At the LHoFT, we strongly believe that financial technology is crucial to advancing financial inclusion, empowering groups that have been left behind by the traditional financial system. Whether it’s financing for entrepreneurs, pension products for the underbanked, specialised insurance plans or even financial education and literacy aids, the positive impact being driven by entrepreneurship is improving lives around the world.

Building on the success of the first edition of the program in 2018, CATAPULT: Inclusion Africa 2020 is a unique one week program of Fintech startup development built by the LHoFT Foundation, targeting African Fintech companies, focusing on creating bridges between Africa and Europe and aligned with the sustainability goals of Luxembourg’s finance centre.

In the run up to our Financial Inclusion bootcamp, we will be sharing insight from the founders participating in this year’s edition, continuing with Stone Atwine, CEO of Eversend:

“In Africa, every single feature is a new integration. I think we have about 30+ partners and we are only 5% done.” – Stone Atwine

Can you tell us a little about yourself and your company?

I’ve been around the block. I’ve worked in financial technology for 9 years in multiple African countries. I’ve been involved with loan management software, I founded a microfinance company based on USSD (offline mobile phone access) and mobile money. I also founded a p2p remittance company before Eversend.

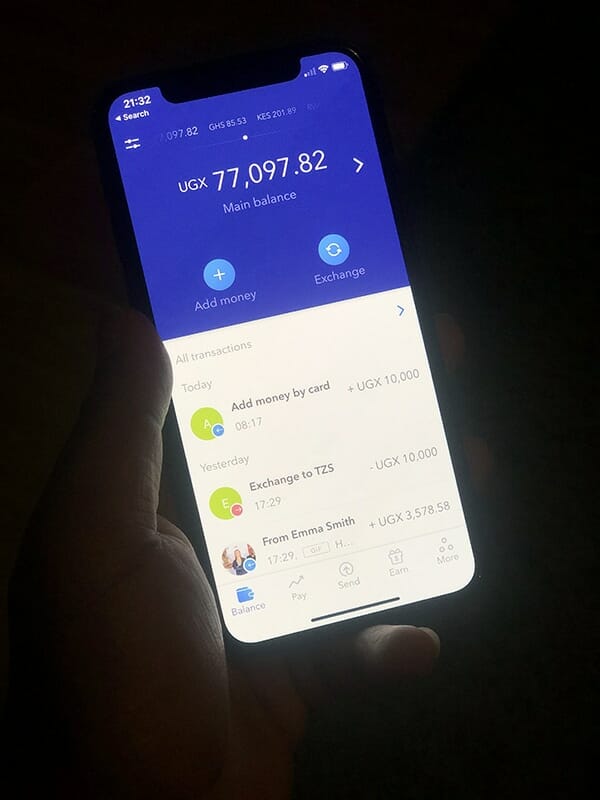

For Africans and Africans in the diaspora that experience inconvenient and expensive financial services and hidden fees, Eversend is a one-stop financial services hub that provides a multi-currency wallet allowing them to exchange, save and send money at the best possible rates while offering personal loans, payments, investments, and other financial services. Eversend is Africa’s first digital-only banking alternative.

What were you involved in before Eversend which led to the development of this idea?

It starts with me trying to send money to my grandma from Kenya to Uganda. The two countries are next to each other but the trouble I used to go through was shocking. I had to use brick and mortar money transfer companies which cost up to 15% and then my grandma would have to take a bus to find an agent. I thought this was unacceptable and decided to build a platform that would alleviate this problem.

With deep experience in cross border remittances and microcredit, I learnt that the problem with access to financial services in Africa was fragmentation. I discovered that people do not need piecemeal interventions that currently exist. People have 10 apps on their phones, an app for loans, one for money transfer, one for insurance, pension, bill payments, etc. So we decided to build a financial super app to bring access to one place.

Neobanks are a prominent category in global Fintech, what are the considerations for a neobank operating in Africa?

You must be ready to build 20 times more than global neobanks. In Europe for example, features and services can be plugged in at once. SEPA, cards, IBANS. In Africa, every single feature is a new integration. I think we have about 30+ partners and we are only 5% done.

What advice would you offer to other founders looking to increase Financial Inclusion in Africa?

Think deeply about the problems you are solving and the markets you are solving for. While financial inclusion has been helped by mobile money and agent banking, we still see massive exclusion of women. We see the exclusion of marginalised communities like refugees. We need to be intentional about solving problems of access and we shall achieve a lot.

What are you hoping to get out of your experience at CATAPULT: Inclusion Africa?

I am hoping to share and learn from other founders working on problems of financial inclusion in other areas of Africa. I believe we need collaboration as players in the space and I will be looking out for these opportunities. This is the only way for us to achieve our goals quickly.

What’s next for Eversend? What do you see as the key challenges as you grow further?

Our biggest challenges are around regulatory compliance and prohibitive regulators who stifle innovation with archaic rules and requirements. This is starting to change across the continent but there are some jurisdictions that are still behind.

We will be entering new markets and adding new features in 2020 to help our members access better and more affordable financial services.

What does ’financial inclusion’ mean to you?

To me, financial inclusion is about access, affordability, and usefulness of a whole suite of financial services. An account for the lady in my village may be a starting point but can she access health insurance or credit? Access is about bringing people economic prosperity who would otherwise have been unserved or underserved. This is exactly why we are bundling multiple services in one package. Our work is harder but someone has to do it.