Much of the world benefits from a strong finance industry, and a thriving financial technology sector providing innovative services to ease the lives of businesses and consumers. It is easy to forget that some countries lack the infrastructure for such innovation, and are much more cash reliant and without access to formal credit, savings, or other more secure financial products.

Tackling these challenges, the EFSE Fund and the SANAD Fund for MSME, advised by Finance in Motion, have partnered with Village Capital and the Luxembourg House of Financial Technology(LHoFT) to develop the Fincluders Bootcamp 2017. Building on the successful Fincluders Startup Competitions in Berlin, Germany and Amman, Jordan the Fincluders bootcamp is a unique investment readiness program designed for entrepreneurs offering inclusive financial products to underserved groups across Southeast Europe, the European Eastern Neighbourhood region and the MENA region.

Details of the full agenda will be available in the Fincluders Bootcamp website soon.

The Qualifying Startups

The criteria for startups looking to join the program were the following:

- Currently be operating in/have ability to expand your business to the regions served by the EFSE and SANAD Fund

- Have a minimum viable product (MVP), and raised less than $3M in equity

- Have meaningful customer or business validation (not limited to revenue, can also be successful pilot studies, number of users, and/or strategic partnerships)

The bootcamp will provide the 12 selected startups with intensive mentoring and coaching, and will offer opportunities for targeted exposure visits and business development, helping them to move to the next stage of their development.

The Startups:

Provides underbanked farmers with competitive point-of-sale financing for farm inputs:

Tarfin:Turkey

Lending-as-a-service platform for schools, providing access to student finance options:

Quotanda:Spain/Mexico

Quotanda:Spain/Mexico

Online trade hub connecting farmers and buyers and on-demand logistics service:

Agrocenta:Ghana

Lending and saving with friends and family through the use of social reputation:

Moneyfellows:Egypt

Affordable cloud point-of-sale platform for small business owners:

POSRocket:Jordan

Provides underbanked farmers with competitive point-of-sale financing for farm inputs:

Seso:South Africa

Credit-scoring for smallholder farmers, based on a range of data including agricultural:

FarmDrive:Kenya

FarmDrive:Kenya

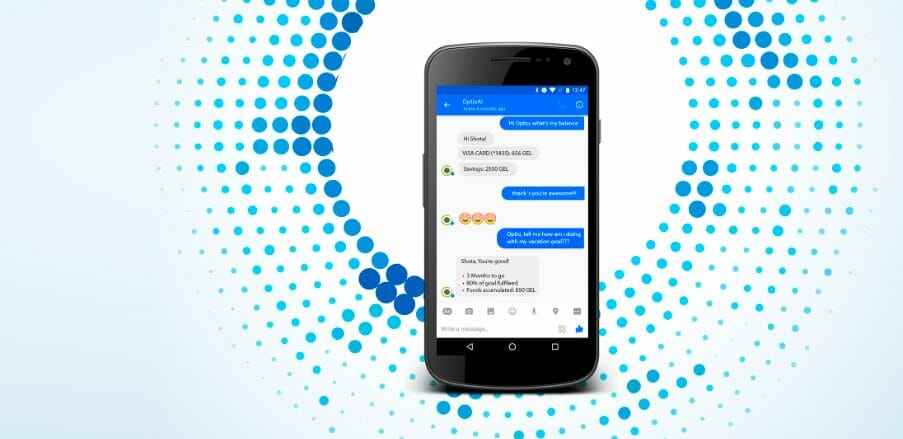

OptioAI:Georgia

Chatbot giving personal finance advice for millennials, improving spending decisions.

OptioAI:Georgia

Chatbot giving personal finance advice for millennials, improving spending decisions.

CircleMoney:Croatia

Multilateral compensations platform settling claims of SMEs.

Kredico:Turkey

Individual and business credit scoring using multiple data sources.

PayMob:Egypt

Financial infrastructure and mobile money solutions for merchants and consumers.

KiraPlus:Turkey

Payments platform facilitating property rent management.

Over the next few weeks we will be publishing interviews with the founders of each of these startups, which you will be able to find here.