‘Financial Inclusion’ might be the most noble sector of financial technology, solving problems the traditional finance industry won’t — servicing underbanked demographics in areas with poor financial infrastructure.

Tackling these challenges, the EFSE Fund and the SANAD Fund for MSME, advised by Finance in Motion, have partnered with Village Capital and the LHoFT to develop the Fincluders Bootcamp 2017, unique investment readiness program designed for entrepreneurs offering inclusive financial products.

In the run up to the event, we caught up with the founders behind the startups. This time, we spoke to Shota Giorgobiani, CEO of OptioAI:

Giorgi Mirzikashvili, CFO of OptioAI; Shota Giorgobiani, CEO of OptioAI

“Today, we have an opportunity to reshape the industry that was unchanged for maybe the last century. It’s important to consider that these changes do not mean “traditional” institutions will lose, and new fintech startups will win.” — Shota Giorgobiani

Could you introduce yourself?

I started my career about 11 years ago as a junior developer, and since then I have worked in various sectors, on various projects and roles. All those years have given me experience and knowledge of not only the technical field, but also an understanding of project & team management, product development, and more.

What does ’financial inclusion’ mean to you, as a personal mission?

For me, financial inclusion means not only access to finances, but also access to knowledge and easy to use tools that are necessary for the effective use of those finances.

Could you describe the mission of OptioAI?

We want to help young people develop healthier spending habits. For most it doesn’t matter how much they earn, they overspend and have financial trouble. The natural solution is budgeting, but no budget will save you from impulsive purchasing habits. That’s what we are addressing — the root of the problem. Like Fitbit, but for your money.

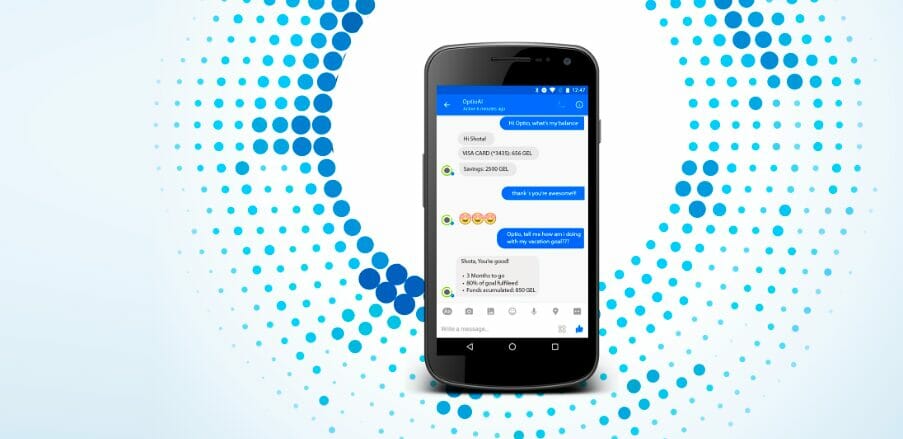

OptioAI’s chatbot for youth spending advice

What are the unique challenges and opportunities of your home market?

Georgia is great country, and there’s many young people who are potential users for our product. There’s little competition, we know the market and most young people speak English. This is important as OptioAI, being a chatbot, also understands and speaks English.

On the other hand, it’s not an ideal place for scaling. As a startup, we are looking for larger markets, and want to begin with the CEE region where we benefit from some cultural similarities.

What is your relationship like with the regulator there?

As Georgia is moving in the direction of EU, our government is trying to align with EU legislation. For example, legislation about personal data protection is developed based on EU standards, so if a startup is compliant in Georgia, that startup is also aware about EU legislation and there’s a viable transition path.

How does the regulatory landscape differ in developing countries and developed countries?

Even with EU alignment, it’s still less strict at the moment. I think main difference is that developing countries are still experimenting, and have more freedom. One thing that could be helpful is some type knowledge transfer, helping startups harmonize their product with EU regulations.

Photos: Forbes Georgia

Any final thoughts on Fintech of entrepreneurship you wish to share?

Today, we have an opportunity to reshape the industry that was unchanged for maybe the last century. It’s important to consider that these changes do not mean “traditional” institutions will lose, and new fintech startups will win. It’s a chance to create better services and find better ways to provide services. It’s a long, but exciting journey.