Author: Nasir Zubairi, CEO of the LHoFT

Fact: The more we understand about the behaviours, lives and environment of our target customers, the better we are able to design and market our products to them and accelerate adoption.

Focusing on the use of technology by a market and their “Normal” level of technology sophistication can provide significant insight into the likelihood of that market’s adoption of new technology products and services, allowing firms and stakeholders to better define their target market and to refine their product offering for greater customer take-up.

Markets are complex and fascinating. Understanding how they work and how they pertain to and define your product or service are critical to the success of your business. “Will customers buy my product/service?” “Why will they buy?” The concept of “adding value” is core to any business case.

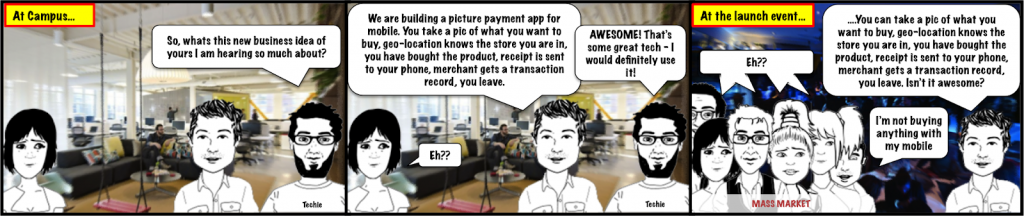

Generally and particularly so in the tech industry, your peer group – the guys you hang out with in “Tech City”, the guys you sit next to in your shared workspace – are not the right benchmark for your product to succeed. They are not representative of the mass market. If they think your idea is great and they are likely to use it, you really really need to double check whether less tech orientated consumers will adopt your product. There are early adopters but there are also “too-early adopters”. Niche products proliferate amongst tech folk, many of which will never get to the mainstream. There is a “market perception bias” due to peer group and the pressure to deliver cool innovation relative to localised behaviour. The product/service misses the mass market as it is too cutting edge.

The Adoption Curve

Most people are familiar with the Adoption Curve (The Bass Diffusion Model to give it its proper name – find out more on Wikipedia) that describes the penetration of a new product in a population. Be it subconsciously, it defines our forecasts when launching new products and, by inference, investment decision-making and capital allocation.

An issue with the model: keeping all parameters constant while varying the size of the market, the length of time to fulfil 100% market potential is always the same.

Estimates of the key parameters are made on existing sales data or synonymous comparables data. The size of the market variable is arbitrary – there is no prescribed science behind it. You can make it 1000 or 100 million and the key output, the estimate of customers, does not change except in scale relative to the initial input.

I hope you agree, this does not make sense. A firm launches a product, it is selling well. They then incorrectly assume that their existing customers are a subset of a very large market and build marketing strategy and estimates on sales revenue using this misplaced market definition. It will take them forever to “own” the market; it cannot be that the length of time to saturate a large, more heterogeneous market is the same as a small and more appropriate one.

Market segments are defined by habits and behaviours as well as in many cases, law. They are not defined by demography – age, location, density….though, in certain cases, demographics may act as a good proxy. I personally wince when I hear references to “millennials” in Fintech and distinctions on the service offerings that should be developed to cater for this badly defined market.

Banks don’t sell mortgages to the “UK market” they sell mortgages to people in the UK that are looking to buy property, a need driven by the behaviours the people within that group and in this example, the laws that apply, which further segments the broad market; commercial mortgages, investment mortgages, first-time buyers, etc. More granular still, individual mortgage “products” are defined to appeal to specific customer groups that are driven by even more granular behaviour; e.g. their level of risk aversion, their accumulation of wealth, their use of time.

Broadly (and maybe controversially?) speaking, I believe it is good practice for young businesses or for any business launching a new product to focus on a very small, well defined market segment, really understand it, own it, then broaden the market definition and leverage their experience and brand credibility from previous success to sell to new target customers.

Understanding your customer’s normal level of technology use is key to marketing and success

First, let’s get everyone on the same page with a couple of definitions:

“Technology”, does not just relate to computers or electronics. It is more broadly defined as “The application of scientific knowledge for practical purposes” this could relate to machinery, pipes, a saucepan and even a comb.

“Innovation“, is not just invention, is not just a new product or service, I define it broadly as “something new that adds value”. This could relate to a process, a product or service, a business model.

Combining the two, “technology innovation”, therefore is the application of scientific knowledge to create something new that adds value.

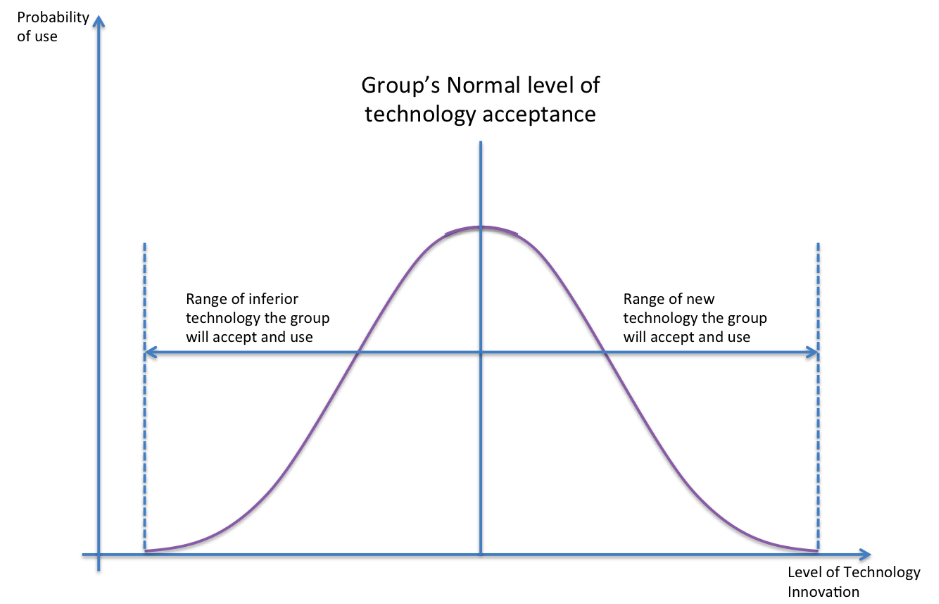

Let’s say there is an arbitrary line that represents the technology innovation that is available to us. The further along the line the more “high-tech” the product and service. We can benchmark a “Normal” (mean) for the sophistication of technology people within homogeneous groups are comfortable using on a regular basis. Either side of this Normal, is a range that represents the inferior and new technology that we are willing to utilise today. For a very large market definition, this is, unsurprisingly, normally distributed.

As time goes on and users accept and use more innovative technology, the normal shifts to the right, i.e. the normal level is at a level of more sophisticated technology tomorrow than it is today. This is usually an incremental transition and takes time. There are very few “disruptive” products or services that have led to a large shift in the normal level of technology utilised by a market. “New and Improved” trumps disruption every time. To ensure you acquire rapid acceptance and use of your service or product, you need to target somewhere to the right of the normal line. Excellent – all fits well with the adoption model.

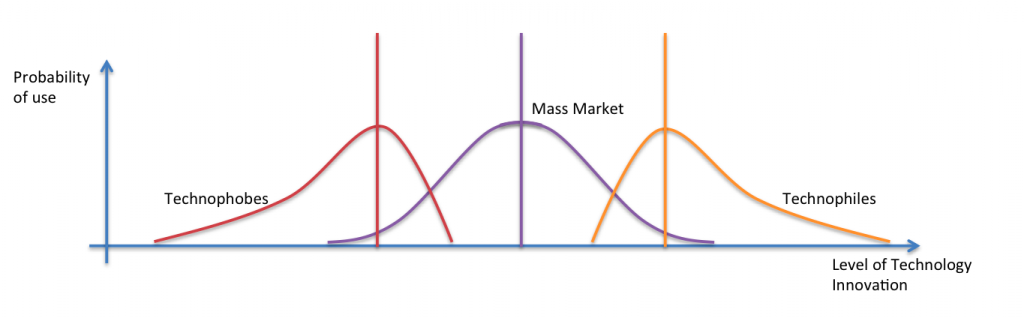

But wait, we know there are more distinct groupings within the population. What if we were to consider the habits and behaviours of “technophiles” and “technophobes” as exogenous to the mass market?

To generalise, technophiles are more likely to adopt new technology innovations and will be less accepting of inferior technology, while technophobes are less likely to adopt, relative to the mass market. The chart is likely to look like this, with technophile and technophobe adoption of technology skewed appropriately.

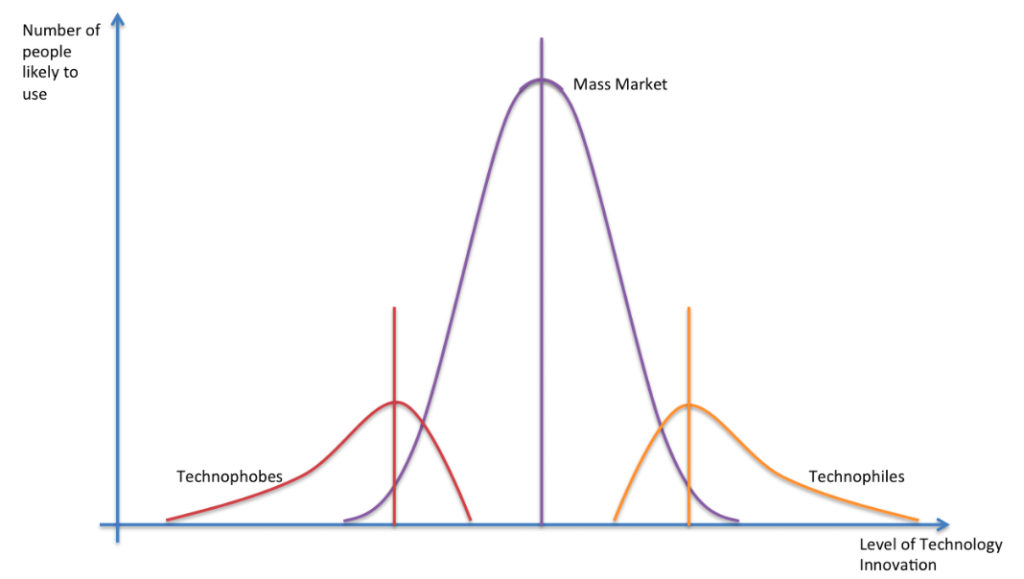

Now let’s make this more useful; let’s multiply the y-axis by the size of each market segment to give us a representation of the number of consumers likely to use the product:

Where do you want your new product to be perceived to fit?

To me, it’s fairly obvious that, for a product to be successful in the mass market, a business should be targeting the technology sophistication of the product to be slightly inferior to the normal level of technology sophistication acceptable to a market of technophiles. I.e. if the guy sitting next to you in google campus or anya.n. other tech workspace thinks your product is cool and innovative (for them), it should ring an alarm bell in your head – check, re-check, and check again what is normal for your mass market.