At the LHoFT, we strongly believe that financial technology is crucial to advancing financial inclusion, empowering groups that have been left behind by the traditional financial system. Whether it’s financing for entrepreneurs, pension products for the underbanked, specialised insurance plans or even financial education and literacy aids, the positive impact being driven by entrepreneurship is improving lives around the world.

Building on the success of the first edition of the program in 2018, CATAPULT: Inclusion Africa 2020 is a unique one week program of Fintech startup development built by the LHoFT Foundation, targeting African Fintech companies, focusing on creating bridges between Africa and Europe and aligned with the sustainability goals of Luxembourg’s finance centre.

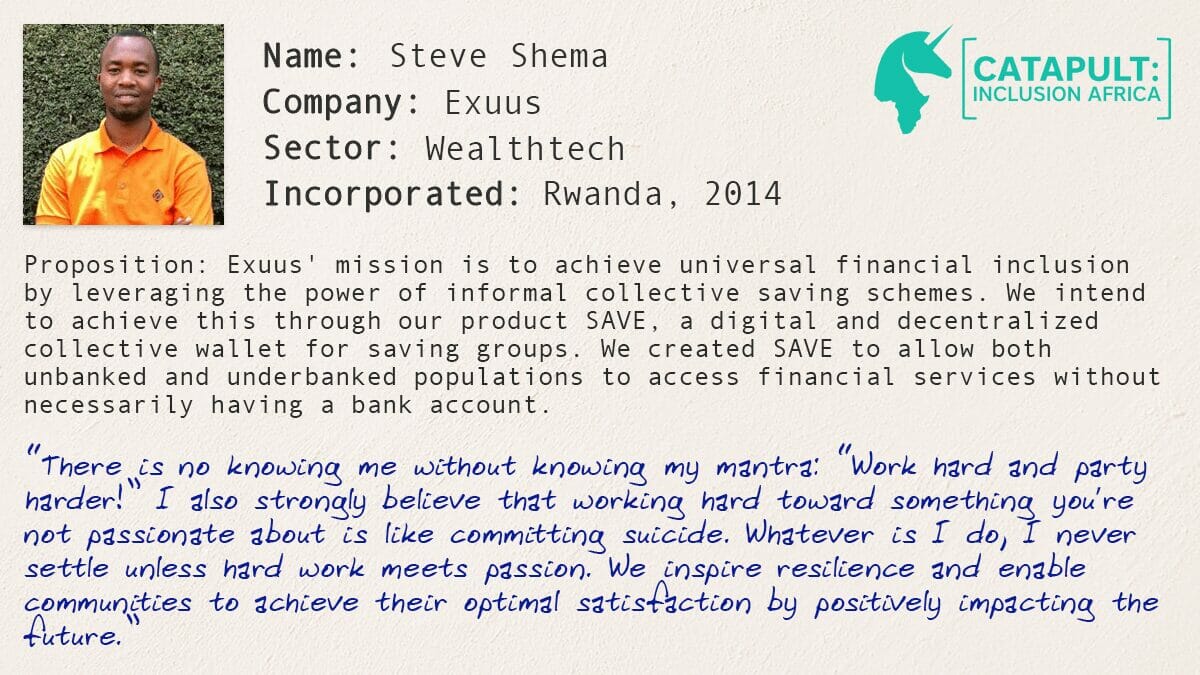

In the run up to our Financial Inclusion bootcamp, we will be sharing insight from the founders participating in this year’s edition, continuing with Steve Shema, Founder and CEO of Exuus:

“Take your time to observe, learn and above all work on solutions that make a difference in the lives of communities around you.” – Steve Shema

Can you tell us a little about yourself and your company?

A small fact about me – There is no knowing me without knowing my mantra: “Work hard and party harder!” I also strongly believe that working hard toward something you’re not passionate about is like committing suicide. Whatever I do, I never settle unless hard work meets passion.

This is how Exuus came to be, hard work motivated by one sole drive – finding passion. The beauty of passion is that it creates an insatiable attitude, it’s always work in progress. At Exuus, we inspire resilience and enable communities to achieve their optimal satisfaction by positively impacting the future.

What were you involved in before Exuus which led to the development of this idea?

As mentioned above, passion has always been the motivation to my hardworking spirit. Before Exuus, I was an independent consultant and I was fighting the idea to seek a job despite all adversities. I felt like a job would distract me from seeking and finding my passion.

One day, like many other days while on assignment, I met a lady whose story changed my life. Her story and journey towards financial resilience resonated with that passion I was after. The rest is history.

What can be achieved by bringing awareness of savings groups to the major players in the private sector, and the policy making sector?

2 main aspects one has to consider when it comes to saving groups:

- Women and the youth: Over 70% of saving groups are women while more than 60% is the youth. These numbers correlate with the African demographic where the majority of the population is both female and young. Savings groups were designed with logic and they have achieved efficiency that conventional channels have failed to achieve.

- Inclusive financial resilience: If you observe, savings groups in Sub-Sahara have achieved unapparelled financial resilience with unmatched social ramifications especially amongst women. Through inclusive financial resilience, women have not only been able to be financially included but they’ve gained the voice they never had.

The one challenge, I believe has been a major hindrance to the blossoming of saving groups is scalability. I strongly believe the digitalization process will unlock various opportunities for savings groups, exposure to the broader financial market as well as sustainability.

What advice would you offer to other founders looking to increase Financial Inclusion in Africa?

Avoid the copy and paste syndrome. Take your time to observe, learn and above all work on solutions that make a difference in the lives of communities around you. At Exuus, we believe in the ideal of creating products that are ideal in every possible way. Products that excite, that are easy to use and powerful.

What are you hoping to get out of your experience at CATAPULT: Inclusion Africa?

In simple words: observe, share, learn and ultimately apply. I plan to network extensively in the process.

What’s next for Exuus? What do you see as the key challenges as you grow further?

Achieving the next 1 billion users.

What does ’financial inclusion’ mean to you?

Financial inclusion means being in charge of my life regardless of my social status.