The World Economic Forum (WEF) last week published their fourth report as part of The Disruptive Innovation in Financial Services Project, an initiative launched at the World Economic Forum Annual Meeting 2014 in Davos. The report is the culmination of three phases of research into the transformative role of fintech on the financial services ecosystem.

The report, “Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services”, prepared in collaboration with Deloitte, leveraged the extensive network of the WEF, reaching out to over 150 interviews with industry experts from traditional and new financial service firms and associations and included 10 international workshops. The steering committee and working group involved in the production of the report are outstanding and the resulting analysis and insight contained within the 197 pages is a must read for:

- CEOs and boards of traditional institutions considering their future strategy

- Innovators and entrepreneurs in Fintech looking at areas of opportunity

- Regulators looking at future market developments

The report provides an overview of Key Findings, then digs into specifics for key sectors:

· Payments

· Insurance

· Digital Banking

· Lending

· Equity Crowdfunding

· Investment Management

· Market Infrastructure

Each section of the full report is structured methodically; Introduction, Findings, Uncertainties, Potential End States, Conclusion.

It would be a fruitless exercise to provide a generic summary of the full report given the value of all of its content. We strongly encourage each of your businesses to make their own assessment of the report and take from it what is right for you. What we present below has been a difficult exercise of constraining ourselves to focus on five key highlights from each section to give you a taster of a report that we hope will significantly contribute to your innovation thinking.

A key theme that runs throughout the report is that of partnership and collaboration. With the disruption to business models and value chains across financial services, competitive advantage for all participants will come from capability and agility in building meaningful partnerships for execution.

Overview — Key Findings

- Fintech firms have materially changed the basis of competition in financial services but have not, yet, changed the competitive landscape. Fintechs define the direction and pace of innovation and are re-shaping customer expectations. However, Fintechs have difficulties overcoming switching costs and pushing new infrastructure ecosystems.

- Fintech allows traditional firms to externalise parts of their innovation function and provides a “supermarket” for capabilities. A focus on selection and filtering and procurement agility, be it internally or with partners, is becoming a necessary key capability.

- A financial institution’s continued ability to compete is more and more predicated on business model agility and the ability to rapidly instigate partnerships.

- Forces shaping the future of financial services include platforms, cost commoditisation (automation, mutualisation and externisation), Profit re-distribution (dis-intermediation), Regulatory divergence, data monetisation, and customer experience ownership.

- There will likely be a break-up in the value chain, with clear distinction between product manufacturers and product distributors. Hyper-scale and/or hyper-focus will be core to success in manufacturing, while breadth of products and customer experience key to distribution — e-commerce will become the next distribution battleground with the mega tech brands potentially in the driving seat.

Payments

- Payments are becoming more seamless and less visible to the customer, eradicating friction.

- There are acute margin pressures through increased priced competition — payments utilised as a loss leader for customer cross selling and retention is a developing strategy.

- There is a massive shift to online and mobile payments in developing markets. However, cards still dominate in Europe and US. The marginal benefits of switching to mobile payments are still not strong enough, with no massively sustainable advantage over cards.

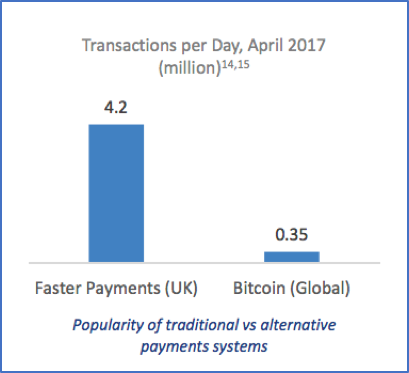

- There have been no real inroads by alternative currencies despite the hype. Traditional payment ecosystems and fiat currency schemes continue to dominate and are aided by technological progress in payments schemes. Security concerns and image dog cryptocurrency.

- Innovations in payments will not be particularly advantageous to either customer or card-issuer, but merchants will win through more choice and lower fees.

Insurance

- Customers are purchasing insurance in new ways and insurance is being packaged differently, for example, Tesla Lifetime insurance included in the price of a car in Asia. There is an increase in modularity and micro-insurance, with connected devices offering alternative forms of risk assessment, though new tactics are required to convince customers to use these devices.

- Emerging markets growth, with new consumer profiles, needs and digital savvy, is shifting the market dynamics for life insurance. More flexible policies and product discrimination will be key. Easier access, using alternative data sources to bypass the health check to remove pain points in the onboarding process, will be vital for competition.

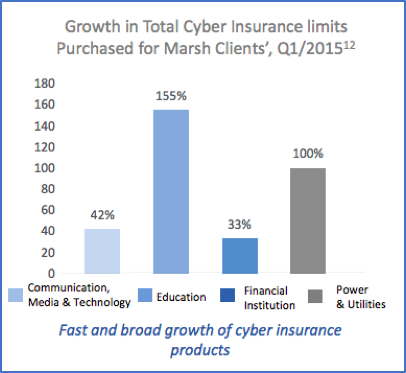

- Insurance for new risks need to be developed with agility to put stakes in the ground — new markets, cyber insurance, AI, self-driving cars, connected insurance. Margins in traditional products are eroding so emerging risk insurance is critical for future growth and profitability.

- Increasing integration with retail products, as well as more focus on customer experience and customisation, is driving a de-prioritisation of traditional distribution channels via agents. Complex products, simply distributed.

- AI developments and their complexity, combined with industry margin pressure, could lead to insurers outsourcing underwriting to more technically capable specialists, shifting the insurer’s focus from risk transfer to risk monitoring.

Digital Banking

- There is a significant likelihood of disruption to the existing business model and economics of traditional banks by the shift to platform models, requiring a serious strategic focus on defining the role of the bank and how they service customers.

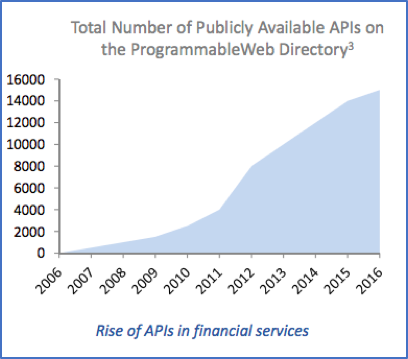

- There are various future states that revolve around platform banking at the core, but differ in participation and control: Bank controlled curated platforms with Fintechs as distribution platforms/partners, tech controlled aggregation platforms led by the tech giants, open platforms, proliferated by choice and APIs. Do banks want to be platform managers or product distributors?

- The branch is still not dead. Where challenger banks have gained traction, they are being used as secondary bank accounts. Traditional Banks still have the lion’s share of profitable customer segments. Barriers to entry for new banks have declined significantly, but there is still resistance in regulation. High switching costs are weighing down on faster adoption for new entrants.

- Customers are looking for frictionless experiences where precedents have been set by non-banking applications. Firms must look at new models of customer engagement to reduce resource costs and prop up margins.

- Retail/e-commerce is leading a charge in distribution of products by integrating them at point of sale (e.g. Amazon) and the broader customer experience (e.g. Facebook). These channels leverage enhanced data analytics to better service customers and will gain further resonance from regulatory changes and proliferation of banking APIs.

Lending

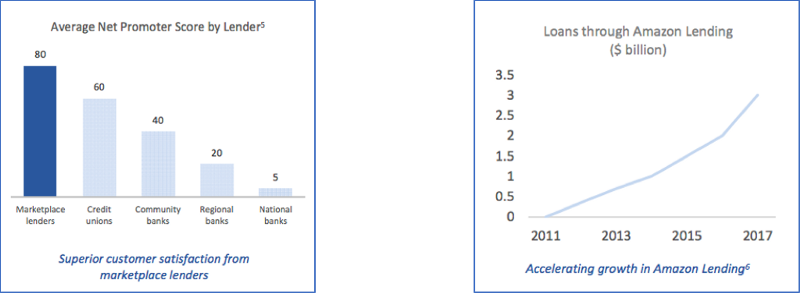

- There has been a significant expansion in access to credit for the underbanked and sub-prime categories led by Fintech innovation in seamless digital origination and fast approval.

- Iteration cycles for enhancing credit models are shorter for Fintech firms providing them with learning advantages. Fully automated models delivering fast approval are becoming the de-facto expectation and are driving customer “purchasing” patterns.

- Non-financial platforms as distribution platforms for credit and as important sources of data for use in underwriting are gaining rapid prominence. These platforms are tying credit directly with the purchase, providing a seamless experience and timeliness.

- High customer acquisition costs and access to lending capital are still hindering new entrants. In particular, cost of capital is very high relative to incumbents’ low-cost deposits.

- Distribution 2.0 — Bank partnerships with non-financial firms for distribution and enhanced scoring will likely develop and disintermediate traditional brokers.

Investment Management

- Robo-advice is proving a compelling tool for customer engagement. Robo-advisory offerings have proven relatively quick and economical to develop. The low cost of entry has allowed incumbent managers to fast follow new entrants keeping acquisition costs low by leveraging existing brand and reputation. (If you have not done it yet, then you must do it). More comprehensive robo-advisory services offering full suite servicing across an investor’s financial needs, particularly cash flow management, could become a differentiator for firms in the future and would rely on access to broader customer data, such as in relation to PSD2.

- Scaling investment advice requires fewer resources as middle and back office functions are being automated and externalised. Automation and AI are driving down competitive advantage in process execution.

- Alpha is becoming more elusive diminishing appeal of traditional products in favour of lower cost products. Price competition in low cost products (3 points on lowest cost US ETF) are driving necessary scale based technology strategies in the production of low cost products and eventual consolidation. Smart-beta products are becoming more attractive to compensate product gaps. There is a return in popularity of defined income products in the retail segment due to a shift to defined contribution programmes by employers.

- There is more demand for self-managed investment plans fuelled by the social trend of “self-reliant go-getters”. Customer-centric solutions are a must, providing flexibility, and thus AI is becoming imperative for cost effective and customer-centric relationship management.

- Clients still value intangible human relationship based services particularly as they increase in net worth.

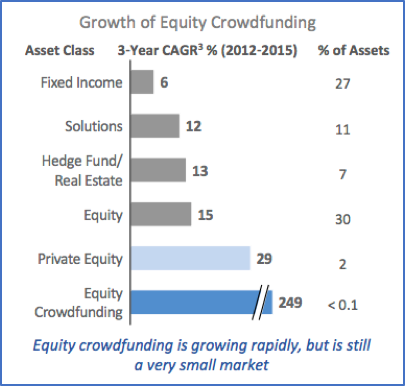

Equity Crowdfunding

- Equity Crowdfunding is growing rapidly but is still a small market. Growth of the market has been helped by Regulators:

a. taking a relative light touch approach with respect to disclosure requirements. Where regulators have imposed harsher rules, the calibre of startups on the platforms has been low as only those desperate for capital go through the process

b. relaxing private market suitability requirements to allow more non-accredited investors to participate and ensure good flows of capitalDivergent requirements across regulators are making it difficult for platforms with credibility to easily expand and operate internationally.

- There is strong interest in leveraging new forms of data and AI to perform commercial due diligence to provide more information to the crowd.

- The disconnect between Equity Crowdfunding and the broader financial system could limit its long-term viability. A need for a secondary market and the development of pooled products with access through traditional wealth management distribution channels will drive future growth.

- The opportunity for the traditional sector to access alternative yield products in a sustained low interest environment via equity crowdfunding would be interesting differentiator, particularly as new more robust technologies for advanced analytics help wealth managers perform due diligence.

Market Infrastructure

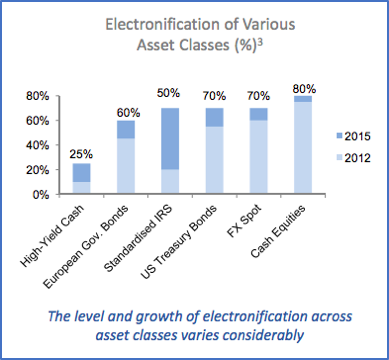

- Electronification in OTC markets will continue, driving more transparency and data standardisation. Data becomes the new battleground with platform providers increasing their focus on monetising data flows.

- Regionalisation of regulation and uncertainty of regulation somewhat as a result of political disruption, hinders development of the sector.

- Traditional providers are becoming more innovative and continue to disrupt themselves to remain competitive, making it difficult for new entrants to enter with similar economies of scale.

- Partnerships and JVs with incumbents and customers are the best ways for new entrants to tap the market. “Minimum Viable Ecosystems” are critical to the development of future market infrastructure.

- AI and DLT may have impact on post-trade services thereby disrupting the existing value chain, however these technologies are still immature. Improvements to post-trade settlement will allow for simpler cash flow management and streamlined operations driving margins for buy-side participants in the future.

Read the full WEF report here.