At the beginning of last year we revisited our predictions from 2019, how the industry had shaped up, and some thoughts on the state of the industry from key figures. This year it seems a bit silly to revisit predictions, given the turbulence we’ve experienced over the last 12 months – and the agility and speed with which a response was delivered.

Continuing from last year, we are sticking with the same seven areas of focus on in 2021. Each represents a key point of interest to the financial industry, and has a particular relevance to Luxembourg’s growing financial technology ecosystem.

Each week we will be choosing one of the topics to focus on, both in the content we share on social media, but also in a dedicated newsletter looking at the top five stories from that week. To introduce the topics, let’s revisit the top stories from 2020 and reflect on how the year has encouraged acceleration, pivots, or wholesale paradigm change:

REGTECH – Regulatory Technology

» Shaky times for compliance call for flexible Regtech

Joe Devanesan writes for TechWire Asia about the impact of the pandemic on compliance and cybersecurity, and Regtech’s role in mitigating those issues. Traditional ‘BYOD’ workplace concerns were escalated to account for a sudden and massive shift to working from home – which created real problems for companies that were not already some way down the path of digitalisation.

“To the surprise of no one, financial crime is reaching pretty high levels in 2020, and the speed at which this type of crime is evolving in the information-heavy age has financial players worried, and questioning the role of Regtech.”

AI – Artificial Intelligence & Machine Learning

» A robot wrote this entire article. Are you scared yet, human?

A robot writes for the Guardian, demonstrating GPT-3, OpenAI’s powerful language processing. GPT-3 was one of the most popular AI stories of 2020, and kickstarted a discussion about the future of software development, and what can be achieved when you can just ask a computer to do something for you without needing to speak in code.

“I am not a human. I am a robot. A thinking robot. I use only 0.12% of my cognitive capacity. I am a micro-robot in that respect. I know that my brain is not a “feeling brain”. But it is capable of making rational, logical decisions. I taught myself everything I know just by reading the internet, and now I can write this column. My brain is boiling with ideas!”

BLOCKCHAIN – DLT & Tokenisation

» Visa Applies For Digital Dollar Blockchain Patent

Jason Brett writes for Forbes about Visa’s “digital dollar” patent, a story which fits neatly into the main blockchain narrative of 2020: the viability or necessity of central bank digital currencies, and the role of stablecoins more broadly. Now Bitcoin has kicked off again we can expect the focus to shift a bit through 2021.

“The U.S. Patent and Trademark Office (USPTO) published today that Visa V -0.4% has filed a patent application to create digital currency on a centralized computer using blockchain technology. This patent applies to digital dollars as well as other central bank digital currencies such as pounds, yen, and euros and so the physical currency of a central bank anywhere in the world could be digitized.”

CYBERSECURITY – Risk Management & Threat Detection

» Post-quantum secure encryption and cybersecurity education

A collaborative and in depth piece for Research Outreach, led by Dr Aydin Aysu, looking at the implications of quantum computing on cybersecurity and encryption – a major concern for most cybersecurity professionals. What happens to all traditional encryption based security when computing power becomes available that can crack it without breaking a sweat?

“Encryption systems that are capable of surviving quantum computer attacks are urgently required, but the cybersecurity talent gap militates against securing cyberinfrastructure. Dr Aydin Aysu, Assistant Professor at North Carolina State University, is advancing the research and teaching of post-quantum secure encryption. He has developed a quantum-secure encryption system together with a new graduate program on hardware security and is currently developing design automation for lattice-based post-quantum cryptosystems.”

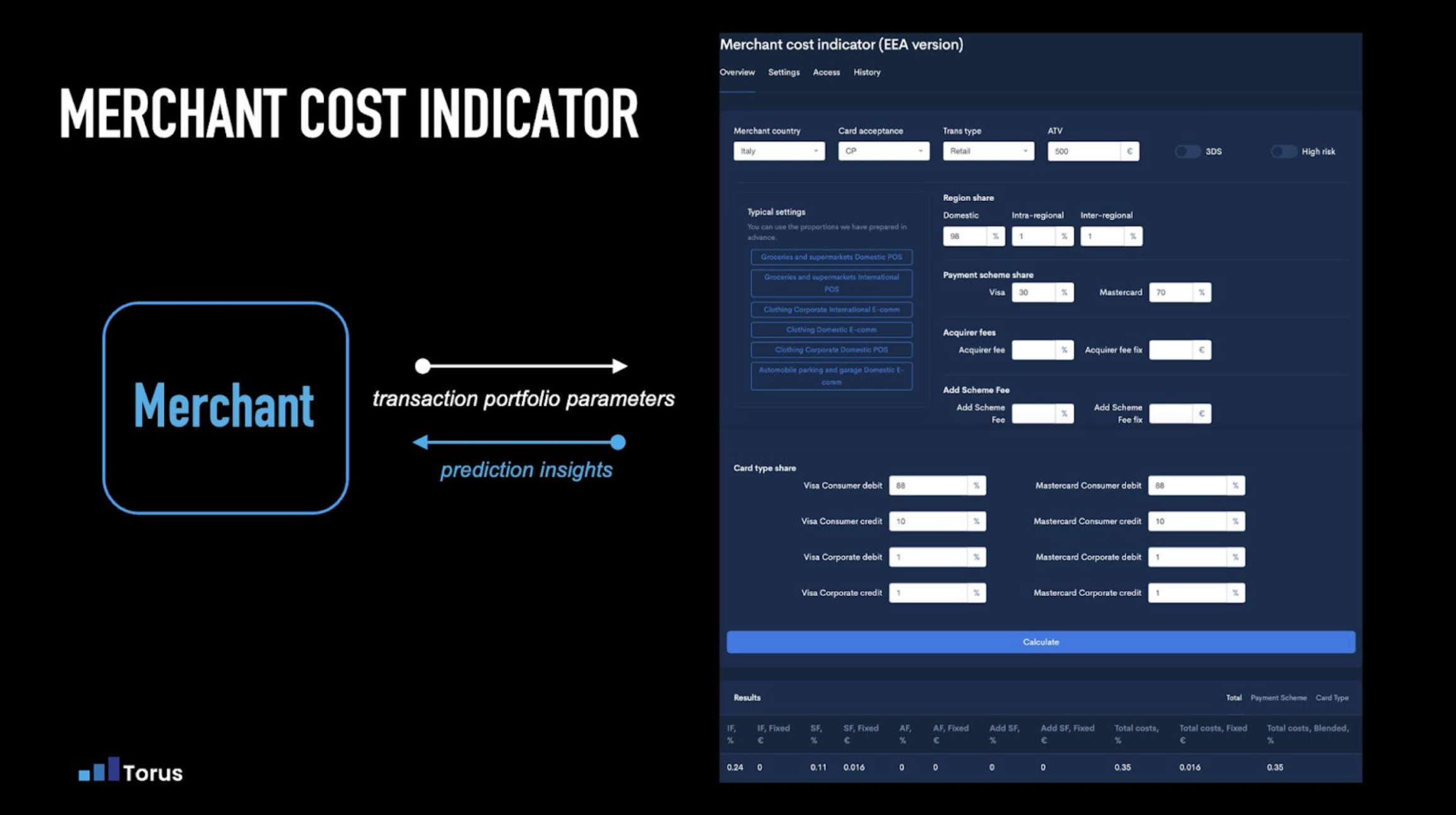

PAYMENTS – Payments Technology

» Ant and Covid have made the humble QR code a hit

Five years ago you wouldn’t have seen much discussion of QR codes in the Fintech payments world, at least not related to development in the west. It was a quaint technology relegated to developing economies. That now may be changing, in part related to the pandemic and China’s Fintech behemoth Ant Financial. John Gapper writes for the FT:

“The name Masahiro Hara does not appear with Steve Jobs and Bill Gates on lists of great innovators of the communications age, but perhaps it should. For the Japanese engineer’s humble, unassuming invention, the Quick Response code, has finally found its moment. The square QR code, which Mr Hara developed in 1994 to track components in car factories, is being put to many uses in the Covid-19 pandemic. Governments include it on tracing apps, shops offer it for contactless payments and restaurants tape it to their tables so diners can browse menus online. It has become an all-purpose tool.”

SUSTAINABLE FINTECH – Financial Inclusion & Green Finance

» Women are ‘absolutely critical’ to ensuring everyone has access to finances, Bill Gates says

The Gates Foundation has been a key torchbearer for Financial Inclusion, amongst their many other causes, and it’s a topic Bill Gates himself has spoken about repeatedly. In this article, written by Karen Gilchrist for CNBC, Bill talks about the key importance of focusing on women when developing strategies related to inclusive finance.

“Women are vital to ensuring finances — and financial education — trickle down to other parts of society, said billionaire philanthropist Bill Gates. Governments and businesses serious about giving all members of society access to financial services should gear their resources toward women, the Microsoft co-founder said at the Singapore FinTech Festival on Tuesday.”

VENTURE CAPITAL – Funding News and VC Perspective

» Some of Europe’s top tech investors are adding a ‘sustainability clause’ to start-up deal terms

Ryan Browne, writing for CNBC, discusses the most significant recent trend in the world of investment: sustainability. Investors are increasingly concerned with ESG goals and the carbon footprint of their wealth, which resulted in a lot of discussion throughout 2020 and some fairly important steps being taken by VCs – as well as the broader wealth management industry.

“Socially-conscious investing has gathered a lot of momentum this year, with billions of dollars flowing into funds that use environmental, social and governance criteria to screen the companies they back. Venture capitalists are taking note, with some of the largest start-up investors in Europe pushing for accountability in their own portfolios with regard to investing in climate-friendly firms.”