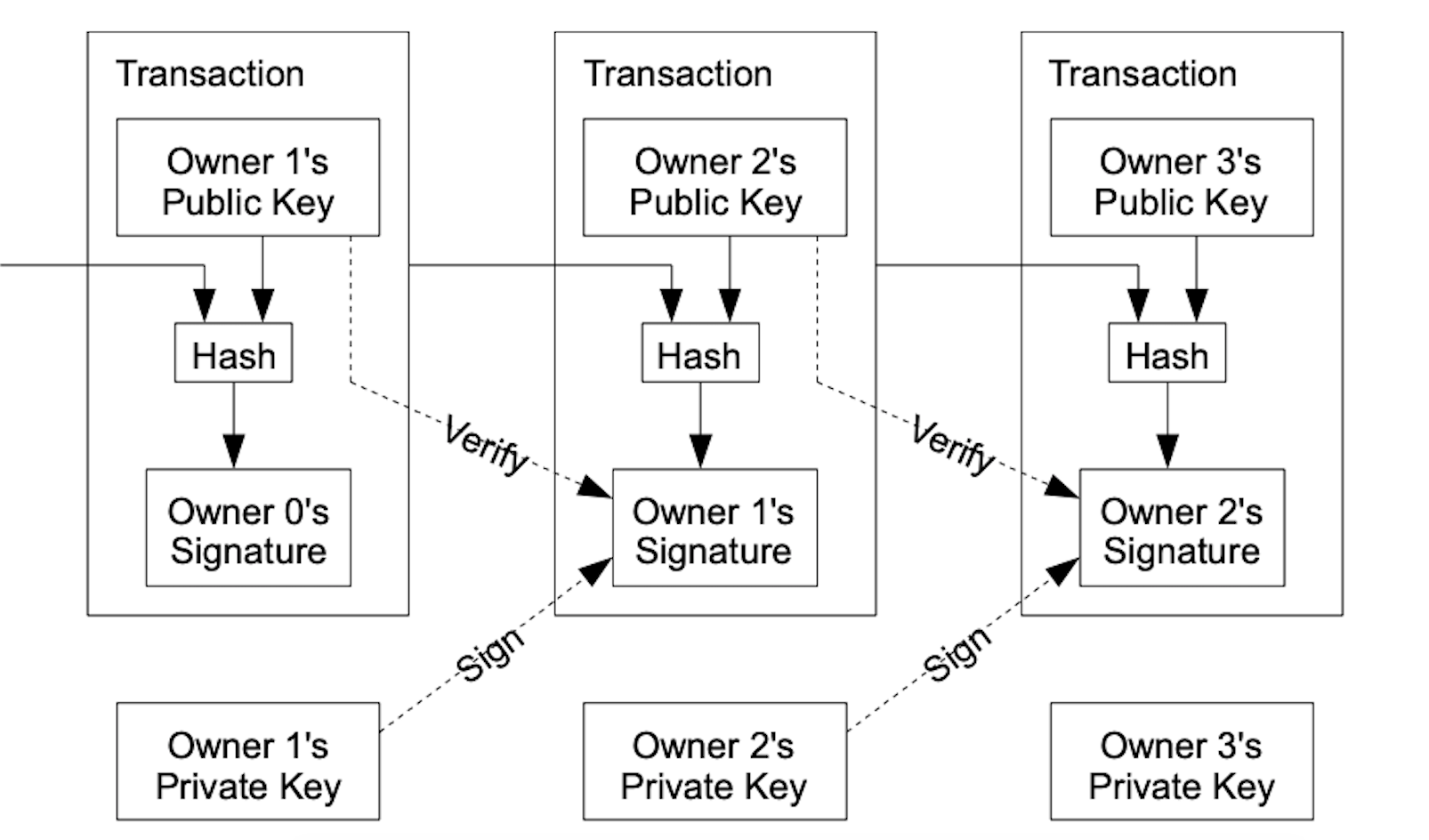

Blockchain technology, a form of distributed ledger technology first described in Bitcoin’s foundational 2008 white paper, has evolved from an obscure experiment in decentralization into a technology receiving ever-growing recognition for its ability to transform processes and open up new applications across the private and the public sector.

Figure 1: conceptualization from the original bitcoin white paper.

While the rise of cryptocurrencies has led to an automatic association of the term “blockchain” with alternative financial applications, in reality, the underlying technology is increasingly attracting investment and adoption across industries, with major impacts expected, for example, in logistics. This wide applicability of blockchain technology and other DLT approaches has received official endorsement from high places, as evidenced by the German federal government’s Blockchain Strategy, published in late 2019.

On an intergovernmental level, the OECD has set up a global blockchain policy centre as well as a policy advisory board. At the LHoFT, we rcently hosted Caroline Malcolm, Head of the Global Blockchain Policy Centre at the OECD, for a fascinating live discussion looking at their work around Blockchain and the impact of COVID19 on financial services. See a few highlights of that conversation here.

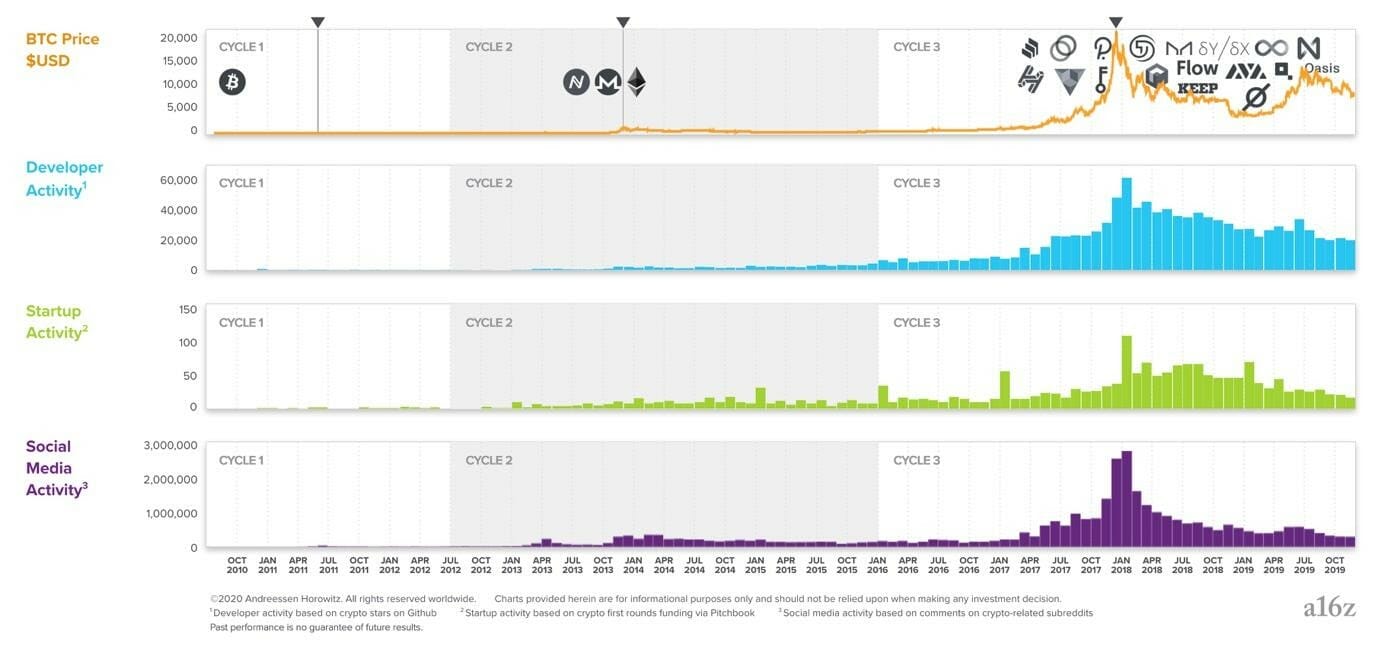

From an investment perspective it is interesting to note, as Andreessen Horowitz are doing here, that the initial interest and enthusiasm driven by the fulminant appreciation in cryptocurrency prices has translated into subsequent waves of idea generation & the financing of blockchain-related projects.

Figure 2: Andreessen Horowitz researchers have correlated cryptocurrency price with waves of developer activity, startup activity and social media activity. 3 cycles of activity are distinguished.

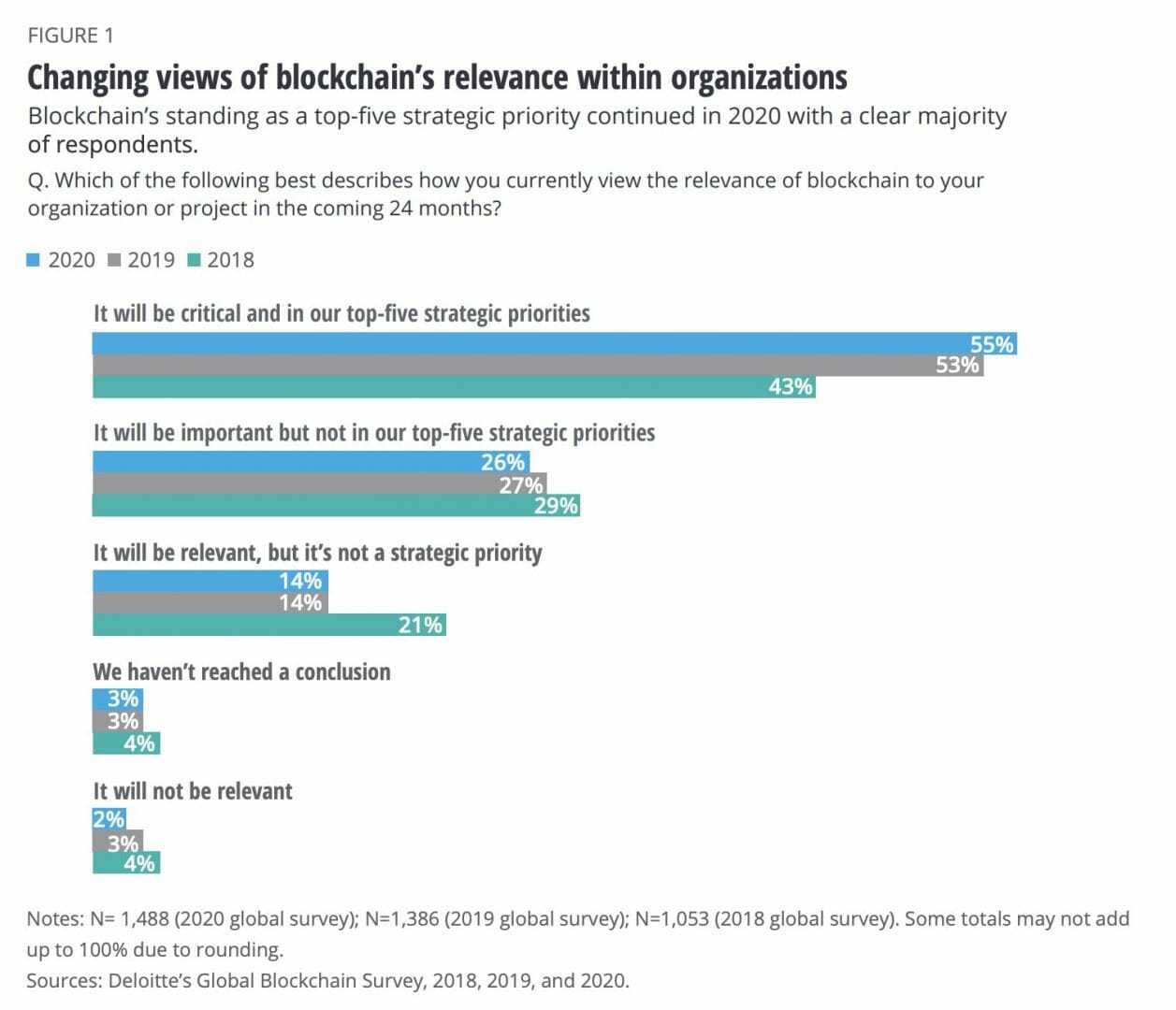

Successive international surveys among business leaders also paint a clear picture of the rising importance attributed to blockchain and DLT in the context of international competition and an increasingly digitalized economy. While not captured in the data discussed below, it is fair to expect that the COVID-19 health & economic crisis will provide another boost to such developments.

Deloitte 2020 blockchain survey

LHoFT partner Deloitte just published its 2020 Global Blockchain Survey, providing valuable insights into the opportunities and obstacles to implementation of blockchain technology in established commercial organizations. Conducted between February and March this year, the 2020 Survey polled 1488 senior executives and practitioners who were competent to comment on their organization’s blockchain and digital assets investment plans and perceptions, across 14 countries.

Deloitte notes a shift away from contemplation towards concrete measures:

“In recent years, we have seen sentiment about blockchain’s potential similarly evolving, along with companies directing actual investment dollars toward applications. In Deloitte’s 2019 global blockchain survey, we observed this continuing trend in thinking and investment […] this year’s survey suggests […] that blockchain is solidly entrenched in the strategic thinking of organizations across industries, sectors, and applications. […] the key takeaway [is] that leaders […] now see the [the technology] as integral to organizational innovation.”

The implementation of blockchain solutions is considered from the perspective of global competition, both for MNCs and for individual jurisdictions:

“Related issues of pressing concern include […] cybersecurity, global digital identity, compliance with established […] reporting frameworks, governance, and the full implications of an ever-increasing digital asset development. Relevant parties, including regulators and standard-setters, have been working to understand, monitor, and address these concerns as they emerge; those organizations and nations that don’t find a clear path could risk losing market share to others that have addressed these challenges.”

Blockchain reliability is a prerequisite for materiality

Against the backdrop of significant keenness to implement blockchain technology and an evolving technological and regulatory landscape, potential adopters need to consider best practices, and the WEF is here to help.

Addressing a core concern of potential blockchain adopters across industries, the WEF explains that ensuring the reliability of blockchains is a precondition for the protection of, and hence trust in, digital assets. Both from a practical and from a legal perspective, the very existence of digital assets, and an organisation’s ability to demonstrate as much, relies on the design and maintenance of a blockchain and its key ancillary services.

The WEF reminds us that vulnerabilities can emerge not only from any given blockchain’s intrinsic attributes such as the cryptographic protocols used, but also from associated deployment services such as digital wallets, the absence of network enablers (node operators) or a dedicated community of developers.

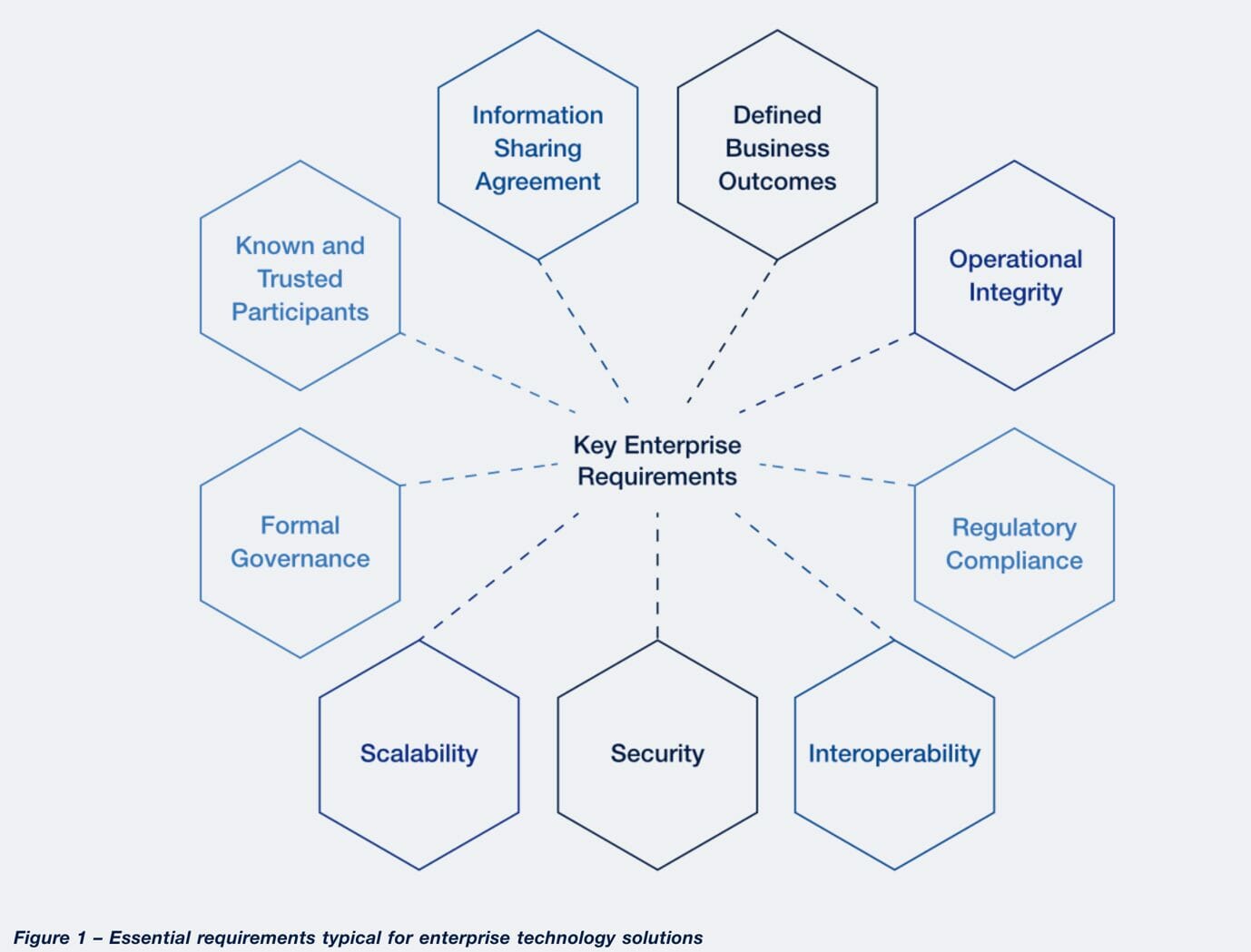

Readers are reminded that the WEF provides a blockchain toolkit supportive of the successful development and deployment of new blockchain solutions. By so doing, the WEF reminds potential adopters that blockchain is another tool in the tech stack – no more and no less – which should comply with basic requirements common to all enterprise technology solutions. These include operational integrity, regulatory compliance, formal governance and interoperability, among others.

Concrete use case: HQLAx

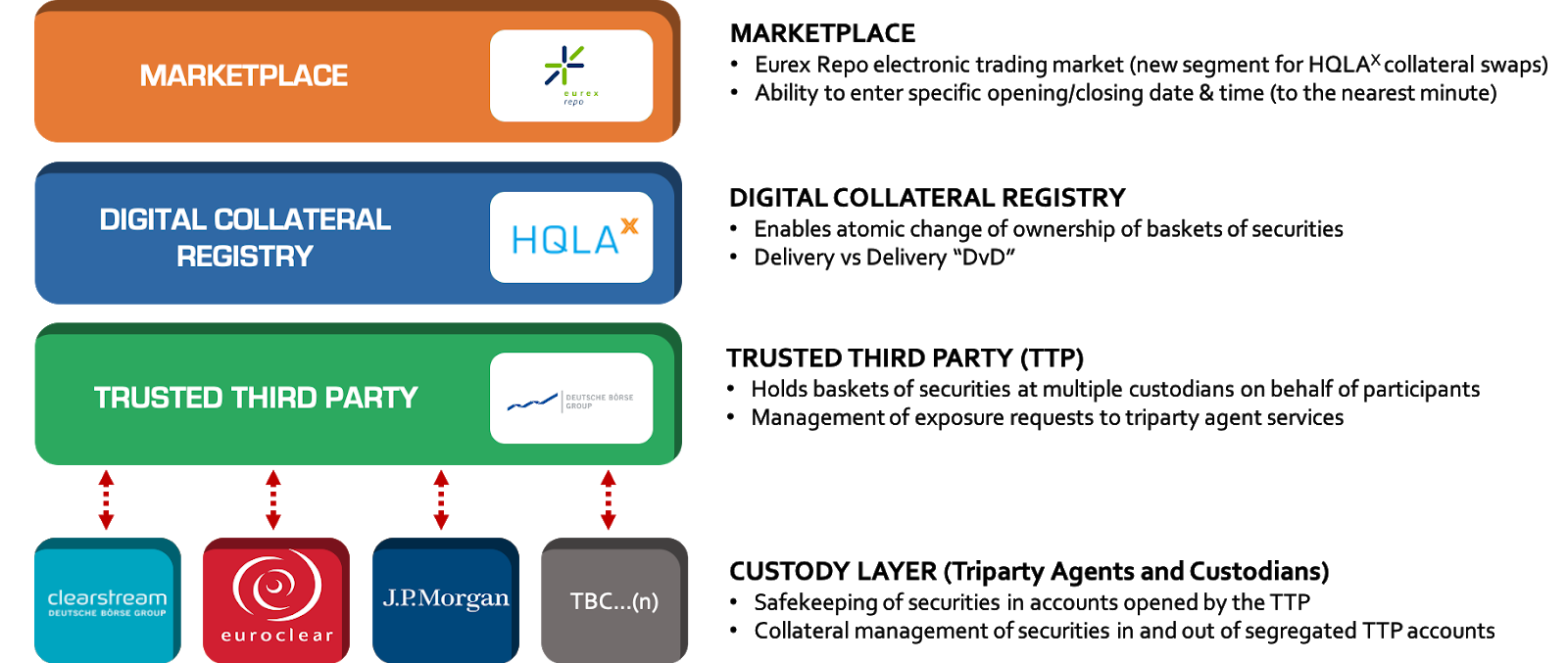

With all of the above in mind, it seems timely to present a concrete use case of blockchain and DLT more broadly in the financial sector. Recently, financial markets infrastructure (FMI) has been of particular interest to the community, as evidenced by strategic partnerships between consortia of established financial institutions and innovative startups. A good example of such collaboration is provided by LHoFT member HQLAx, which leverages R3’s Corda technology to make collateral management more efficient.

For the sake of conciseness, readers are referred to this writeup by HQLAx staff on the company’s approach to integrating with existing FMI. The value proposition involves making reconciliation processes unnecessary via DLT. HQLAx are mindful of the particularities of the financial sector and have tailored their offering accordingly:

“We need to consider that DLT is an emerging technology and that financial institutions and service providers are operating in a highly-regulated field. Our clients and partners are at different stages of assessing DLT and not all are ready to integrate a DLT-based system into their enterprise architecture today. To facilitate frictionless adoption, HQLAᵡ, therefore, offers an evolutionary transition, where participants can start out with their node hosted in a secure data centre from an HQLAᵡ partner. This allows a fast onboarding process onto the HQLAᵡ platform to already use the benefits of the platform today.”

The combination of a clear value proposition – technologically enabled – together with smooth integration into existing FMI and regulatory considerations, makes for a strong proposition.

To learn more about the blockchain industry in Luxembourg and what we at LHoFT are doing to support this promising area of financial technology, be sure to tune into our July 14 International Showcase on the subject.

Author: Jérôme Verony – LHoFT Research and Strategy Associate