At the LHoFT, we strongly believe that financial technology is crucial to advancing financial inclusion, empowering groups that have been left behind by the traditional financial system. Whether it’s financing for entrepreneurs, pension products for the underbanked, specialised insurance plans or even financial education and literacy aids, the positive impact being driven by entrepreneurship is improving lives around the world.

Building on the success of the first edition of the program in 2018, CATAPULT: Inclusion Africa 2020 is a unique one week program of Fintech startup development built by the LHoFT Foundation, targeting African Fintech companies, focusing on creating bridges between Africa and Europe and aligned with the sustainability goals of Luxembourg’s finance centre.

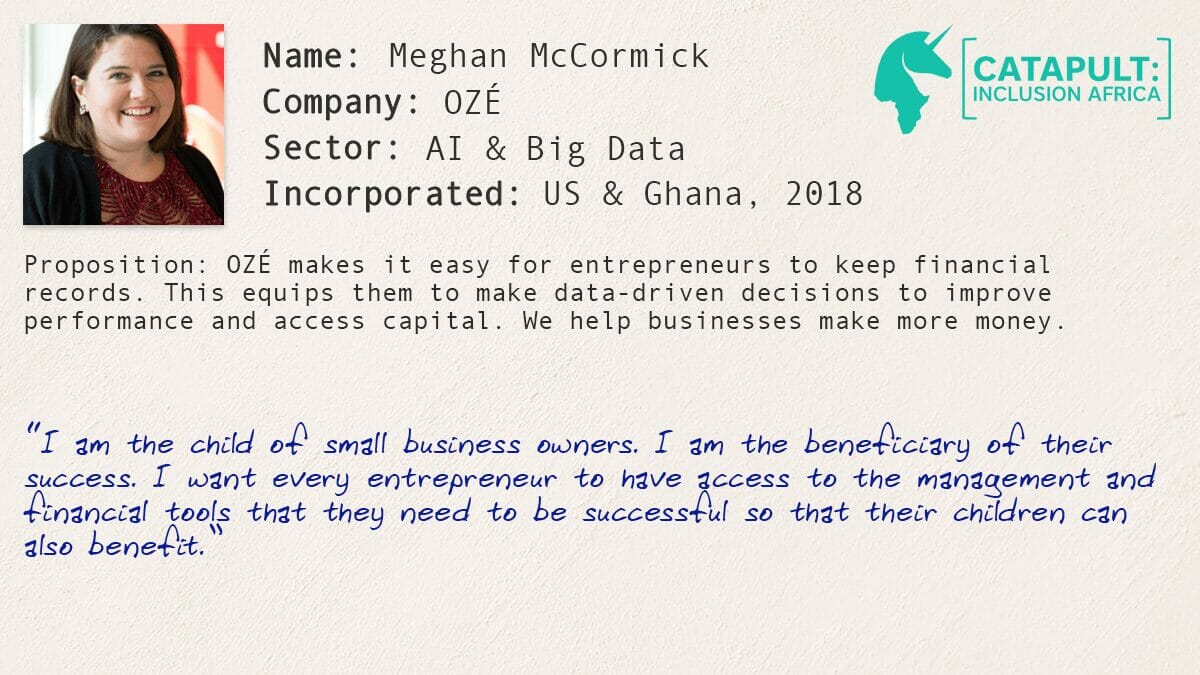

In the run up to our Financial Inclusion bootcamp, we will be sharing insight from the founders participating in this year’s edition, continuing with Meghan McCormick, Co-Founder and CEO of OZÉ:

“Let’s think beyond payments. Payments should be the rails that support a vast array of financial products and services.” – Meghan McCormick

Can you tell us a little about yourself and your company?

OZÉ brings African small businesses into the digital era. It is an app that makes it easy for businesses to track sales, expenses, and customer information. The data is analyzed to provide tailored recommendations, reports, and business education. If the entrepreneur needs a little extra support, an OZÉ Coach is just a click away. As they are using OZÉ to manage their business and learn how to run it better, we are learning about them. Using this data and machine learning, we can predict their credit risk and provide them with affordable capital from our banking partners. With over 18,000 registered users, OZÉ is the largest online community of SMEs in Ghana. The most exciting thing is that OZÉ works; 97% of businesses that have used OZE for at least 10 months are growing or profitable or both!

Both my co-founder, Dave, and I are Returned Peace Corps Volunteers. We spent more than two years living in rural communities in West Africa. I was in Guinea and he was in Benin. I lived in a hut with no running water or electricity and Dave was so remote it took nearly a whole day on the road to reach the capital. We also both have had corporate careers. I was a management consultant focused on innovation strategy and Dave was a marketing professional in the financial services industry. As a result, we are just as comfortable selling veggies in an open air market as we are pitching a fintech startup in the board room.

OZÉ Ghana Team

What were you involved in before OZÉ which led to the development of this idea?

I am the co-founder of Dare to Innovate, a youth-led movement to end unemployment in West Africa through investments in the entrepreneurial ecosystem. We launched Guinea’s first business accelerator, and along with Dave, scaled it to be the most active in Francophone Africa. Through this work, I became closely acquainted with the struggles of small business owners. These entrepreneurs were keeping their records in notebooks and because of that, they were making decisions based on their gut and not on data. The results weren’t great. I began hunting for a tool that could make it easy for entrepreneurs to keep digital records and use that data to break down silos, improve decision making, and facilitate access to capital. When we couldn’t find something, we started building the product that became OZÉ.

As you are headquartered in the US, operating in Ghana, and looking at opportunities in Europe, how has this global base influenced your development?

I believe that true innovation happens at intersections. Growing up in the U.S. and working in several small businesses, I am aware of the tools and resources that American business owners have at their disposal. Products like Square give entrepreneurs in America the support they need to move from subsistence entrepreneurship to wealth and job creation. Living and working in Ghana with a team from the US, Ghana, Nigeria, Togo, and Burkina Faso has made us intimate with the nuances of small business ownership and operation in West Africa. At the intersection, you have OZÉ, a tool that aims to be as powerful as any in the world specific designed for the realities of the African market. This program is really our introduction to working in Europe. I’m looking forward to better understanding the economic and trade relationship between Europe and Africa.

OZÉ Entrepreneur Joseph poses with his OZÉ business coach, Prince

What advice would you offer to other founders looking to increase Financial Inclusion in Africa, and in Nigeria specifically?

Let’s think beyond payments. Payments should be the rails that support a vast array of financial products and services.

What are you hoping to get out of your experience at CATAPULT: Inclusion Africa?

The African tech community is doing great work serving customer needs and creating new solutions to problems unique to our markets. I think that where we can be strengthened is in connecting more meaningfully with markets who are focused on banking and financing. Through this program, we hope to make those connections and gain insights. If you can combine the ingenuity of African innovators with the experience of European bankers, you can create solutions that will give millions access to powerful financial tools.

What’s next for OZÉ? What do you see as the key challenges as you grow further?

We have a few big things on the horizon. We recently started lending through a banking partner and are working to build the systems that will allow us to scale it up. We also launched a pilot in Nigeria in January and are excited to learn about the market and discover how we can be successful in it. Finally, we are integrating payments into our app. OZÉ will no longer just be a record-keeping app, but actually be an app through which entrepreneurs can conduct business. We should have that feature out in a few months.

One of the biggest challenges is maintaining rapid growth while educating customers. For many OZÉ entrepreneurs, OZÉ is the first digital tool that they have used in their business. We’d rather have 1000 customers using the app to its fullest, than 10,000 just scratching the surface. At the same time, we want to get it into the hands of everyone who needs it. We are soon launching a re-design of the app that we think will make it easier for entrepreneurs to discover all of its features on their own so we can continue our rapid growth.

Mahfouz shows a potential customer how to use the app

What does ’financial inclusion’ mean to you?

Financial inclusion is about outcomes. It’s about what intuitive, accessible, and affordable financial tools can do to improve business performance and quality of life. If taking a loan hurts the long-term prospects of a business, it is not financial inclusion even if the terms we relaxed to make it accessible. Specifically for OZÉ, financial inclusion means having ownership and control of your financial data so that you can use it to make informed decisions and access affordable financial products.